Morningstar has a free mutual fund screener which is a great resource for helping you choose a bond mutual fund. We use this tool extensively in our articles on how to choose a bond mutual fund as well. Below is an explanation of how we setup a basic screen, which sections we use, and which sections we leave blank. You can see Morningstar’s free mutual fund screener here.

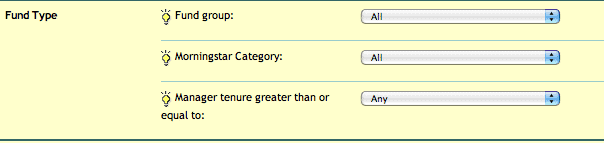

Fund Type Section

Fund Group: The type of bond fund that you are considering investing in, for example “taxable bond funds” or “municipal bond funds”.

MorningStar Category: The sub category within the fund group. For example if you chose “municipal bond funds” for your fund group, you might choose “high yield municipal bond funds” as your Morningstar category.

Manager Tenure Greater than or Equal To: This is where you choose how long you want the fund manager to have been managing the fund for. We suggest you set this to “category average” we do not want brand new managers as the past performance of the fund may be less representative of what one might expect going forward if there is a new manager involved.

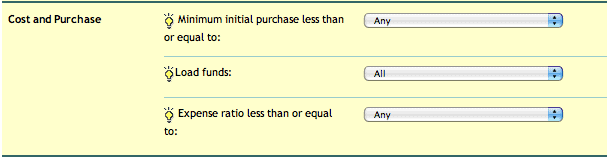

Cost and Purchase Section

Minimum Initial Purchase: This is where you screen for funds with account minimums below a certain amount. For example if you only have $3,000 to invest in a fund initially you can set this to only show funds with account minimums of $3000 or less.

Load Funds: Here you can choose for the screen to show all funds, or only those funds without a load. A load is a fee taken out upfront when investing in a mutual fund. Most funds are available without having to pay a load so Learn Bonds recommends never paying a load fee and setting this to “no load funds only”. You can learn more about mutual fund fees here.

Expense Ratio: Here you can set the expense ratio to be below either the category average or a specific percentage. While minimizing expenses is important, expenses are included in the calculations of total return so we leave this setting blank. In other words we don’t want to rule a fund out just because it has a higher expense ratio than another fund because it may still provide better returns after expenses.

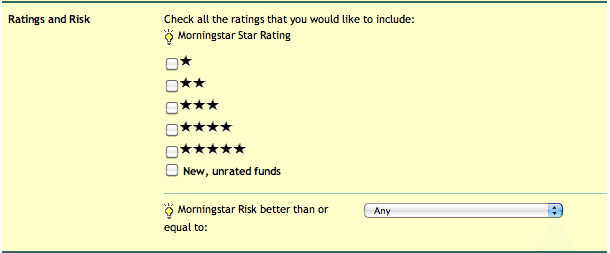

The Ratings and Risk Section

The Star Rating: The star rating system is Morningstar’s way of giving you a quick snapshot of the quality of the fund. The stars go from 1 to 5, with 1 star being the worst and 5 stars being the best. The system is based on the historical performance of the fund over the past 3, 5, and 10 years, minus any fees, compared to other funds in the same category. You can read a more detailed explanation here. We always start with 5 star rated funds since those are the best and then come back and go lower if we do not find the fund that we want.

Morningstar Risk Better than or Equal To: This is Morningstar’s proprietary risk measure. We leave this part blank as we evaluate risk in another part of our mutual fund review process.

The other two sections of Morningstar’s mutual fund screener are the returns and portfolio sections. We also leave these sections blank as we evaluate them later in the process by looking at the individual fund pages.

For more information on bond mutual funds and ETFs visit the bond funds page here at Learn Bonds.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account