Gold is staging a strong comeback in the past few days as the price of the yellow metal keeps moving closer to the $2,000 mark on the back of election uncertainty and other risks looming in the backdrop for global financial markets.

The price of the precious metal is up 0.35% this morning at $1,956 per ounce after leaping as much as 2.45% yesterday as a result of a weaker dollar and amid higher demand associated with increased uncertainty regarding the outcome of the US presidential election.

Gold has posted gains in five out of the six last commodity trading sessions and is now approaching its late-September levels while the price is also just 2.4% away from the $2,000 psychological threshold.

The current backdrop is favoring gold prices as investors are piling on the safe-haven as a hedge against potential pullbacks in the equities – which have rallied furiously in the past few days despite the mounting level of risk associated with record-level virus cases in the United States and the introduction of lockdowns in Europe.

President Donald Trump has contributed to this environment as he has repeatedly made accusations of election fraud – despite not showing any hard evidence to back his claim – while saying that he will contest every single result in the states where he has reportedly lost for a narrow difference.

Meanwhile, the North American country reported yesterday the highest daily virus tally since the pandemic started, with a little more than 118,000 Americans being infected by the disease during those 24 hours while the number of deaths stood above 1,000 deceases per day according to data from virus-tracking website Worldometers.

A similar situation is taking place in Europe as well, as the United Kingdom, Germany, Italy, France, and other important countries of the region keep seeing the number of daily cases surge to record highs despite the reintroduction of lockdowns.

What’s next for gold?

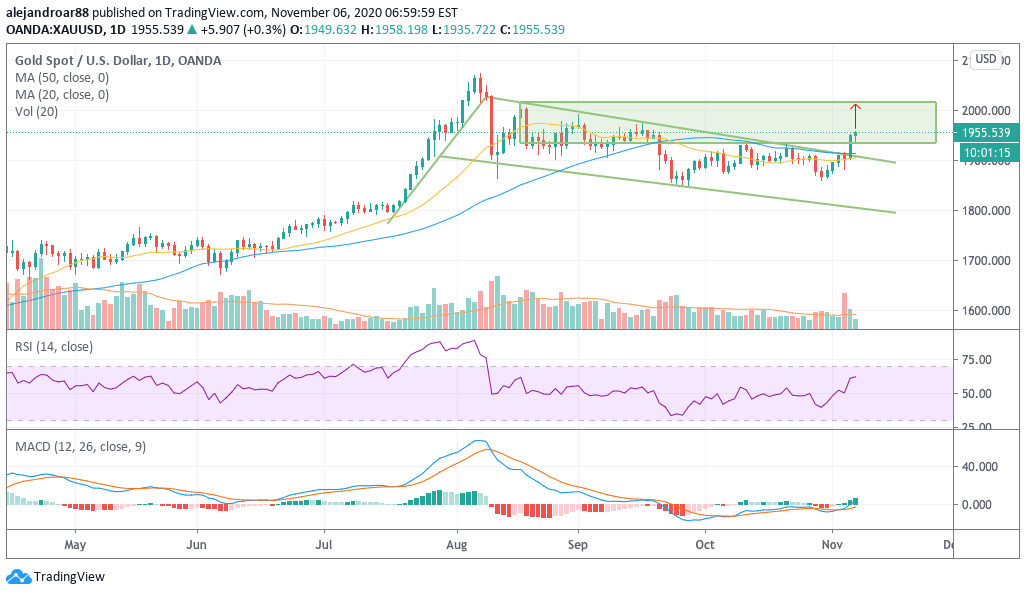

Gold’s latest price action has been the most interesting in months, as the price of the yellow metal has jumped above a downward price channel that emerged after the commodity dropped from its $2,070 all-time high.

This channel – along with the uptrend that preceded it – ended up forming a bullish pattern known as a bull flag – which indicates that a continuation of the previous trend should take place after the price consolidates for a while.

Yesterday’s jump along with today’s shy advance are successfully breaking the upper trend line of this formation and this move is being accompanied by a buy signal given by the MACD along with two bullish candles seen in the last two sessions that came in combination with above-average trading volumes.

A first target for gold at this point could be set at $2,020 per ounce – the yellow metal’s 19 August high – with all-time highs on sight right after that if the bullish momentum continues. This represents a potential short-term upside of 3.3% and 5.9% respectively.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account