Ford (NYSE: F) stock has been crushed by concerns over slowing economic growth and supply chain problems due to shutdowns all over the world caused by the coronavirus outbreak. The massive drop in demand is adding to panic selling; RBC Capital Market report suggests a 16% decline in global auto production and a 20% fall in US auto sales to 13.5m vehicles.

Demand from China was cut by half this year with February marking the largest monthly fall of 79% in car sales, according to the latest figures from the China Association of Automobile Manufacturers.

China is important for automakers because they sold 21.05 million passenger vehicles last year, up from 17 million in the US and almost 15.8 million in Europe.

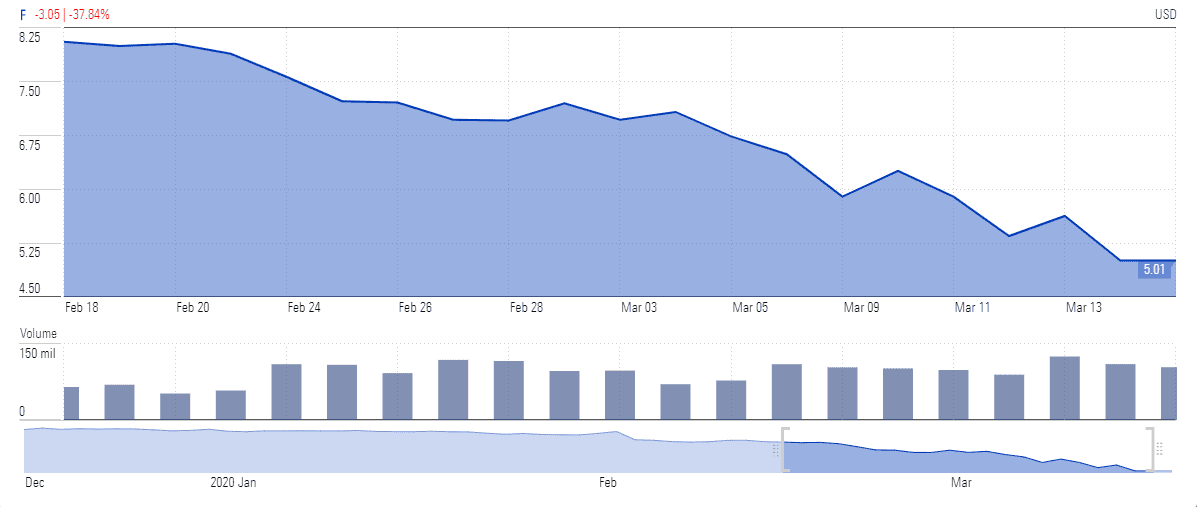

Factories across the European region are closing on coronavirus fear while sluggish business activities are slashing the demand side. Ford closed its plant in Spain and halted production at its Chicago Assembly factory. Ford stock price is currently trading below $5, down from a 52-week high of $10.5 a share.

The coronavirus related impact is a huge blow for the industry that was already struggling with lower margins and the trade war conflict.

The United Auto Workers union has called for the big three carmakers, General Motors (NYSE: GM), Ford and Fiat Chrysler Automobiles (NYSE: FCAU), to suspend production for two weeks in the wake of rising coronavirus cases in the US .

The three largest US auto companies agreed to implement the partial shutdown of facilities, extended periods between shifts, and brought in extensive plans to minimise contact between workers.

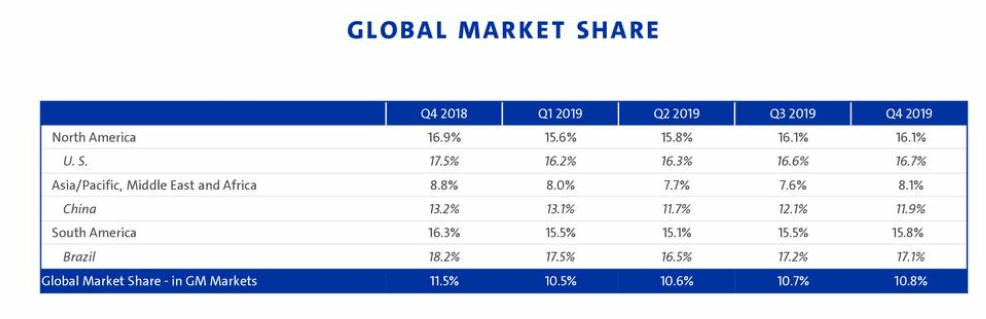

General Motors stock price is also sliding at a sharp pace due to production and demand related concerns. It has a significant presence in the US , China, and Asia Pacific markets. Last month General Motors posted adjusted earnings of just $105m in the latest quarter, against market expectations of £320m, while the coronavirus related volatility could also kill its plan of generating 2020 earnings per share in the range of $5.75 to $6.25.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account