General Motors (NYSE: GM) stock continued its downward trend after it agreed to close its US car plants to protect workers in the face of a slowing economy hit by coronavirus. The move came less than a day after the Detroit Three – General Motors, Ford and Fiat Chrysler – had agreed to reduced shifts and worker numbers to keep the plant running.

General Motors expects to shut down its plants until the end of this month. Its peer Ford also announced to close plants in Canada and Mexico as well.

The closures across North America, Canada and Mexico would impact 25 final-assembly factories; 11 factories belong to General Motors followed by eight factories to Ford and six of Fiat Chrysler’s.

“[United Auto Union] UAW members, their families, and our communities will benefit from today’s announcement with the certainty that we are doing all that we can to protect our health and safety during this pandemic,” said UAW President Rory Gamble.

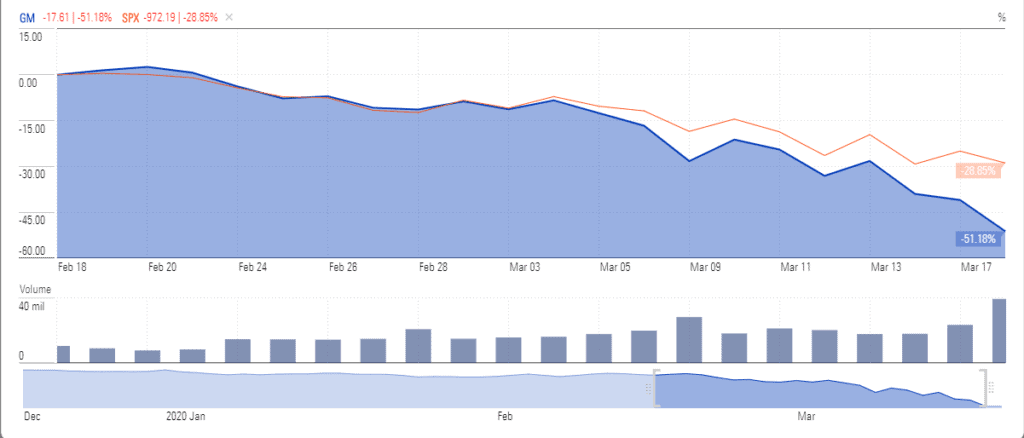

General Motors stock price hit the lowest level since its post-bankruptcy return in 2009. Its shares are currently trading around $16 with expectations for a further decline in the coming days due to production halts across the world. The massive drop in consumer demand is among the biggest contributor to the share price selloff. Last month General Motors generated earnings of $105m in the latest quarter while expectations for fiscal 2020 turned bleak amid shutdowns and economic slowdown.

Along with the stock price selloff, the dividend suspension is highly likely as the company seems set to post big losses in the coming quarters. General Motors is among the biggest laggards of S&P 500 – the broader market index fell close to 30% in the last month amid sustained selling.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account