United Technologies (NYSE: UTX) stock price rallied steadily throughout this year on the back of solid financial growth. The company’s strategy of growing cash returns for investors is adding to the upside momentum. Moreover, a strong outlook for the following quarters is among the contributor to bullish sentiments.

UTX shares are currently trading around $149, which is the highest level in its history. United Technologies stock price is up close to 37% since the beginning of this year.

UTX shares are trading at attractive valuations despite year to date rally. Its price to earnings ratio of 18 is down from the industry average of 22 times to earnings. The lower valuations are the results of significant growth in financial numbers.

Q3 Results Supports United Technologies Stock Price and Valuations

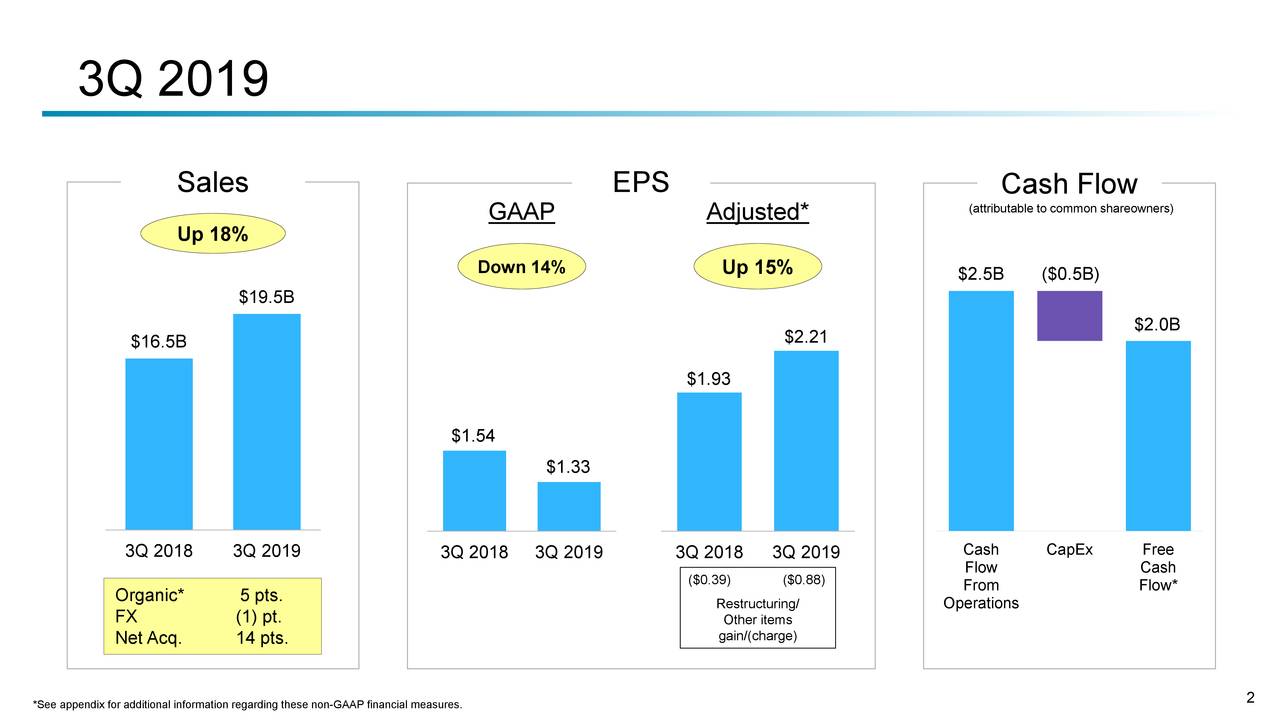

UTX has generated third-quarter revenue of $19 billion, up 18% from the year-ago period. The organic revenue grew 5% in Q3 while the rest of the growth came from a recent acquisition. The Collins Aerospace commercial aftermarket revenue grew 78% from the same period last year. In addition, the company also experienced significant growth in margins and earnings per share.

The adjusted earnings per share rose 15% year over year in the third quarter. The cash flow generation also remains robust during the past nine months. JP Morgan analyst Tusa says, “UTX is one of the best-of-both-world stocks, a defensive growth name that trades like a beaten-down cyclical.”

Outlook Indicates Strong Future Fundamentals

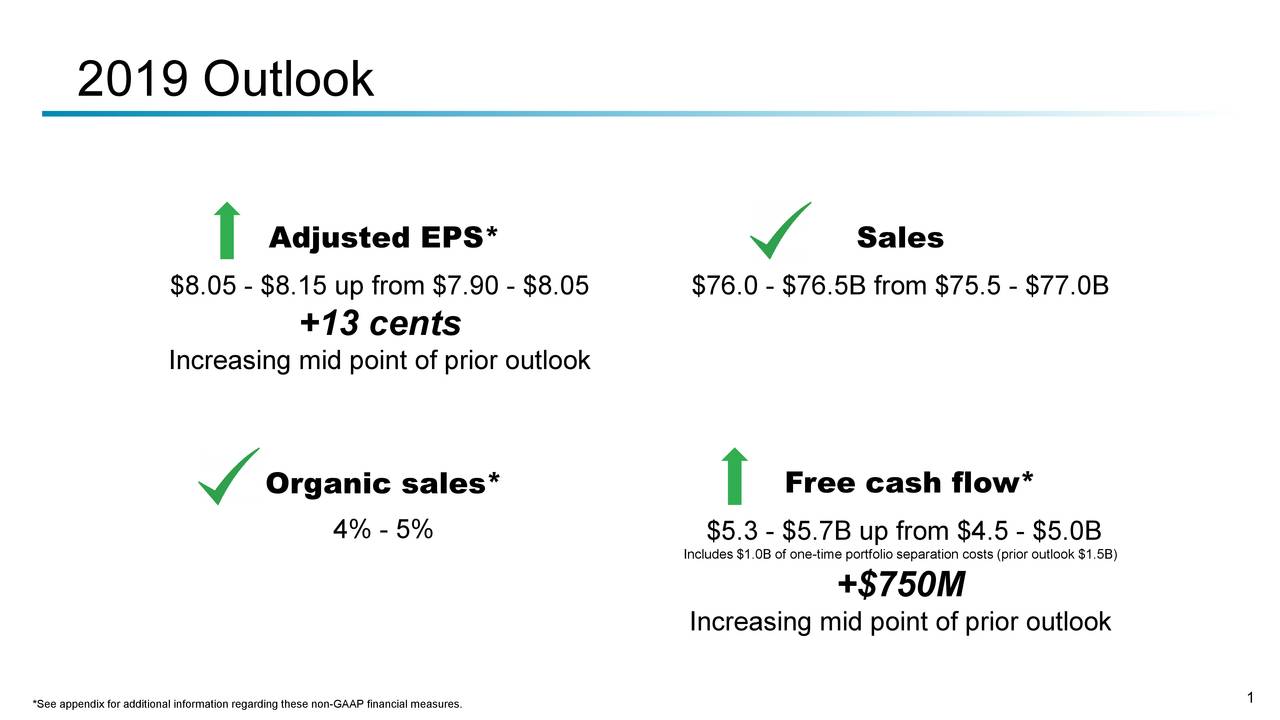

The company has raised its outlook for the full year after experiencing stronger than expected growth in the past nine months.

It has raised a full-year outlook to $8.05-$8.15 per share from previous guidance of $7.90-$8.05 per share. It has also raised the full-year sales forecast to $76B-$76.5B compared to the earlier outlook of $75.5B-$77B.

Chief Executive Officer Gregory Hayes said, “Continued strength at Collins Aerospace, including the integration of Rockwell Collins, and a lower tax rate are expected to more than offset softness we are seeing at Carrier.”

Overall, United Technologies’ stock price is likely to receive backing from financial numbers. It’s a perfect stock for investors who are seeking steady growth in dividend and share price.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account