US Foods (NYSE: USFD) stock price popped more than 4% to $19.30 in pre-market trading on Friday after US private equity giant KKR (NYSE: KKR) reported $500m convertible preferred stock investment in the food distributor.

US Foods Holding is a foodservice distributor to over 300,000 restaurants and foodservice operators, with almost 70 locations and 76 cash and carry stores.

The New York-based investment business said it has a 9.5% stake in the business, adding it intends to engage in discussions with the company about its business, operations, strategy, plans and prospects.

The investments from KKR will boost the US Foods balance sheet during the current environment because its customers have been hit harder by the pandemic.

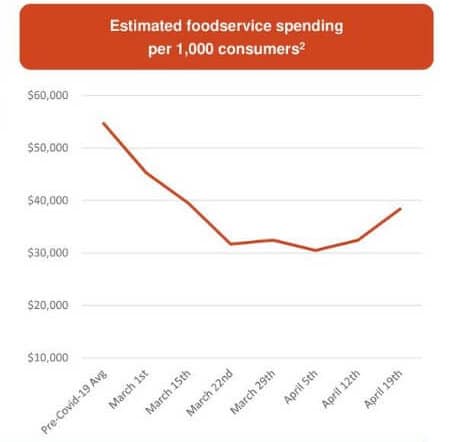

The shares of the food distributor have been hit hard by the pandemic as many of its restaurant customers have been disrupted by lockdowns, with most of them relying on their online services if they have them.

Its stock trading price has been on the recovery mode since bottoming around $8 on 12 March. Despite the recent gains, US Foods Holdings stock is still down almost by half this year.

Guggenheim analyst John Heinbockel says the food distributor would only be able to get back to 2019 sales and profits by 2023.

While BMO Capital said sluggish demand for food delivery to restaurants made it hard to recommend the sector with the broker warning that the US Foods stock is unlikely to perform well in the next two years. The firm has provided a market perform ratings and a $20 price target.

Last month the Pentagon recently announced a $478m contract with US Foods for food distribution to the Defense Logistics Agency, servicing the Air Force, Army, Marine Corps, Coast Guard, and federal civilian agencies

If you plan to invest in stocks via options trading, you can checkout our featured stock brokers here.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account