Square stock was up sharply in pre markets today after its third quarter earnings smashed estimates. For the first time ever, the company reported over $1 billion in revenues from bitcoins.

Square reported revenues of $3.03 billion in the third quarter as compared to $1.27 billion in the corresponding quarter in 2019. Analysts were expecting the company to post revenues of $2.04 billion in the quarter. Excluding bitcoins, Square generated revenues of $1.40 billion in the quarter.

Looking at the breakup, its seller business generated revenues of $965 million in the quarter while the Cash App that was launched only about a year back reported revenues of $2.07 billion

Square posts a profit in the third quarter

Square posted a gross profit of $794 million in the quarter while analysts were projecting the metric at $708 million. In the third quarter of 2019, Square had posted a gross profit of $500 million excluding the Caviar business which has since been sold. Square’s third quarter adjusted earnings per share of 34 cents was almost double of the 16 cents that analysts surveyed by Refinitiv were projecting.

In its letter to investors, Square said that “While the macroeconomic environment remains uncertain, we continue to believe that our Seller and Cash App ecosystems are well-positioned to benefit from the acceleration of secular shifts, such as omnichannel commerce, contactless payments, and digital wallets for consumers.” It added, “We intend to invest in the business to drive attractive returns.”

Strong liquidity

Square ended the third quarter with total liquidity of $3.8 billion. This includes cash and cash equivalents of $3.3 billion and a $500 million undrawn credit facility. Earlier this year, Square invested $50 million in bitcoins that accounted for almost 1% of its total assets.

Square invested in bitcoins

While announcing the investment, Square had called cryptocurrencies “instrument of economic empowerment” and said that it “aligns with the company’s purpose.” It said that it intends to hold these bitcoins for the long term. It also clarified that “the accounting rules for bitcoin will require us to recognize any decreases in market price below cost as an impairment charge, with no upward revisions when the market price increases until a sale.”

Earlier this week, Square’s chief executive Jack Dorsey, who is also the chief executive of Twitter, managed to win over the Twitter board’s backing amid the push from activist investor Elliott Management to overhaul the top leadership.

Square’s October business update

In its third quarter earnings release, Square also pointed to the positive momentum in its business in October. It said, “In October, Seller delivered positive revenue and gross profit growth year over year. Seller GPV was up 8% year over year, which improved modestly compared to year-over-year results in the third quarter.”

Commenting on the Cash App business, Square said that the segment delivered strong year over year growth in revenues and gross profit in the month. However, it cautioned that “Gross profit growth in October moderated compared to the third quarter, driven by a decrease in transaction volume per active customer.” According to the company, the trend was due to the end of the fiscal stimulus and extended unemployment benefits.

Meanwhile, Square admitted that “We recognize Cash App growth may not sustain at the same levels during the remainder of the fourth quarter.”

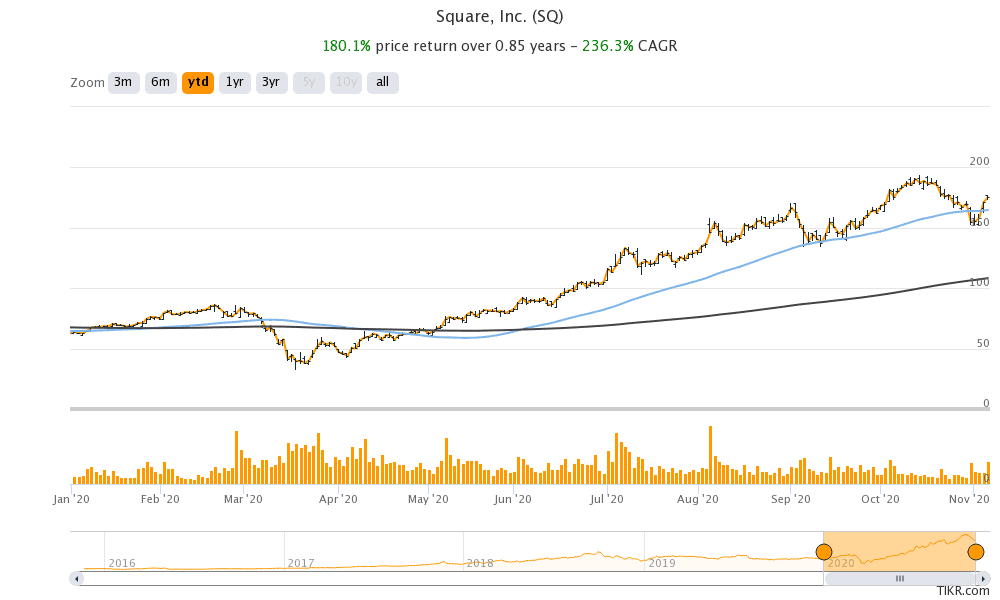

How has Square stock fared in 2020?

Square stock has gained 180% so far in 2020 and is among the biggest gainers this year. The stock is currently trading above its 50-day simple moving average, a sign of technical bullishness. It trades at an NTM (next-12 months) enterprise value to revenue multiple of 8.23x. Square stock gained 2.3% in regular trading yesterday and was trading 5% higher at $184 in pre markets today.

You can buy Square stock through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account