Target (TGT) will report its second-quarter results on Wednesday with investors eager to see whether the general retailer can continue to grow its business in the pandemic.

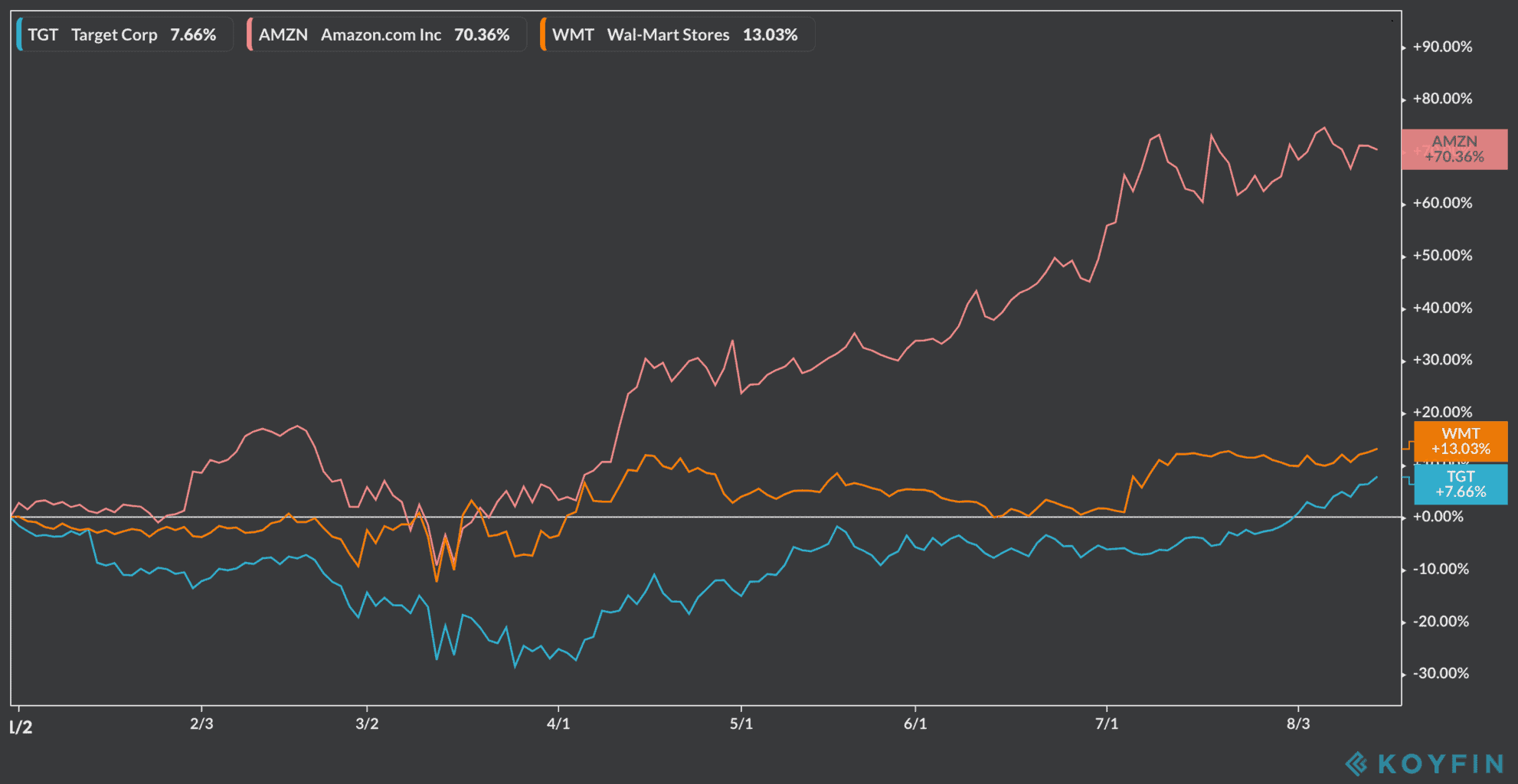

Target emerged as a rival for big-box retailers such as Walmart and even for online retailers such as Amazon.com (AMZN) during the pandemic, although the stock has lagged behind these players, rising 7.6% this year, compared to 13% and 70% for Walmart and Amazon respectively in 2020.

This report from the Minneapolis-based company, led by chief executive Brian Cornell, will provide will not only tell investors how the firm fared during the peak of the pandemic, but should provide clues as to how it is preparing for life after the health crisis.

A great quarter for Target?

Revenues are expected to grow for the second quarter of 2020 for Target (TGT), as the company managed to lure customers by boosting its online offerings while providing alternatives such as curb-side pickups and quick deliveries to give customers safe distribution choices to respond to virus fears.

The company’s e-commerce unit is again expected to be the heart of its growth during this quarter, as the demand for Target’s merchandise through digital channels grew roughly 282% in April, while contributing at least 5% of the company’s 10.8% growth in comparable sales during the first quarter of this year.

Revenues for the three-month period are expected to come in at $19.64bn, up 6.6% from the $18.18bn the company sold a year ago.

Meanwhile, analysts will keep an eye on the firm’s operating profit margin, especially after Target took a big write-down the last quarter as some of its goods within its apparel and accessories unit missed their seasonal demand due to the shift in consumer preferences caused by the pandemic.

Gross margins fell to 25.1% during the last quarter, 4.5% lower than the 29.6% the company reported during the same period in 2019.

Earnings per share are expected to finish this second quarter at $1.52 per share, down 16.6% from the $1.82 per share in earnings the company reported a year ago as a result of these lower profitability margins.

Are Target (TGT) shares a buy ahead of this earnings report?

Walmart (WMT), one of Target’s key rivals, will be reporting earnings a day before and its results and how they perform against analysts’ expectations should provide a hint as to how Target’s performance may look like.

Meanwhile, both earnings and profitability margins will have the greatest influence in how Target shares will behave following this quarterly earnings announcement.

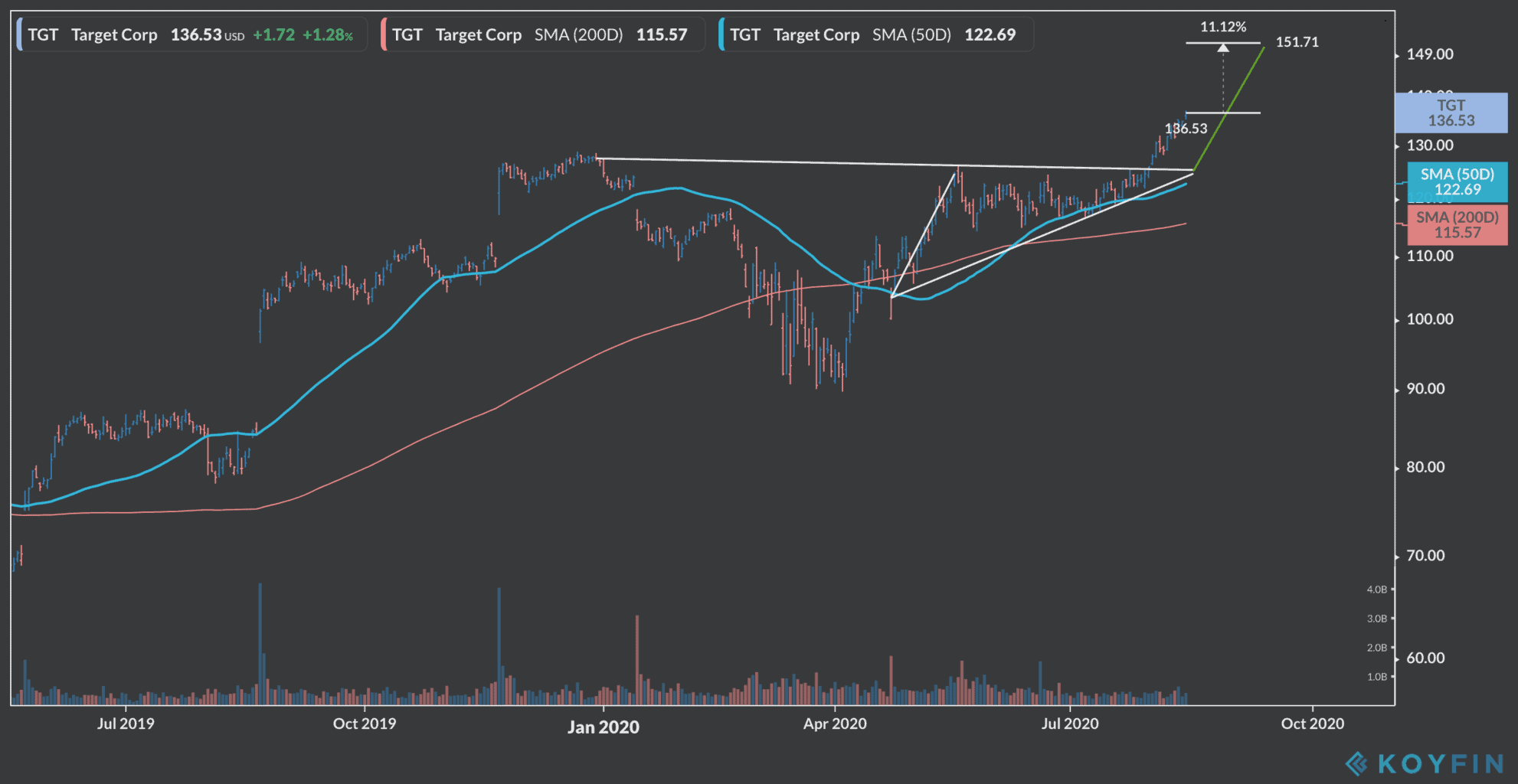

Shares of the retail giant have been up for the past three stock trading sessions in New York, closing on Friday at $136.53 per share, while gaining more than 1% today in pre-market trading activity, as momentum ahead of earnings continues to build up.

The stock’s latest price action shows that Target shares have recently broke through an ascending triangle and they could still have 11% more upside ahead if this upward trend continues and the company’s earnings manage to beat or at least match Wall Street estimates.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account