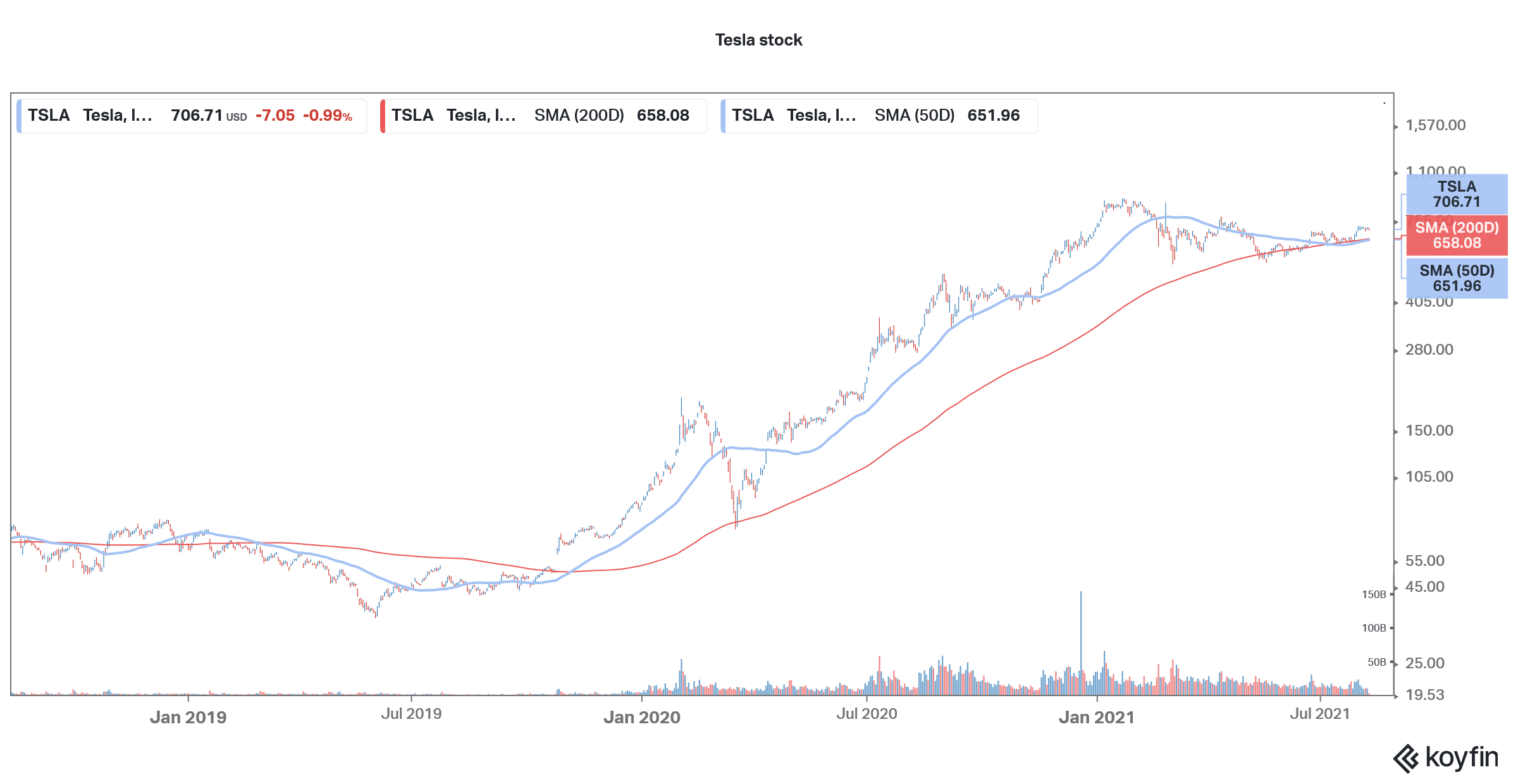

Tesla stock was trading lower in early price action today. China Passenger Car Association (CPCA) released the July vehicle sales data that showed the company’s sales in China plummeted in the month.

Tesla delivered 8,621 China-made electric cars in China in July, which were 69% lower than what it did in June. However, the company exported 24,347 China-made cars in the month. Tesla’s sales in China have been very volatile over the last few months. The company faced a backlash from Chinese consumers over alleged poor customer service. While the company initially denied the allegations, it took a more reconciliatory approach later.

Tesla EV sales in China fall

Meanwhile, Tesla’s EV (electric vehicle) sales in China fell way behind other companies. BYD Motors, which is baked by Berkshire Hathaway delivered 50,387 EVs in the month in China. General Motors joint venture with China’s SAIC Motor delivered 27,347 vehicles in the month.

Overall, there were some interesting highlights of July EV sales in China. NIO delivered 7,931 cars in July which was below the 8,083 that it did in June. Li Auto delivered 8,589 cars in the month while Xpeng delivered 8,040 cars in the month. Both Li Auto and Xpeng delivered a record number of cars in July. It was the second straight month when Li Auto’s deliveries were higher than that of Xpeng Motors. It was the rare month when NIO’s deliveries were lower than that of Li Auto and Xpeng Motors.

China EV sales

Looking at Tesla’s July deliveries in China they are only marginally higher than that of Li Auto. Tesla had lowered the price of China-made Model Y earlier this year amid the intensifying competition in the world’s largest EV market. Chinese EV makers are flush with cash after having raised capital in multiple tranches over the last year. Tesla is not short of cash either. After the $13 billion capital raise in 2020, the Elon Musk run company now has negative net debt.

While EV companies would use the massive cash on their balance sheet for growth and R&D expenses, it also means that they have a higher tolerance for cash burn in the short to medium term. The price war in the Chinese EV market is expected to only intensify looking at the crowded market for electric cars.

Tesla analyst action

Yesterday, Jefferies upgraded Tesla stock from neutral to buy and raised its target price from $700 to $850. “Tesla is still leading innovation – Legacy [original equipment manufacturers] progress on EV powertrain and line-ups, but Tesla continues to build or maintain multiple edges, notably in product complexity, inventories, direct selling and initiatives in selling subscription services,” said analyst Philippe Houchois in his note.

EV industry

Undeniably, Tesla has been a gold standard in the EV industry and every EV company tries to benchmark itself against Tesla. Even Volkswagen, which has set itself a target of becoming a leader in the EV industry by 2025 has admired Tesla’s software capabilities.

Jefferies also sees a rise in EV demand. “Tesla has been capacity constrained all year. Looking into 2022, we see more global battery electric vehicle demand, more battery and assembly capacity, a broader and mix-accretive model line-up and still no legacy issue.”

Tesla deliveries rise

Tesla delivered almost half a million electric cars in 2020 and in the second quarter of 2021, its deliveries were above 200,000. It was a new milestone for the company. Tesla expects its deliveries to rise at a CAGR of 50% over the next few years. In order to meet the growing demand for vehicles, the company is setting up new plants. It is setting up two new Gigafactories in Berlin and Texas and earlier this year Musk talked about the possibility of opening a new plant in Russia.

Elon Musk

Musk has been championing the cause of electric cars. Until about a couple of years back, electric cars were seen as a fad. Mainstream automakers did not saw much value in electric cars and had a couple of electric models in the portfolio for the namesake.

However, things have changed over the last two years and now every automaker is focusing on electric cars. General Motors has committed itself to a zero-emission future by 2035. Other auto companies also have outlined aggressive plans to electrify their fleet.

Notably, markets have given a thumbs up to legacy automakers’ vehicle electrification plans and they are outperforming this year. EV stocks on the other hand are sagging as markets have been wary of their rich valuations considering the increasing competition in the EV industry.

How to buy Tesla stock?

You can trade in Tesla stock through any of the best online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account