The US stocks suffered another roller-coaster day plunging to their maximum allowed limit before rebounding sharply in Tuesday trading as investors pin their hopes on a White House $1trn stimulus package to help the economy through the coronavirus pandemic.

The S&P 500 recovered from the previous session’s sell-off to end up 6%, even though earlier in the day stocks were in ‘limit down territory, a situation where trading is temporarily suspended after futures hit a 5% loss and can go no lower.

European stocks also rebounded. The UK FTSE 100 swung throughout the session but closed 3 per cent higher. The European composite Stoxx 600 gained 2 per cent, having lost more than a third of its value in less than a month.

Stocks lifted after Donald Trump’s administration said it was seeking support from Congress for a $1trn spending package that may include direct payments to everyday Americans.

The US stock market has swung wildly on virus-related volatility as the S&P 500 see-sawed more than 4% in either direction over the last seven consecutive sessions.

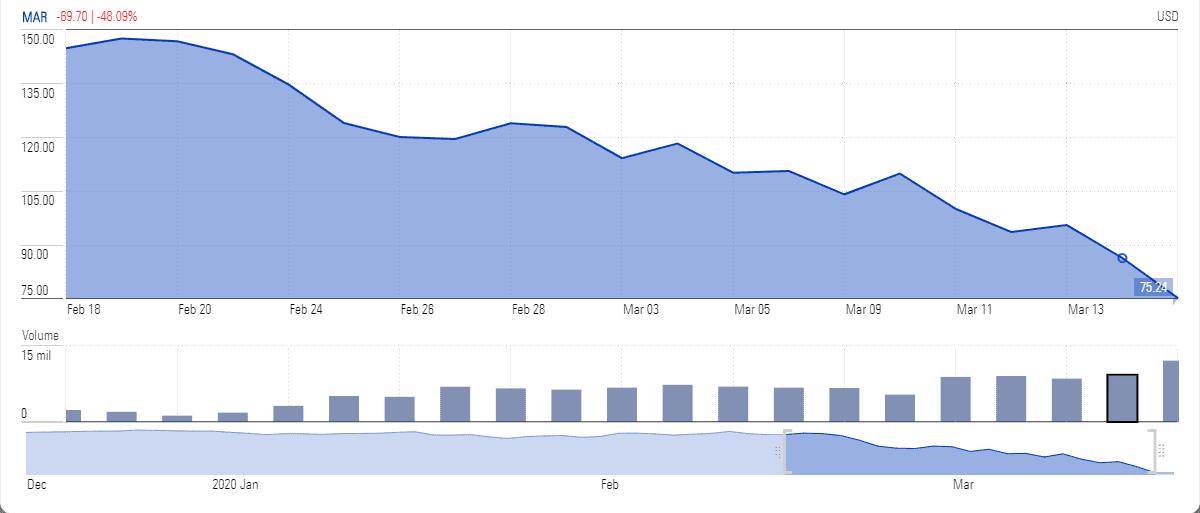

Travel companies are among the biggest laggards of the coronavirus inspired selloff. Marriott’s (NASDAQ: MAR) stock price loss of 50% in a month alone forced its executives to seek help from President Trump in the form of a bailout package consisting of $150bn for the hotel industry.

In a meeting with Donald Trump on Tuesday, executives from the hotel industry warned that half of the hotels could close this year due to cash burn and slower demand and this could cause the loss of 4.6 million jobs.

“The economic impact of the pandemic on the hotel industry was already bigger than “September 11th and the 2008 recession combined,” said Chip Rogers, chief executive of the American Hotels and Lodging Association.

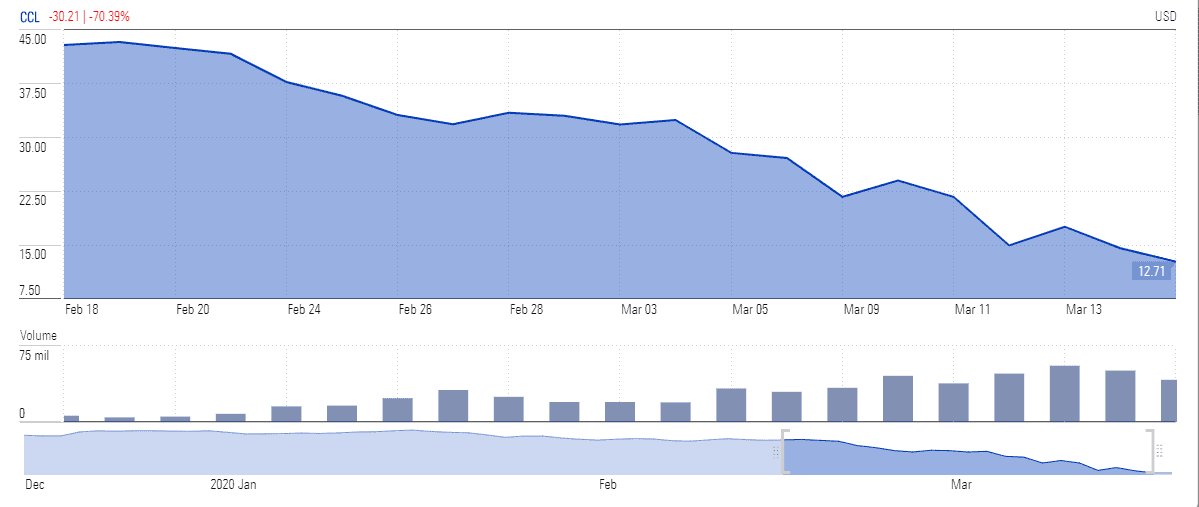

The coronavirus spread has also hammered the Cruise ship sector; the biggest cruise ship players like Carnival (NYSE: CCL) have recently announced to suspend outbound cruises for thirty days. Carnival stock price lost 70% of value in the last month, up significantly from the S&P 500 drop of close to 25%.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account