The US dollar is losing ground against all major pairs today in early forex trading activity as positive news on the vaccine front keep encouraging a risk-on attitude in the markets, favoring riskier currencies over traditional safe-havens.

American biotech firm Moderna (MRNA) announced yesterday that its vaccine candidate proved to be effective in 94.5% of the cases within a study that included 30,000 participants, with half of them taking the vaccine while only five of them reportedly falling ill with COVID-19.

The company could move to seek approval from the US Food and Drug Administration (FDA) for its vaccine by the end of the month, once it has accumulated more safety data to support its application.

The news contributed to today’s depreciation in the greenback, with the pound sterling seen the biggest gains so far, as the British currency is advancing 0.5% at 1.3261, further supported by positive news on the Brexit front.

The yuan and the euro are next on the winners’ board, gaining 0.3% and 0.23% respectively so far in today’s session at 1.1877 and 104.25, while other forex pairs like CHF/USD and CAD/USD are also advancing more than 0.2%.

As news of a potentially effective vaccine by year-end keep piling up, low-risk assets like the US dollar, gold, and treasury bonds are likely to continue suffering, as traders will keep favoring riskier instruments like equities, exotic currencies, and high-yield bonds.

Meanwhile, certain states in the United States have moved to reintroduce restrictions as daily virus cases keep surging to record levels.

Michigan, Washington, New Mexico, and New Jersey are among the states that have been implementing strict measures to curve the number of virus cases in their respective areas, with most of them restricting indoor gatherings, dining, and other activities that require interaction in confined spaces.

This situation is possibly creating expectations regarding further economic and monetary stimulus coming from Congress and the Federal Reserve, as regulators are likely to move to contain the financial fallout caused by another wave of the virus. This could plunge the greenback once again to the lows seen in early September.

What’s next for the US dollar?

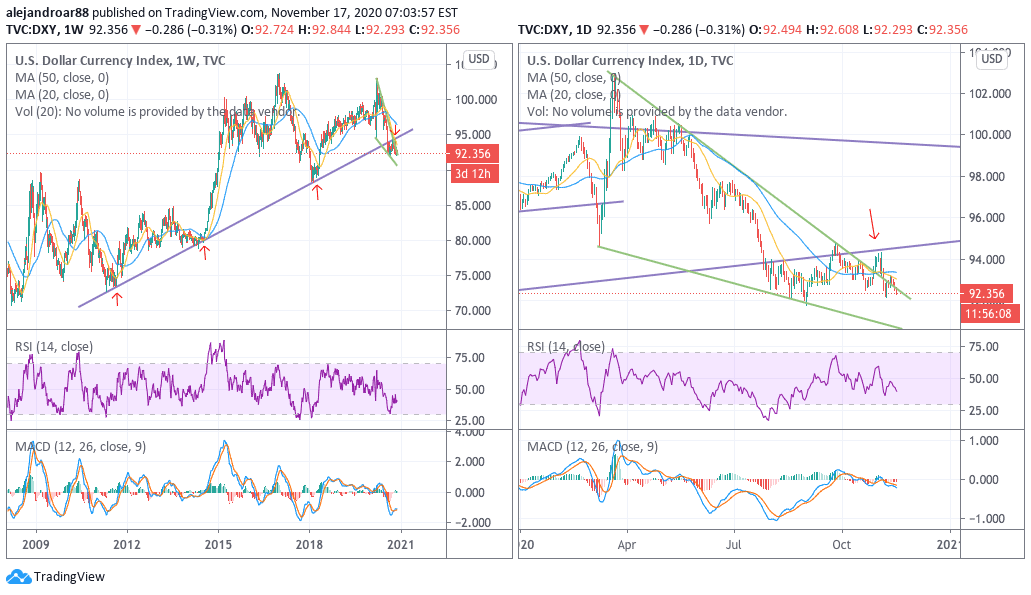

The US dollar failed to break above a long-dated uptrend a few weeks ago and was once again submerged in the falling wedge pattern shown in the chart, which means that the value of the greenback remains inevitably poised to head down in the following weeks.

Most analysts coincide that there’s not much at this point that could cause a strong uptick in the North American currency – especially as the Federal Reserve’s monetary policy remains highly accommodative.

That said, although a rebound seems unlikely at this point, support can be found by the US dollar index at 92.1 while a move below those levels could end up plunging the greenback to the lows seen in the first few days of September.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account