Oil futures are rising this morning to their highest level since March as a combination of vaccine optimism and the prospect of a peaceful transfer of power in the United States have kept market players excited in the past few days.

Futures of the West Texas Intermediate (WTI), the US benchmark, are 1.1% higher at $45.41 per barrel, while Brent futures are up 1.8% at $48.46 per barrel during the European commodity trading session, despite yesterday’s report from the American Petroleum Institute (API), which indicated an inventory build-up of 3.8 million barrels last week – way higher than what analysts had forecasted for the week.

Positive news on the vaccine front, including the recent announcement from British drugmaker AstraZeneca, which showed a 72% average efficacy in its COVID-19 vaccine, are contributing to oil’s recent uptick, with crude now rising for the sixth day in a row while it has also moved higher in seven out of the last eight trading sessions.

“The broader market is in de-risk mode as we now have three effective vaccines that can combat the virus” Kevin Solomon, an energy analyst from StoneX, told CNBC earlier today.

Meanwhile, traders are eagerly awaiting next week’s 180th OPEC meeting – scheduled to take place on 30 November – as the oil cartel is expected to prolong its production cuts well into the first quarter of 2021 as a vaccine may not be readily available in the entire world until then.

That said, significant uncertainty is surrounding the potential outcome of the meeting, as OPEC+ countries, which include non-OPEC members like Russia, could advocate for rolling back a portion of the cuts to improve their fiscal budgets.

A recent note from Goldman Sachs highlighted that although they believe that the group will delay its decision of ramping up production by 2 million barrels per day, recent rumors of a potential exit of the United Arab Emirates have put the cartel’s “future and purpose” once again into question as its influence in the markets has been diminished in the past few years.

Although the UAE addressed the rumors in a statement released on 19 November to clear the air, analysts believe that some of the most powerful countries within the cartel have continued to weigh the pros and cons of participating in such an alliance.

What’s next for oil futures?

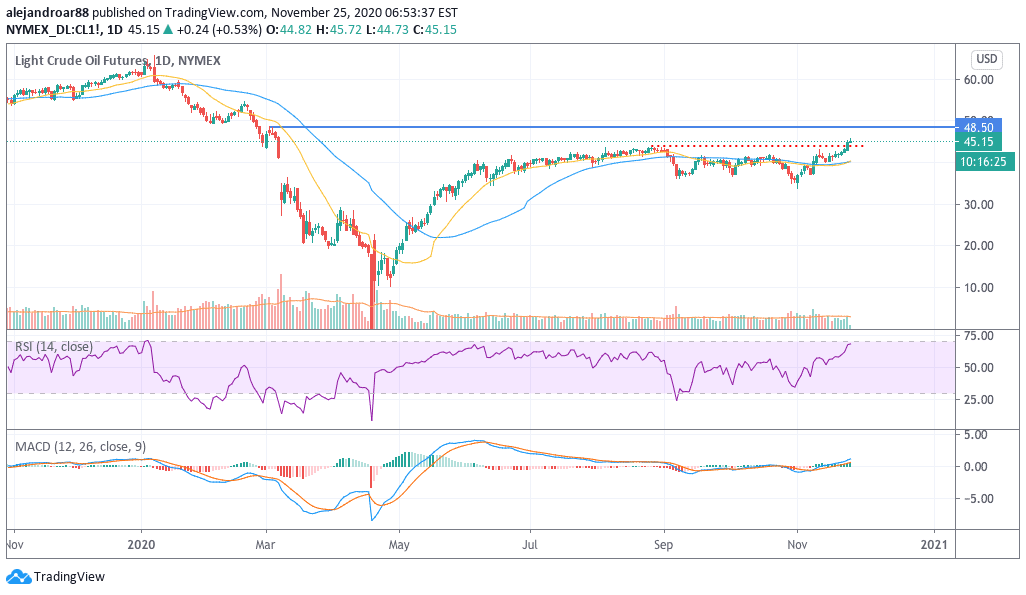

WTI futures have continued to rally after they jumped above the $42 resistance we highlighted last week and are now also crossing their $43.8 post-pandemic high dating back to the last few days of August.

This bull run could now be headed to the $48.5 bull trap seen during the March meltdown although the RSI is already stepping into overbought territory.

Since the outcome of the OPEC+ meeting is far from being a sure thing, traders should be cautious not to be overly greedy now as the price could take a breather at any moment.

This means that it will be a good idea to keep your stops short to lock in any profits made during the rally, while it is plausible to expect that a decision to prolong these cuts could push the price higher as late buyers start to jump on board.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account