Gold prices posted mixed results after the US Federal Reserve said it would continue buying Treasuries and mortgage-backed bonds at an accelerated rate, citing concerns about the strength of America’s economic recovery.

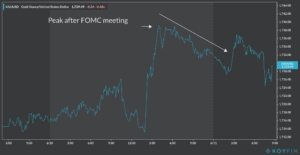

The price of gold took a jump during Fed chairman Jerome Powell’s (pictured) speech, moving from $1,713 to an intraday peak of $1,740 but then slid back to $1,727 during today’s early commodity trading activity, as investors seem to have mixed views on the yellow metal’s future.

This mixed picture reflect analysts’ comments on gold prices, as some favor a decline in the price of the precious metal, citing the strength of the economic recovery and an appetite for greater risk from investors, while others see gold as a safe haven during a time of potential deflation.

“The market is really tossed and torn between the pessimist and optimist and that’s the main reason why we are still moving around this 1,700 level for quite sometime now”, said Carsten Menke, an analyst from Swiss bank Julius Baer.

The Federal Reserve Open Market Committee announced just yesterday that it planned to maintain its 0-0.25% benchmark interest rate at least until the end of 2021. The Fed also set a target inflation of 1% for 2020, down from a 1.9% it expected last December, fueling fears about a period of deflation as a result of the pandemic.

Powell said the US economic recovery would not be easy after losing some 20 million jobs since February. He added: “We have to be honest that its a long road.”

Australian bank ANZ said that “macro uncertainty, lower interest rates and accommodative central banks should remain long-term supports [for gold]”, but economists at Capital Economics commented that “unless the virus takes a turn for the worse, we think safe-haven demand will wane too as the global economy recovers, ultimately weighing on the gold price”.

The price of the yellow metal continues to dive so far this morning, losing 0.70% against yesterday’s closing price of $1,732, while Gold Miners Vaneck (GDX) exchange-traded fund is also sliding by 1.8% during pre-market stock trading activity, potentially opening the session at $33.9.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account