VMware (NYSE: VMW) stock price lost significant value in the past few months. The shares plunged close to 20% from 52-weeks high of $200 a share. The selloff in share price is only due to traders’ concerns over the trade war and macroeconomic headwinds.

VMware stock price is currently trading around $160, up significantly from 52 weeks low of $110 a share. Fortunately, the majority of analysts believe the dip in VMware shares is presenting a buying opportunity.

The Dip in VMware Stock Price Is Presenting a Buying Opportunity

The market analysts are showing confidence in the future fundamentals of this tech company. For instance, Wells Fargo has upgraded the VMware stock price target to $180 with outperform ratings. The firm is optimistic about recent acquisitions of Bitnami, Heptio, and Pivotal Software and the release of VMware Tanzu.

Goldman, on the other hand, has expressed confidence in the long-term product roadmap. Meanwhile, Oppenheimer believes VMware shares are significantly undervalued considering a multi-year growth plan. The firm has set a price target of $200 with an Outperform rating.

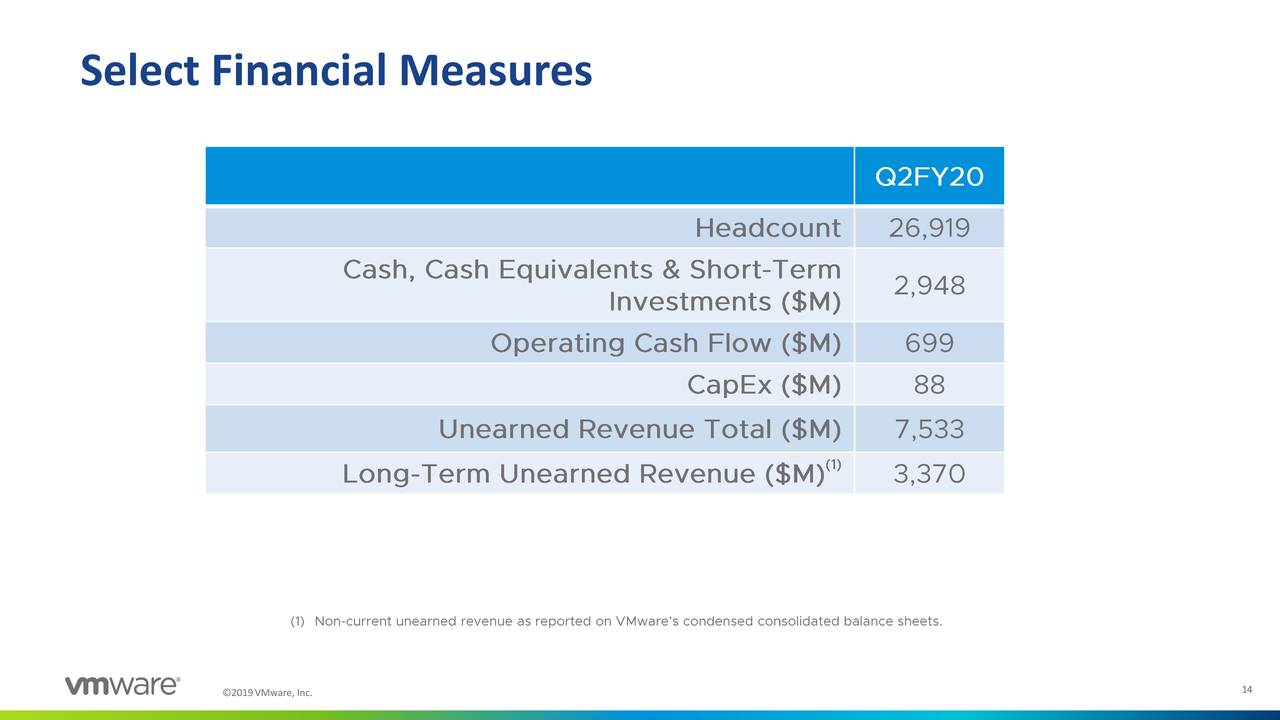

Financial Numbers are Supporting Uptrend

The company has generated robust financial and operational results in the latest quarter. Its second-quarter revenue increased by 12% year-over-year. In addition, the company plans to make multiple acquisitions in the coming days. These acquisitions include Pivotal Software (PVTL) and Carbon Black.

“Acquisitions address two critical technology priorities of all businesses today — building modern, enterprise-grade applications and protecting enterprise workloads and clients,” said Pat Gelsinger, chief executive officer, VMware.

The company claims that its cloud strategy along with penetration in Hybrid Cloud and SaaS markets will accelerate revenue growth in the coming days.

On top, it appears in a strong cash position to support investments in growth opportunities. The company generated operating cash flow of $699 million in the second quarter. Free cash flow stood around $611 million. It does not offer any dividends to investors. Therefore, the company can use free cash flows for investment purposes. Overall, future fundamentals are supporting VMware stock price upside momentum.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account