The US shale industry may collapse due to a plunge in the price of oil because of the coronavirus pandemic, according to an influential report.

“The sharp fall in oil prices will affect political regimes in the Middle East, especially in Saudi Arabia, Iraq and Iran, which may result in the collapse of the shale oil industry in the US, unless oil prices return to their prior levels,” said the Australian Institute for Economics & Peace.

The report issued by the Sidney-based think tank also highlighted that the price of oil & gas credit default swaps, insurance policies that protect investors against the default of corporate bond issuers, increased significantly, pointing to concerns about the future of companies in this sector in a low oil price environment.

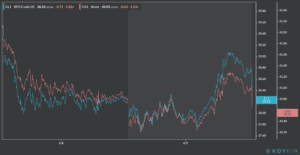

Oil prices have recovered significantly since hitting their bottom in late April, when the price of crude fell to negative territory as a result of an oil glut and a severely limited global storage capacity. So far, crude prices are near the $40 level, jumping by more than 200% since then.

Meanwhile, oil futures are falling for the second consecutive session today after the WTI, the US oil benchmark, lost 1.8% of its value yesterday, closing at $38.23, while the Brent, the global oil benchmark, slide by 1.5% to end the session slightly above $40.

This report is in line with a note from US investment bank Goldman Sachs, which said on Tuesday that the price of crude oil is set to fall in the next few weeks.

The US bank said: “The collapse in refining margins to unprecedented lows is reflective of both over-valued crude prices as well as a more moderate demand recovery, two pillars of our short-term bearish view.”

The note added, that the recent rebound “has been fueled by a macro risk-on backdrop and a policy-induced Chinese crude import binge, yet fundamentals are turning bearish”.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account