US airline stocks – as tracked by the US Global JETS ETF (JETS) – tumbled yesterday following President’s Trump call for pausing stimulus talks until after the election, an announcement that added up to the uncertainty that surrounds a pending $25bn second bailout for the battered industry.

Shares of the exchange-traded fund plunged 1.66% during late stock trading activity in New York at $17.17 per share, with American Airlines (AAL) leading the drop by losing 4.5%, followed by Alaska Air (ALK) and Spirit Airlines (SAVE), which lost 3.9% each.

US airlines have been expecting another round of stimulus from Congress since the 30 September deadline set by the previous $25bn bailout to halt layoffs has passed, leaving these companies with few options on the table as demand continues to be far lower than what it was before the pandemic stroked.

Democrats and Republicans have been prolonging stimulus talks for weeks now as they have failed to compromise in both the size and the scope of the new bill and the clock is ticking for airline workers, whose job is at risk if no further funding for the industry is approved.

Meanwhile, President Trump appears to have taken a softer stand after his controversial announcement, as he tweeted a few hours later that he will be willing to immediately sign a bill stand-alone bill that passes $1,200 stimulus checks for American.

Additionally, he pushed the House and the Senate to quickly approve this new $25bn bailout for airlines, which is probably renewing hopes that air carriers may end up receiving the aid in the next few days.

Are US airline stocks presenting a buying opportunity at these levels?

The uncertainty that surrounds the commercial aviation industry is very high and it is primarily tied to the effective containment of the virus situation, not just in the US, but also across the world.

Airlines are trying to survive the downturn at the moment and both carriers and industry associations have said multiple times that they do not expect that demand will climb back to pre-pandemic levels for at least two years.

That leaves US airline stocks with a bleak outlook, as although the approval of this bill can provide short-term relief to their finances, revenues are likely to see significant downward pressure for longer than initially expected.

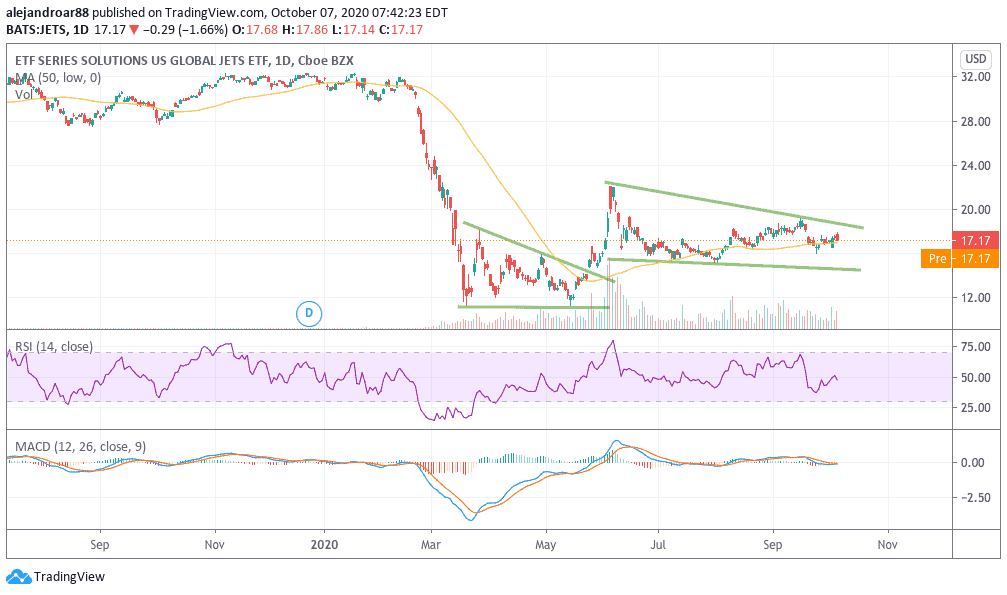

The latest price action – displayed in the chart above – shows how JETS has been trading in a tight downward price channel, with the ETF failing to make a new high since June as the virus situation in the US persists.

Although the approval of the stimulus may lead to a break of that price channel, the ETF is unlikely to go above its previous post-pandemic high of $22 per share as the negative backdrop continues to weigh on the outlook of the industry as a whole.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account