The successful launch of SpaceX’s Dragon spacecraft has lifted the shares of rival Virgin Galactic as investors dream of commercial flights into space.

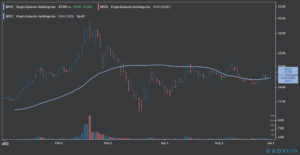

Stocks of the New Mexico-based Virgin Galactic (SPCE) surged by more than 7.9% during early morning trading on Monday, once again seeking to remain above their 50-day moving average line, a technical indicator that tracks short-term price trends.

Investors seem to be hoping that the feat of its rival spacecraft manufacturer SpaceX at the weekend can be replicated by Virgin Galactic, a business venture owned by British billionaire entrepreneur Sir Richard Branson (pictured).

Eric Stallmer, the President of the Commercial Spaceflight Federation, said the SpaceX mission “is the beginning of a burgeoning commercial business in human space flight that won’t be limited to one provider, but instead will open up opportunities for tremendous growth in the commercial human space flight industry”.

SpaceX’s program, currently a joint venture with the US National Aeronautics and Space Administration (NASA), managed to launch astronauts from US soil to the International Space Station (ISS), the first time in history this had been done by a privately-owned carrier.

Branson’s enterprise, lags behind in the race towards space tourism compared to SpaceX, as the company only offers suborbital flights for passengers into the lower reaches of space.

Meanwhile, SpaceX, owned by US-based billionaire Elon Musk, has already achieved a key milestone in the race by sending astronauts into the ISS, even though it still has to fly them back safely, another accomplishment that could further fuel the company’s long-term outlook.

Virgin shares were trading at $17.75 this morning while the S&P 500 started the day with mild 0.1% gains as investors weigh the impact of various news including increasing riots in the US and China’s decision to cut agricultural imports from the North American country.

You can buy shares of Virgin Galatic (SPCE) by using one of the brokers on our list of best stock brokers or you can also trade CFDs that track this stock.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account