Norway’s sovereign wealth fund posted a loss of $21.27bn (188 billion Norwegian crowns) in the first six months of the year, as it saw “big swings” across global stock markets due to the coronavirus pandemic.

“The year began optimistically, thanks partly to expectations of healthy growth in the real economy,” said the world’s largest wealth fund, valued at $1.15trn, in its half-year report on Tuesday.

It added: “The bull market came to an abrupt end as the coronavirus began to spread globally and countries around the world took drastic action to limit contagion.”

The fund, set up in 1996 to invest the nation’s oil wealth, is 69.6% comprised of equities through stock trading, which lost 6.8% in the first six months of the year.

Tech stocks on the up

Another 2.8% of the fund is in unlisted real estate, which lost 1.6%.

However, 27.6% of the fund is in fixed income, which gained 5.1% over the period as the health crisis led to global monetary easing, with rate cuts and central banks around the world buying bonds to stimulate growth.

The overall value of the portfolio fell by 3.4% during the period.

The fund, managed by Norges Bank, holds stakes in some 9,200 companies globally, owning 1.5% of all listed stocks. US stocks, which are the fund’s

single-largest market with 41.7% of its equity investments, fell by 2.1% over the period.

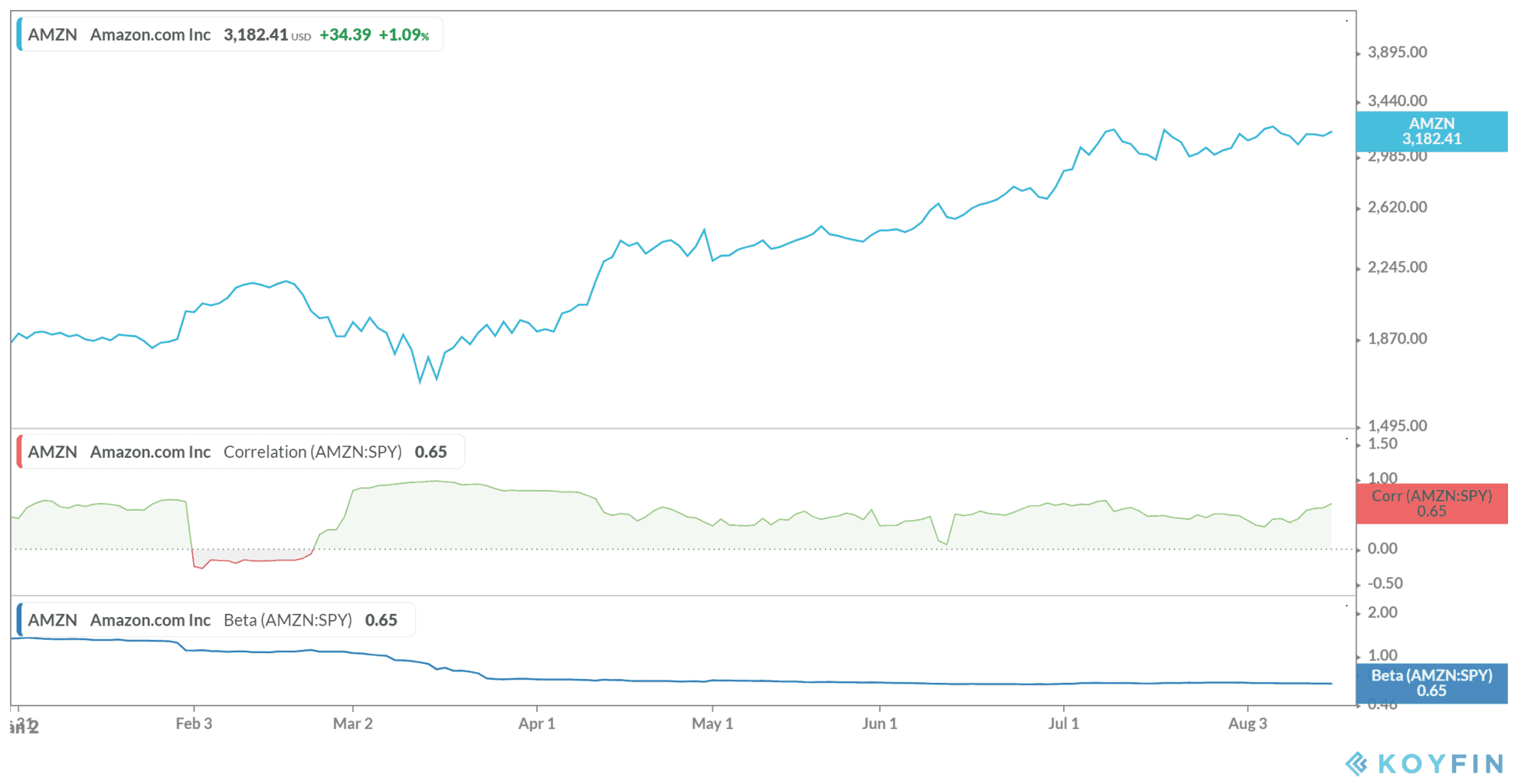

It said its three best-performing stocks were Amazon, Microsoft and Apple as the tech sector enjoyed “strong demand for online solutions for working, education, shopping and entertainment due to the coronavirus pandemic”.

The fund said its three worst-performing stocks were oil major Royal Dutch Shell and banks HSBC and JPMorgan, which were hit by the emergency in different ways.

Tech firms were the best performers in the portfolio, returning 14.2% in the first six months.

Next came health stocks returning 4.8% “as demand for medicines was not hit as hard by the pandemic.”

It added: “Suppliers of equipment and solutions for diagnosing and treating coronavirus produced particularly strong returns.”

Oil and bank stocks drag down the fund

The worse industry performers were oil and gas firms, which fell by 33.1%.

The fund said: “This was due mainly to a slide in oil prices in the first quarter as a result of both weak demand on account of the pandemic and an increase in supply from Saudi Arabia. Low gas prices and refining margins also weighed on the sector.”

The second worst performing sector was financial services, which fell by 20.8%.

The fund said: “Lockdown measures to contain the coronavirus pandemic led to economic recession, lower interest rates and higher expected loan losses. Pressure from some regulators to suspend or reduce payouts to shareholders also had an adverse effect.”

Norges Bank warned that there were dangers for investors in the second half of the year.

“Even though markets recovered well in the second quarter, we are still witnessing considerable uncertainty”, said Deputy chief executive of Norges Bank Investment Management Trond Grande (pictured).

Norway has the largest wealth fund in the world, when ranked by total assets, followed by the China Investment Corporation and Abu Dhabi Investment Authority, according to the Sovereign Wealth Fund Institute.

You can check out a list of recommended stock brokers if you want to invest in stocks.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account