Phil Orlando, chief equity strategist for Federated Hermes, tells investors to brace for a potential 10% market pullback over the next few weeks, citing several factors that are weighing on stock prices.

Orlando (pictured) came into the year as one of the biggest bulls on Wall Street, but he has now changed his outlook based on the risks looming for US stocks, including a spike in coronavirus cases in various states, President Trump’s drop in polls, and the upcoming earnings season.

“The reality is we could pull back another 10% here over the next six weeks or so”, Orlando told CNBC’s “Trading Nation” on Thursday.

He added: “You want to be a little cautious here because the market could experience a continuation of this June swoon over the course of the next few weeks”.

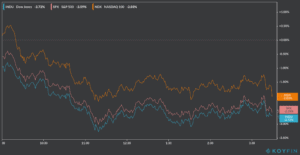

Stock markets saw a red day yesterday, with major indexes in the US and across the world shedding hundreds of points amid a surge in coronavirus cases in the North American country.

The S&P 500 closed the session at 3,050, down 2.6%, while the Dow Jones Industrials shed 700 points to close the day at 25,445, down 2.7% from the previous session. Meanwhile, the Nasdaq 100 saw milder losses, closing slightly above the 10,000 threshold, while losing 2% at the closing bell.

This is the second time Orlando warns investors about a potential upcoming pullback in stock prices, after sharing a bearish outlook on late May when he pointed to a high probability of a “cleansing correction”.

His biggest worry at the moment is the surge in coronavirus cases across the country, qualifying the situation as “disconcerting”.

“Right now, we’ve got a lot of questions with not a lot of answers”, said Orlando about a treatment for the virus.

His advice to play out the situation was to stay diversified and avoid doing anything drastic as volatility and turmoil continues to influence the pace of the markets.

S&P500 and Dow index futures are pointing lower this morning, with the e-Mini S&P index shedding 26.75 points and losing 0.87%, while the DJIA is down 1.06%, trading at around 26,129.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account