Starbucks is set to release its third quarter results next Tuesday, with investors waiting to see how the stores fared during the height of the pandemic. They will also expect some forward guidance as to what could happen if another wave of lockdowns were to take place in the US.

Revenues for the three months to June are expected to come in at $4.13bn, down 39.5% from what the company brought the year before as store sales were hit by lockdown measures resulting in fewer customers.

Meanwhile, the Seattle-based coffee chain is also expected to report a $0.60 loss per share, resulting in a $2.20 drop, compared to the $2.80 profit per share it reported in the same period last year.

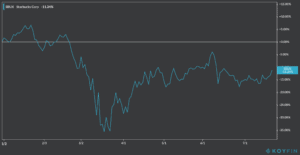

Starbucks (SBUX) shares recovered strongly from the blow of the February pandemic sell-off until reaching a peak at $83.6 on 8 June, but then slid down to $71.6 a share in late June as a spike in coronavirus cases in the US instilled fears of another potential wave of lockdowns.

The stock fell slightly below its 50-day moving average, a technical indicator of its short-term price strength, but it is staging a comeback as analysts have turned bullish as they perceive that the company’s capacity to withstand lockdown turmoil is stronger than the market expects.

“Investors currently underappreciate the pliability of Starbucks’ business model and sustainability of long-term sales drivers in the presence of temporary disruptions of the business related to Covid-19,” Jon Tower, a top analyst for Wells Fargo, told Barrons on Monday.

Tower highlighted that Starbucks’ convenient locations and its capacity to sell goods through a delivery service or pick-up will play in its favor, while the company’s strong balance sheet should make it easier for management to lead the coffee giant back to where it was before the pandemic struck.

The Wells Fargo analyst currently holds a price target of $92, which would result in a potential 19.5% upside based on Starbucks yesterday closing price of $77.24.

Starbucks is scheduled to release its quarterly results on Tuesday 28 July at 2:00 PM PDT.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account