Nvidia stock was trading higher in early US price action today and hit its new 52-week highs. The stock is among the top 30 S&P 500 gainers in the year and more gains could be on the card for investors.

Nvidia stock was among the top S&P 500 gainers in 2020 also and is among those few stocks that have continued their good run in 2021 also. Most of the top gainers of last year are underperforming this year amid the pivot from growth to value stocks.

Nvidia stock split

Last month, Nvidia completed its four-for-one stock split. Amid soaring stock prices, several tech companies have gone for a stock split. Last year, Apple and Tesla went for a split and both of them surged after the split. While fundamentally a split does not change anything for a company and only leads to higher liquidity, markets have sent the stocks higher post the split.

There have also been several reverse stock splits this year. While companies do a reverse stock split to meet the minimum listing requirements, General Motors and Ashford Hospitality announced a surprise reverse stock split. While Ashford was a penny stock and the reverse stock split would help it escape the categorization, GE’s announcement came as a total surprise to markets.

Nvidia gets target price upgrade

Today Rosenblatt raised Nvidia’s target price calling it a “best-in-class” play on artificial intelligence. “We are taking our price target for Buy rated NVDA to $250 from $200 based on earnings power over $6.00 for FY24 (calendar 2023) on best-in-class AI play with growth vectors into next generation networking/DPU (data processing unit) adoption and early-days of autonomous driving software kicker,” it said in its note.

Nvidia stands to benefit from several emerging trends into autonomous cars, higher gaming demand, and digital transformation.

Arm deal could be in limbo

Meanwhile, Nvidia’s acquisition of Arm Holdings could get into limbo amid the regulatory crackdown. The $40 billion deal has been facing regulatory scrutiny in several jurisdictions, especially in the UK where Arm is based. Bloomberg reported that the UK could block the deal on national security concerns.

“We continue to work through the regulatory process with the U.K. government. We look forward to their questions and expect to resolve any issues they may have,” said Nvidia in its response to CNBC.

Softbank

SoftBank bought Arm Holdings in 2016 for $31.4 billion, making it among the company’s largest acquisitions. However, Arm Holdings wasn’t among the most profitable investments for SoftBank and the private equity giant made only about 26% return on the investment in four years. That’s a CAGR (compounded annual growth rate) of only about 6% over the period. Arm Holdings’ growth rates did not improve much under Softbank. However, the merger with Nvidia was expected to put Arm Holdings back in the high growth phase. SoftBank also suffered massive losses amid the crash in Didi Global stock amid the regulatory crackdown in China.

Nvidia-Arm deal has faced opposition

Nvidia’s acquisition of Arm Holdings had faced opposition from some sections when it was announced last year. Hermann Hauser, a co-founder of Arm said, “It’s the last European technology company with global relevance and it’s being sold to the Americans,” Hauser, who founded the company in 1990, started a “Save Arm” campaign to stop the acquisition of the company by Nvidia.

“This puts Britain in the invidious position that the decision about who ARM is allowed to sell to will be made in the White House and not in Downing Street,” said Hauser. He added, “Sovereignty used to be mainly a geographic issue, but now economic sovereignty is equally important. Surrendering UK’s most powerful trade weapon to the US is making Britain a US vassal state.”

The deal with Arm would have made Nvidia a leader in mobile chips as almost all the phones use Arm chips. However, the deal’s future looks uncertain amid the issues in the UK.

Will NVDA stock go higher?

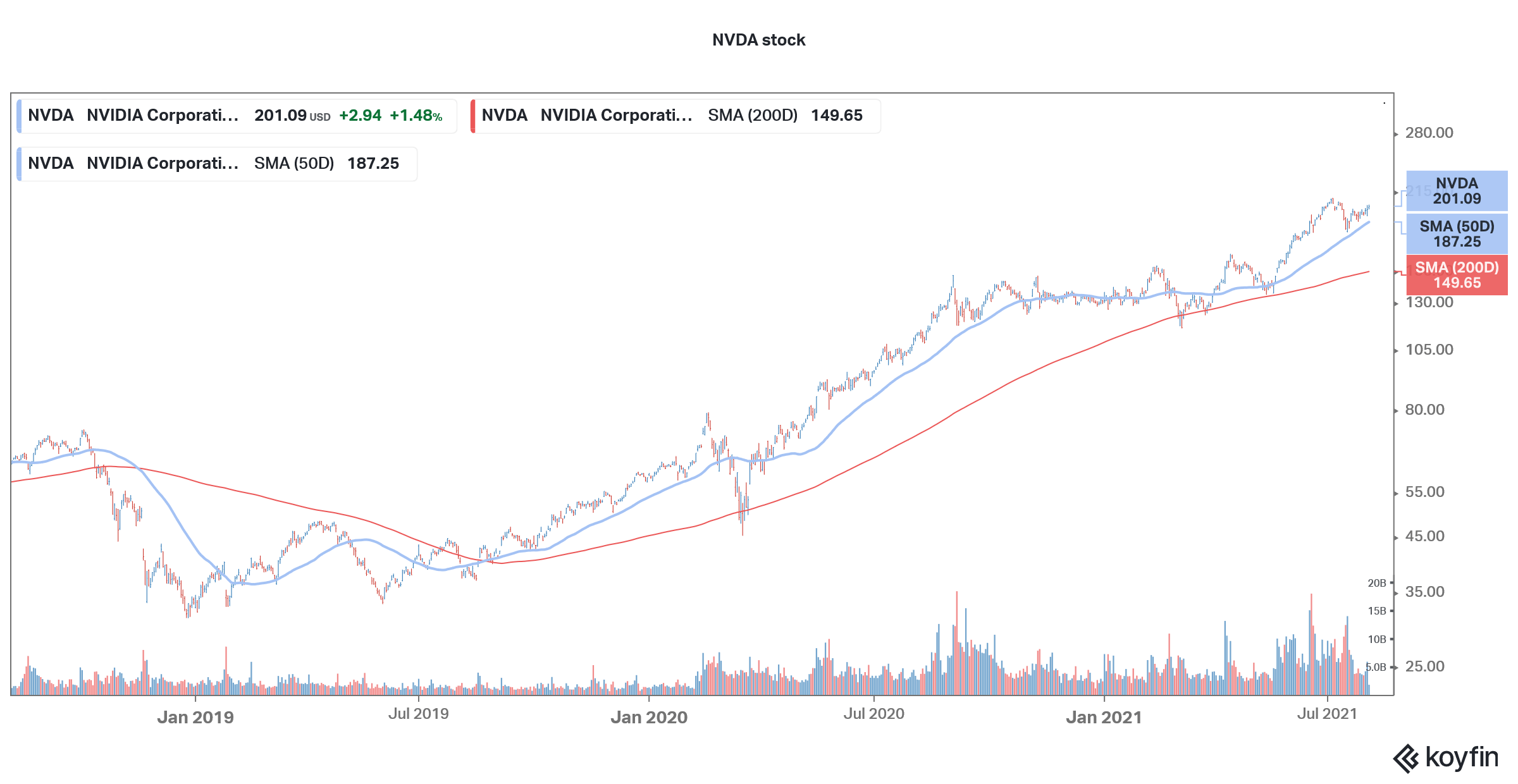

NVDA stock is looking in an uptrend and is trading above all the key moving averages. The stock looks strong fundamentally also and the valuations don’t look unreasonable considering the strong growth outlook. Nvidia stock still looks like a good buy despite the surge even as consensus estimates forecast the stock going down over the next 12 months. However, Nvidia could see more analyst upgrades amid the strong business outlook.

You can buy Nvidia stock through any of the best online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account