Gold is slipping this morning to its lowest levels since late September as the US dollar is gaining strength on news that drugmaker Pfizer (PFE) could move to seek emergency approval for its vaccine within days.

Vaccine news have been driving the price of gold lower as traders adopt a risk-on attitude in hopes that the virus situation could be put behind once an effective cure finally arrives.

The price of gold is retreating 0.6% this morning at $1,860 per ounce, making it the fourth consecutive day of losses for the precious metal, which have lost 4.6% since its 06 November highs of $1,951 per ounce.

A stronger US dollar is contributing to today’s drop in the commodity, as the value of the North American currency – as reflected by Bloomberg’s US dollar index (DXY) – is advancing 0.33% at 92.618 during early forex trading activity.

Gold losses may be somehow offset by a rising number of daily virus cases in the United States and Europe, as traders remain cautious on the effect that the reintroduction of multiple restrictions in key states of America could have on market sentiment.

The recent behavior seen in 10-year US Treasury yields reinforces this notion, as they slipped from a previous high of 0.972% the day after the news from Pfizer’s vaccine came forth to 0.882% today.

Despite gold’s recent downtick, the long-term case for higher gold prices remains pegged to the accommodative monetary policy adopted by central banks to contain the financial fallout caused by the virus.

In this regard, analysts believe that further fiscal stimulus or monetary easing could keep pumping gold prices in the near future, which means that any temporary setback could be taken as a potential buying opportunity.

“The U.S. Federal Reserve’s continued attempt to spark higher inflation expectations should suppress real rates deeper into negative territory. This will continue to drive investment appetite for precious metals, as capital seeks to shelter itself from increasingly negative real rates”, said TD Ameritrade Securities in a note to client released yesterday.

Where is gold headed?

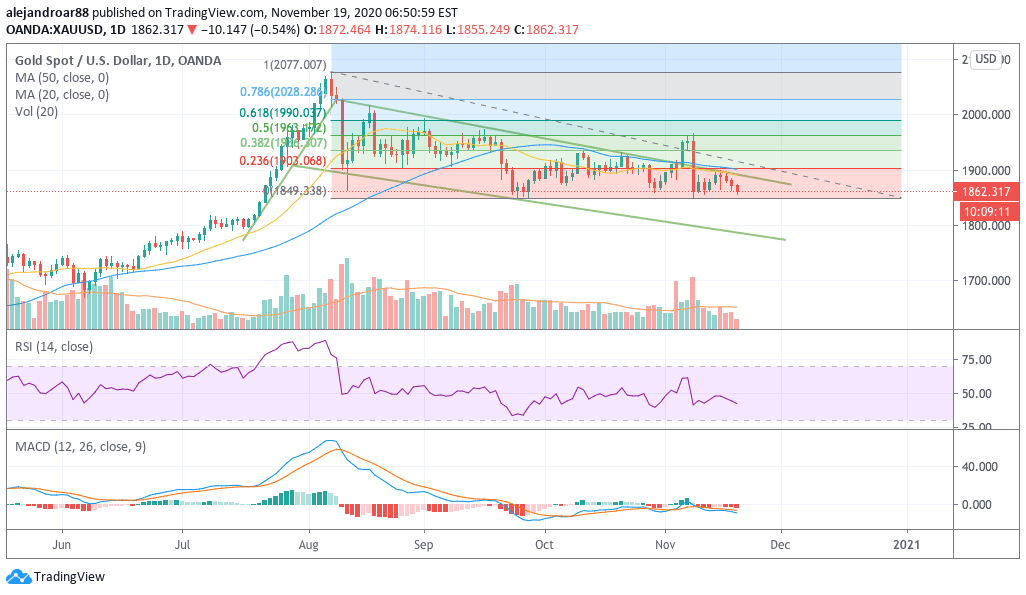

Gold prices are closing in on a major intraday support from which the precious metal has bounced two times lately, which is the $1,850 level.

This support has been the lowest level that gold has hit since the price nosedived from its all-time highs in August and it remains a key level to watch as a move below this level could end up plunging the price to the low 1,800s.

Such a move could give birth to a more pronounced downtrend, although the price is still trading within the bull flag shown in the chart.

This flag pattern – which is bullish – has not been invalidated just yet, although it will be if the price moves below $1,780, which would confirm this second wave of downward momentum for the precious metal.

In summary, the key levels to watch for now are $1,850 – gold’s latest stronghold – and then $1,780 – the last line of defense for gold before what could be a much deeper collapse.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account