Dollar Tree (DLTR) stock rose a whopping 16% yesterday which was its biggest single-day rise in years. However, despite the rise, the stock is trading with a year-to-date loss even as some of the other retail companies are trading with strong gains for the year. What’s the forecast for the DLTR stock and is it a good buy despite the spike yesterday?

DLTR stock recent developments

Dollar Tree made a couple of announcements yesterday which helped buoy sentiments. The company which sells almost everything for a dollar at its stores has announced plans to add more higher-priced goods to its stores. The company intends to sell more products at the $1.25 and $1.50 price levels.

To be sure, in 2019 only the company had introduced shelves with products at $3 and $5 at some of the stores. Now, it intends to sell products above $1 not only at these stores that have Dollar Tree Plus sections but also at other stores.

The company getting into a higher price point is not surprising. Firstly, it would be able to diversify and upsell by offering higher prices products. Secondly, the move is also born out of necessity considering the inflationary pressures that US retail companies are facing. The labor shortage situation, shortage of plastic and other packaging materials, and logistics and supply chain issues have pushed up prices for several goods. Dollar Tree, which anyways works on a thin margin, would have found the range of products that it can sell below $1 as shrinking amid the cost pressures.

Dollar Tree to sell higher-priced products

“We recognize the need to make adjustments in the current economic environment,” said Dollar Tree CEO Michael Witynski. He also pointed to “the pressure all of us are seeing on wages, freight and on our suppliers and cost increases.” The company also pointed to the positive customer feedback towards higher-priced products at its stores.

Witynski added, “These price points will bring a meaningful assortment that over time will have a positive impact on our performance.”

DLTR increases share buyback program

Meanwhile, Dollar Tree also increased the share buyback program by $1.05 billion to $2.5 billion. Given the recent weakness of DLTR stock, the company would be able to purchase the shares at attractive prices. “Delivering value to our customers and shareholders is our top priority. We are committed to a disciplined capital allocation strategy that balances returning capital to our shareholders and investing in our business for growth,” said Witynski on the buyback. To put the figure in perspective, it is more than 10% of the company’s current market cap.

Stock buybacks help companies inflate the EPS numbers. While it is more of denominator management, it’s a perfectly legit way of adding stockholder value. This especially holds true when the companies don’t have ample opportunities to invest the cash for growth.

Dollar Tree stock price forecast

Wall Street analysts are not too bullish on DLTR stock though. Of the 25 analysts polled by CNN Business, only nine rate the stock as a buy while 15 analysts have a hold rating. One analyst has a sell or equivalent rating on Dollar Tree stock. The stock’s median target price of $100 is similar to the current prices. The street low target price of $90 is a 10% discount while the street high target price of $131 is a premium of 30% over current prices.

Last month, Deutsche Bank had downgraded DLTR stock from a buy to hold while slashing its target price from $129 to $102. “We remain long-term believers in DLTR’s story including the ongoing turnaround at Family Dollar, however, we are incrementally concerned around accelerating cost pressures from both freight and wages, particularly in light of the Dollar Tree banner’s fixed $1 price point which limits its ability to absorb higher costs through price increases, putting margins at risk,” it said in its note.

Dollar Tree stock long term forecast

The inflationary pressure would impact Dollar Tree in the short term even as the decision to sell more products above $1 would help somewhat offset the impact. The long-term outlook for the stock looks positive as higher-priced products would help it increase the margins structurally.

Also, the continued turnaround at Family Dollar stores, which the company had acquired in 2015, would also be a long-term driver. Wall Street analysts expect the company’s sales to rise 3% in the fiscal year 2022 and 4.7% in the fiscal year 2023. The pivot towards higher-priced products would also positively impact the company’s earnings and revenues.

DLTR stock valuation

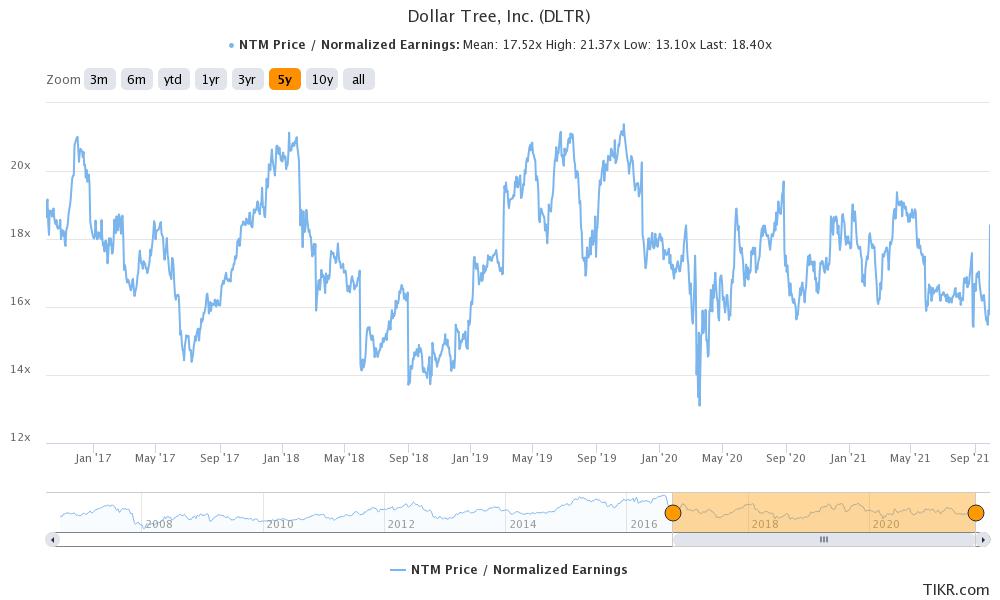

DLTR stock trades at an NTM (next-12 months) PE of 18.4x which is higher than the five-year average of 17.5x. That’s said, almost all the retail stocks are trading at higher valuations than their historical averages amid the elevated broader market valuations. However, at current prices, Dollar Tree stock does not look too stretched.

After the spike yesterday, Dollar Tree stock has moved above the 50-day and 100-day SMA (simple moving average) which is a bullish indicator. The stock now faces strong resistance at the 200-day SMA which is currently at $104.44. If DLTR stock can rise above the 200-day SMA also, it would signal strong bullishness on the charts.

Should you buy Dollar Tree stock?

Overall, DLTR looks like a good retail stock to buy and bet on the new business strategy. The valuations also look reasonable, especially if you intend to hold the stock for the long term. However, the stock might come down somewhat in the short term after the massive spike yesterday.

You can buy Dollar Tree stock through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account