Tether (USDT), the world’s leading stablecoin is becoming more dominant in the cryptocurrency market, especially among ERC-20 tokens.

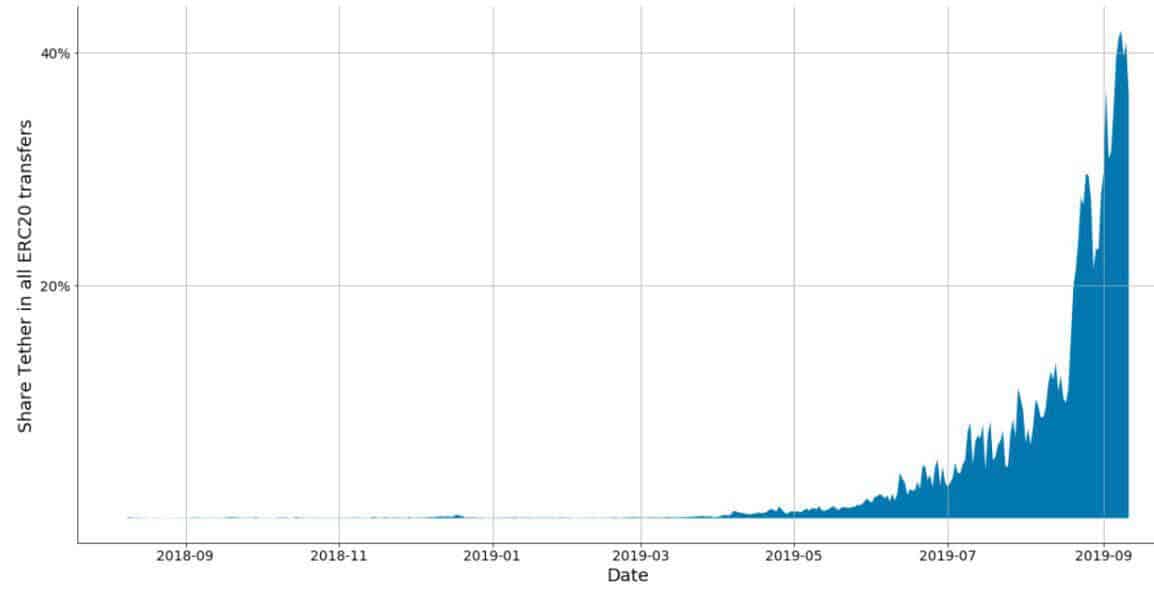

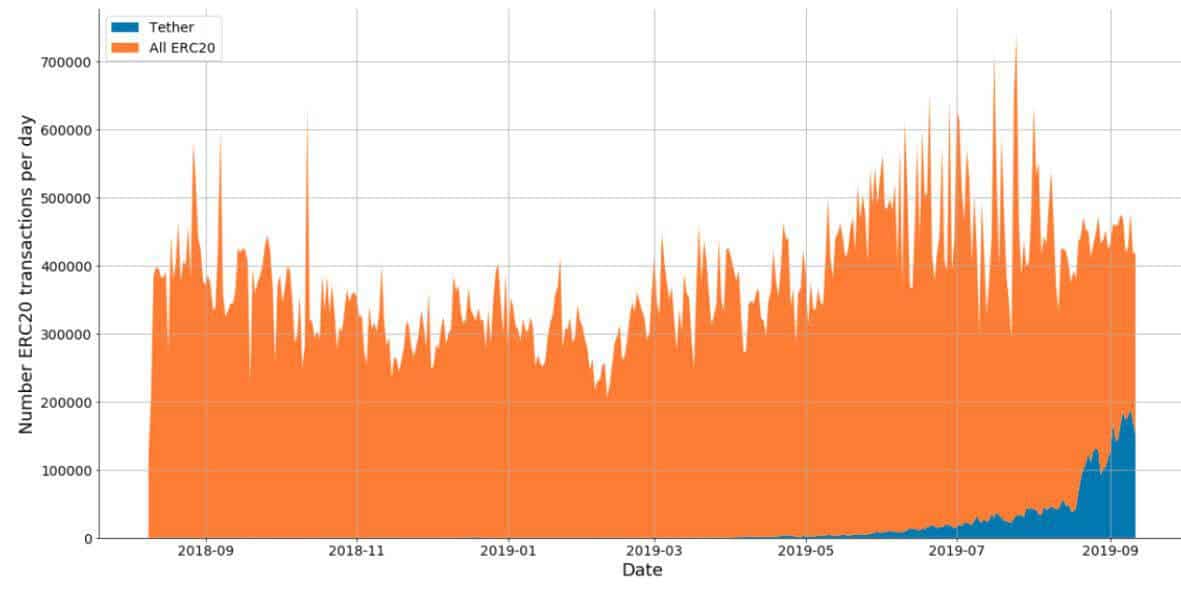

According to a report by cryptocurrency data website Santinment, USDT now accounts for over 40% of all Ethereum-based (ERC-20) transfers globally. This according to the report, is directly due to several exchanges swapping chains from Omni to Ethereum and the lower cost of transfers compared to Omni chain.

ERC-20 USDT recorded an average of 180,000 transfers out of the total average of 430,000 daily transfers in the last week. The number of active daily addresses has also increased significantly during the last month, with every day recording more than 100,000 active USDT-ETH addresses except for one, suggesting increasing preference for ERC-20 USDT.

Exchanges that have done chain swaps from Omni to Ethereum include Binance which announced on July 3 that it was getting rid of Omni-based USDT and creating only ERC-20 wallets for the stablecoin. On the same day, Poloniex declared its support for ERC-20 Tether while Huobi came on board in February this year.

Tether, the company behind USDT is also not left behind as it has been moving a huge amount of USDT to ERC-20 protocol. It announced on 11 September that it will be converting another 300 million to the Ethereum-based ERC-20 protocol. Although this will not change Tether supply, it definitely will increase the supply on the Ethereum network.

Ethereum Becoming a Preferred DeFi Hub

The Ethereum network has a history of congestion due to its slow speed that makes it very difficult to process decentralized apps (dapps) and smart contract transactions. This is a weak point that has been exploited by other projects to promote their trading platforms, including Tron. It is because of concerns on this matter that the co-founder of Ethereum, Vitalik Buterin is bringing on board the Ethereum 2.0 project to increase the scalability of the network by increasing transaction speed and many other improvements.

However, the data here suggest that Ethereum is a preferred platform for DeFi (decentralized finance projects), dapps, and smart contracts, which further suggests that it may not be as bad as it has been made to look. According to Alex Saunders, who is the CEO & Founder of Nugget’s News, the future of wealth management is being built on Ethereum.

Imagine #Defi Apps offering 10%pa in a world of negative interest rates. Accessing stocks, commodities & tokenised assets. Portfolios auto rebalance. Smart contracts allow custody & insurance. No middlemen taking fees. The future of wealth management is being built on #Ethereum. pic.twitter.com/Crcfm3OjhO

— Alex Saunders (@AlexSaundersAU) September 10, 2019

There is a greater appreciation for the Ethereum platform right now than ever, as evident by the booming number of DeFi projects being built on Ethereum.

Stablecoins Gaining Traction

Apart from the fact that ERC-20 USDT is dominating ERC-20 transfers, stablecoins are becoming more popular generally. In a recent survey by Omisego, over 80% of respondents said they had intimate knowledge of stablecoins. Since USDT is the most popular of the stablecoins, it makes sense that it is becoming dominant especially for those on Ethereum blockchain which is considered faster and cheaper for transactions than on the Omni chain.

With the rising popularity for transactions through bitcoin robots to avoid the volatility of conventional cryptocurrencies, Ethereum-based Tether may be becoming even more dominant in the near future as more exchanges do chain swaps to the network. Luckily for them, Ethereum 2.0 is underway and will potentially launch in 2020 to take care of scalability issues. This may be a turning point for Ethereum that will set it apart as a base for USDT. The investors should also consider the risks in investing before making any financial decisions.

Featured image via ConsenSys

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account