US dollar surges for its fifth day as stock sell-off resumes

The US dollar is opening higher for the fifth consecutive day as investors keep favoring the greenback amid a resurgence of the virus in Europe and following what could be a move away from riskier assets.

The Australian dollar and the New Zealand dollar are leading the losers this morning in early forex trading activity, each sliding 0.4%, followed by the Swiss Franc, which is also retreating 0.2% against the greenback.

Meanwhile, the euro is down 0.1% at 1.1643 while the pound sterling is seeing a slight advance at 1.2740, or 0.14% higher than the greenback. The British currency is the only one appreciating against the North American currency today following the announcement of a jobs support program for workers whose job has been affected the pandemic.

Finally, the US dollar index (DXY) – which tracks the value of the dollar against a basket of currencies – is up 0.17%, posting its fifth consecutive session in the green zone, with the index only seeing losses in 4 out of its 18 previous sessions.

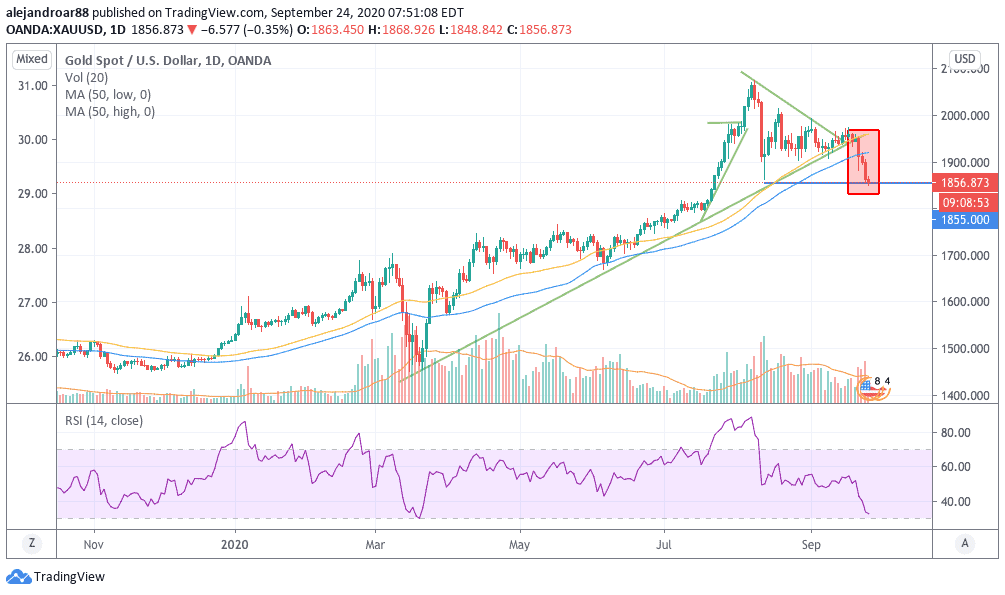

Gold falls below key $1,900 support as the US dollar gains strength

Gold prices have reacted negatively to the dollar’s appreciation after days of range-bound movements.

Right now gold is falling off a lower trend line that dates back to its March lows, which indicates the strength of the sell-off.

The yellow metal is finding support at $1,855 per ounce, which is a key level to watch, as a move below that line could trigger a sharper slide, possibly heading to $1,700 per ounce in the next few weeks if such a move were to happen.

However, there are still multiple elements that could drive gold higher over the long-term, which means that a sharp drop in the price of the precious metal could constitute a buying opportunity for investors.

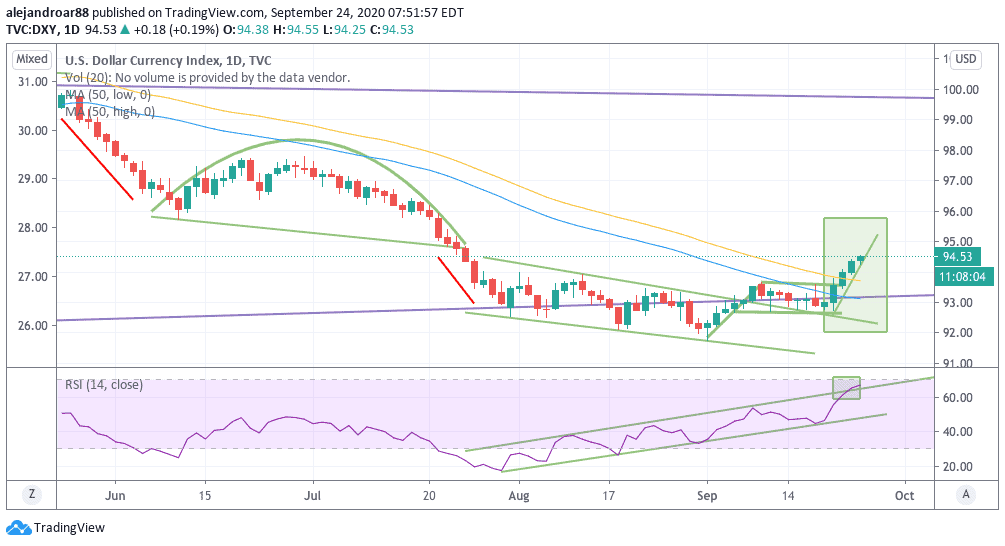

Where is the US dollar headed?

The recent surge in the US dollar indicates the continuation of the bull run that recently broke above the greenback’s tight price channel – as indicated in the chart.

Right after that break, the dollar traded range-bound to form what is known as a flag pattern, a continuation signal that ended up being confirmed once the price jumped above the 94 level.

If this uptrend continues as is, the dollar can easily surge to 96 in the next few sessions on the back of the euro’s weakness following the resurgence of the virus in the European continent and its corresponding economic consequences – which include more pressure to assist the economy through expansionary monetary and fiscal measures.

However, the high levels of volatility seen in the stock market amid the latest tech-driven sell-off could increase the strength of the positive momentum the dollar is seen, prompting investors to find safe haven in the greenback if the correction keeps clearing key levels of support in the most important stock indexes.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account