Airline stocks opened higher on Monday morning following the latest coronavirus treatment news, despite a Bank of America report saying corporate travel demand has evaporated.

As the holiday season comes to an end in the US, airlines would normally rely on corporate demand to produce some revenue through the winter.

But the US bank said: “We are only a few weeks away from moving out of the peak leisure travel season and into the more business heavy fall, and domestic corporate bookings have shown no improvement since mid-June.”

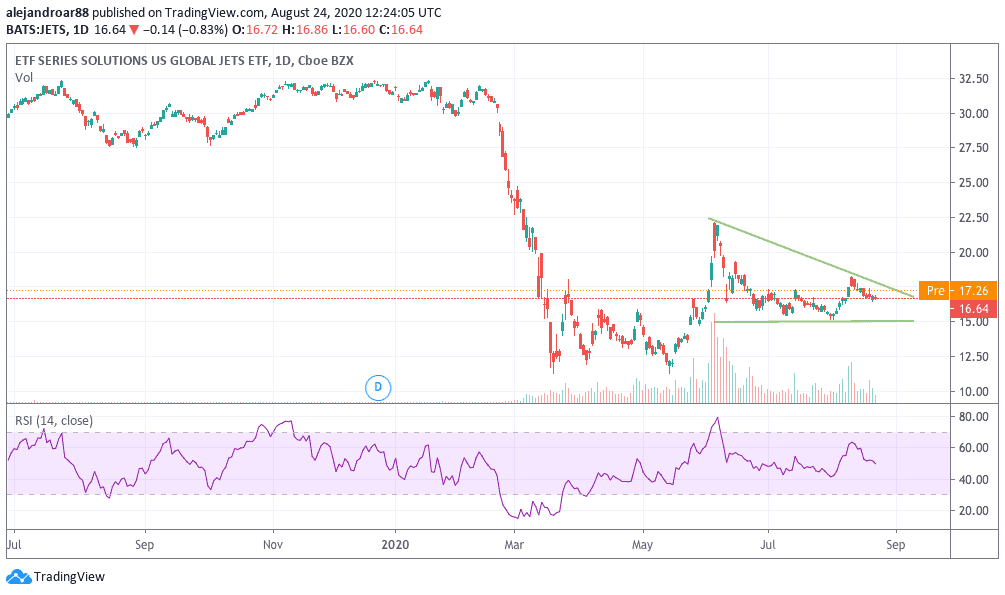

However, airline shares – tracked by the US Global Jets ETF (JETS) – closed last week at $16.64 while seeing a 3% gain so far during today’s pre-market stock trading activity.

Market ignoring demand headwinds, emphasis on treatment news

On Sunday, President Donald Trump said that the US Food and Drug Administration (FDA) had given the green light to the emergency use of plasma for treating coronavirus patients as its benefits outweighed its risks, according to the agency.

“We saw about a 35% better survival in the patients who benefited most from the treatment”, said US Health and Human Services Secretary Alex Azar in regard to the treatment’s effectiveness.

News of the approval of this treatment are providing a boost to virus-battered stocks such as those in the gambling, leisure, travel, and tourism sectors, as a reduction in mortality rates and a viable treatment could increase consumer’s confidence to resume their traveling.

Are airline shares presenting an opportunity?

Today’s session is one to keep an eye on, as investors will have to decide which of these two features have a bigger weight in the industry’s outlook.

The latest price action seen by this exchange-traded fund seems to be forming a descending triangle, a continuation pattern that could lead to another push towards the June highs if the ETF manages to break above that upper trend line.

The next few days could be determinant to see if the momentum is strong enough to deliver that break, while higher trading volumes should provide confirmation of this move.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account