Investors poured hundreds of millions in US-listed exchange-traded funds (ETFs) that track Chinese stocks last week, betting on the country’s swift economic recovery despite being at the epicenter of the coronavirus pandemic.

Chinese stock ETFs grew by $273.9m during the week ended on 24 July, while the country’s bond ETFs drew $2.4m, for a total of $276.3m in inflows for the week, resulting in nearly $93bn in the total assets managed by Chinese ETFs as a whole.

This is the third week in a row that emerging-market funds, including China’s ETFs, received net inflows, totaling $485m, according to data compiled by Bloomberg.

ETFs in demand

The KraneShares CSI China Internet Fund (KWEB) led the charge receiving $135.7m last week, to total $2.6bn in assets under management to date, as investors bet on a surge in China’s tech stocks similar to what has been seen in the tech-heavy Nasdaq 100 index of the US.

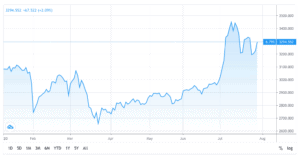

China’s Shanghai Composite Index has risen 7% since the year started after the country managed to beat back the spread of virus, moving from being the epicentre of the pandemic to becoming the first nation to emerge from it, at least for now.

Meanwhile, the ChiNext tech-heavy index, a Nasdaq-like index that tracks the most promising tech and health care stocks in the country, has delivered an eye-popping 55% year-to-date gain, as investors flock to these stocks in hope that they will emerge as the big winners of the pandemic lockdowns.

Summary

Investors have also been pouring money into fixed-income ETFs, with bond funds receiving around $151mn last week, as fears of a second wave of the virus in certain latitudes, including the United States, and fears of another pullback in equities are prompting investors to seek safe haven on fixed-income securities.

However, higher ETF inflows received by emerging-market funds seem to indicate that investors may just be shifting the geographical location of the risky assets they incorporate into their portfolios, rather than fleeing from riskier assets as a whole.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account