The global financial technology market is expected to grow to $309.98 billion at a CAGR (Compound Annual Growth Rate) of 24.8% through 2022. This is according to a report released by the Business Research Company.

Fintech Global Market Report

The FinTech market, that consist of sales of technology solutions and products, is expected to grow by 142% between 2018 and 2022. In this way, the FinTech industry would move from $127.66 billion in 2018 to $309.98 billion in three years.

As per the report, Asia Pacific is forecasted to register the highest CAGR between the five-year period 2018-2023. The region has also been the best performing in terms of annual GDP growth, outperforming every single other region between 2005 and 2014.

This has created a massive market of consumers and investors that is helping the region to become one of the most advanced in terms of technology adoption.

Individuals are now able to make payments through different means, including cryptocurrencies, loyalty points and many other digital cash alternatives. The report shows that the growth in the digital payments sector is driving the market for global Financial Technology.

In addition to it, the growth experienced by the digital commerce market and the proliferation of mobile technology has contributed to the rise of the digital payments sector. Some companies such as Square and Stripe provide portable Point-of-Sale (POS) solutions that can help users make touchless payments using smartphones or credit cards.

Despite the growth registered by the industry, there are some issues and challenges that must be addressed. For example, concerns regarding security of consumer data are restraining the growth of this market.

Indeed, there are companies that collect information about financial records and spending behaviour, among other social media patterns. Thus, the digital footprint is something that users are worried about and that companies must address.

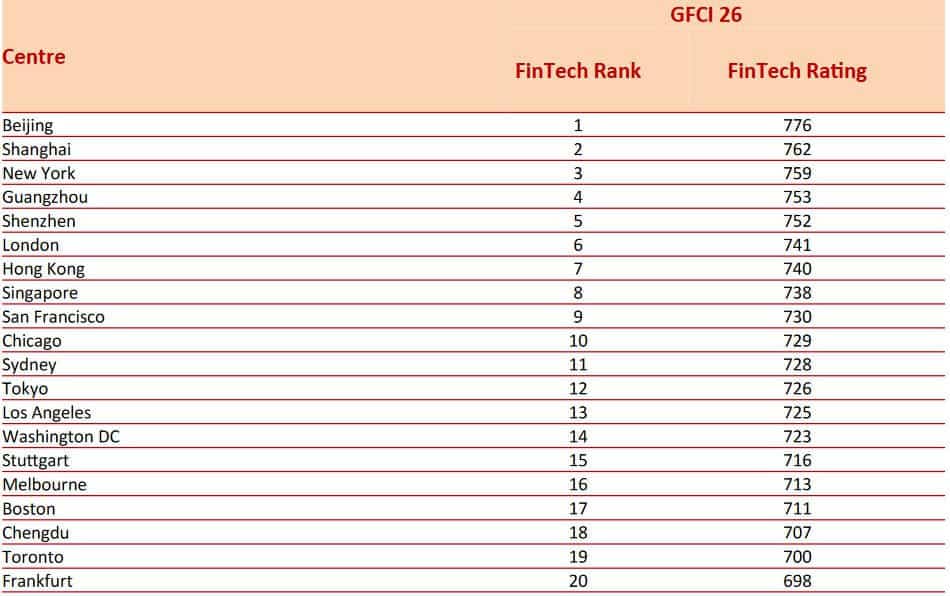

Currently, 4 of the top 5 financial centres in the world are located in Asia. These centres are Beijing, Shanghai, Guangzhou and Shenzhen.

One of the most valuable elements in generating a competitive environment for Fintech providers includes the availability of skilled staff and access to finance.

The Expansion Of Blockchain Technology

Furthermore, companies in the fintech market are also starting to use blockchain technology for improving their operational efficiency. This allows them to use a distributed database that is accessible to all users over a network and it can add new data without erasing or altering previous information.

According to PwC, by 2020, 77% of the financial organizations in the world are planning to integrate distributed ledger technology (DLT) into their operations. Moreover, 90% of payment companies are also planning to use this technology by 2020.

The Fintech industry continues to grow around the world with the APAC region being one of the fastest-growing. Although the results for fintech companies have been positive, there are some challenges related to privacy and data management that they will have to face.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account