Consumer goods maker Whirlpool and chipmaker Qualcomm, that rallied in July and outperformed the S&P 500, can continue their uptrend in August also according to traders.

Whirlpool and Qualcomm, along with Advanced Micro Devices, Hanesbrands, and L Brands were among the select group of stocks that advanced in double digits in July.

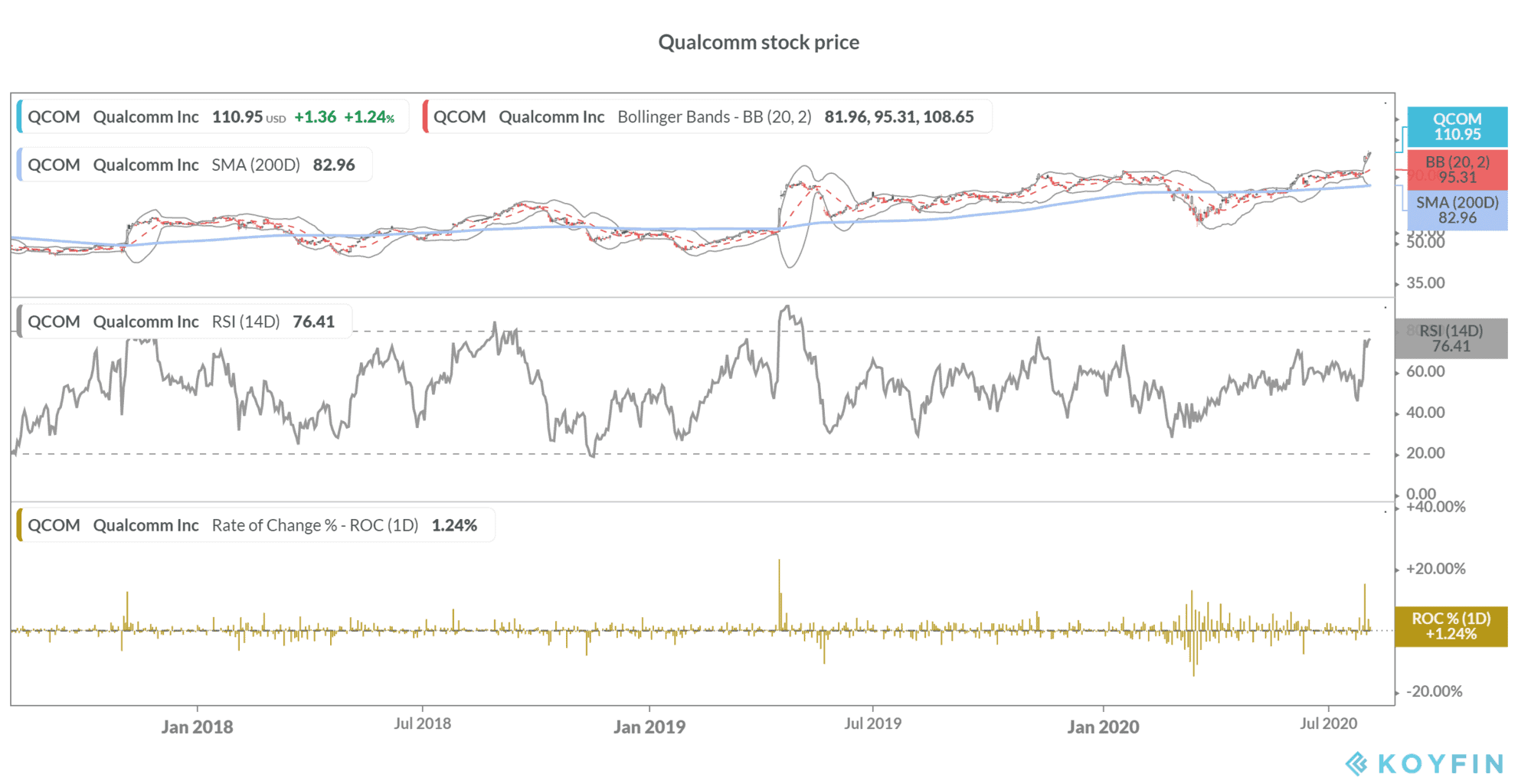

Laffer Tengler Investments expects Qualcomm to rise

Nancy Tengler, chief investment officer at Laffer Tengler Investments expects the rally in Qualcomm stock to continue. Notably, while Qualcomm stock has outperformed the markets over the last month, it is trailing its peers over the last five years. Qualcomm stock is up 67% in the last five years versus 220% returns from SMH Semiconductor ETF.

“This is a semi that has not kept up in the multiyear rally we just experienced. They had a great quarter: They beat, they raised guidance, they’ve got Huawei contracts, they’ve got a 5G handsets. But more important to us, valuation is still attractive,” said Tengler speaking with CNBC’s Trading Nation on Monday.

Tengler likes Qualcomm due to its high dividend yield and low valuation. Qualcomm has a dividend yield of 2.5% as compared to 1.3% yield of SMH Semiconductor ETF. “We think the dividend is safe, we think they can grow the dividend,” said Tengler.

Looking at the valuation, Qualcomm has a next 12-month enterprise value to revenue multiple of 4.3 times while Advanced Micro Devices has a next 12-month enterprise value to revenue multiple of 9.8 times, more than double of Qualcomm.

Speaking on Qualcomm’s valuation, Tengler said: “It’s cheaper than in many of the others in our work. So we added to it last month, and we’re going to continue to hold it.”

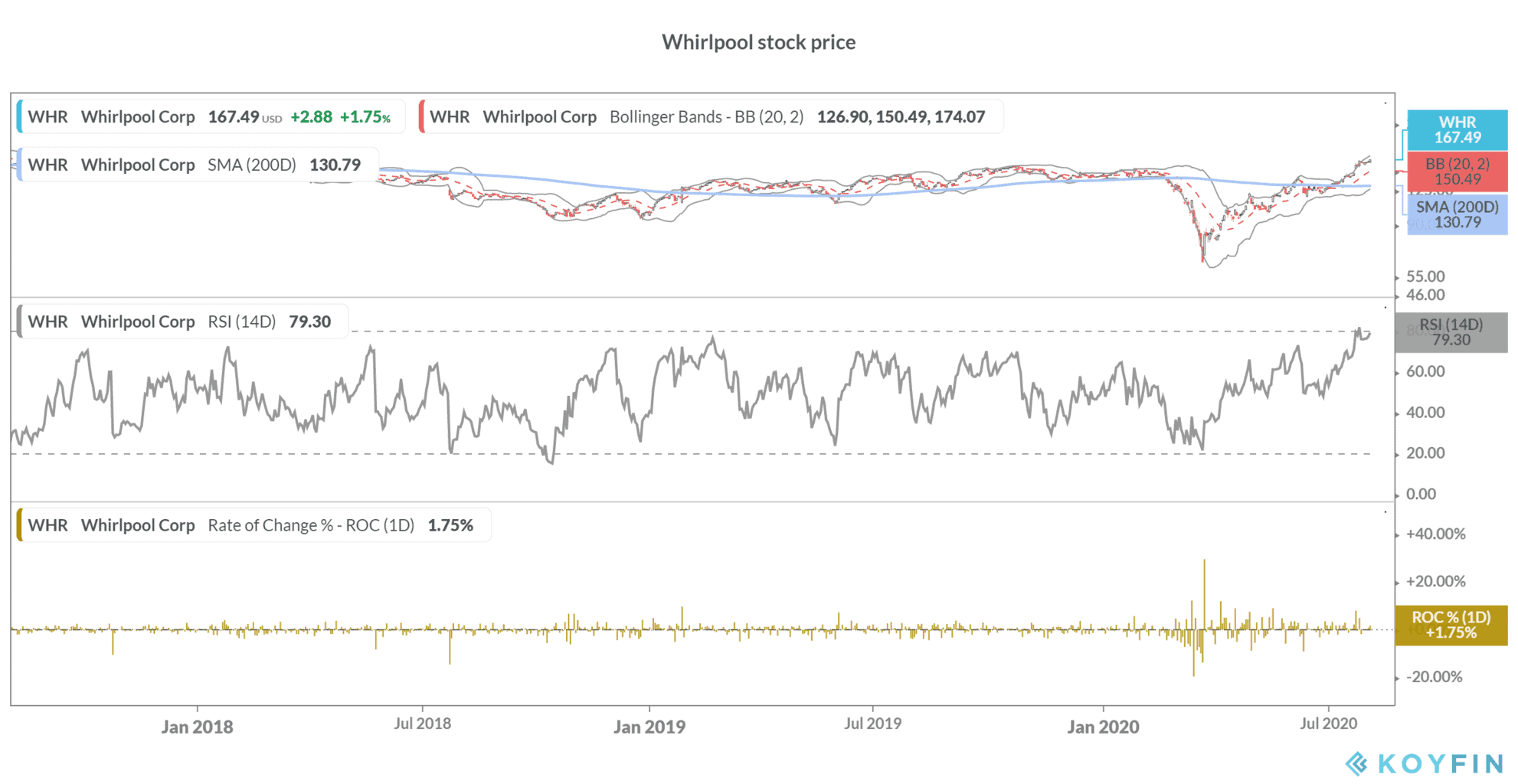

Piper Sandler bullish on Whirlpool

Whirlpool stock is up 26% over the last month, as compared to the S&P 500’s 6% rise. Last week, Whirlpool shares hit their fresh 52-week highs. On a year to date basis, Whirlpool shares are up 15.8%, versus the S&P 500’s roughly 2% rise.

Craig Johnson, chief market technician at Piper Sandler expects Whirlpool stock to rise even further. He said: “We like Whirlpool. This is a stock that has reversed a downtrend going back to the 2017 highs, you’ve broken above your 2019 highs.”

He added: “It still looks like to us you’ve got about 16% to maybe about 24% upside up to the next kind of resistance levels around $188 and $200 on the chart.” According to the consensus estimates compiled by Refinitiv, Whirlpool has a mean consensus price target of $159 that implies a potential downside of 5.1% over the next 12 months.

Whirlpool has a dividend yield of 2.89%, ahead of the S&P 500’s 2% yield. It is valued at a next 12-month price to earnings ratio of 11 times. However, based on the 14-day Relative Strength Index of 79.3, Whirlpool stock looks overbought in the short term.

For more information on trading in stocks, please see our selection of some of the best online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account