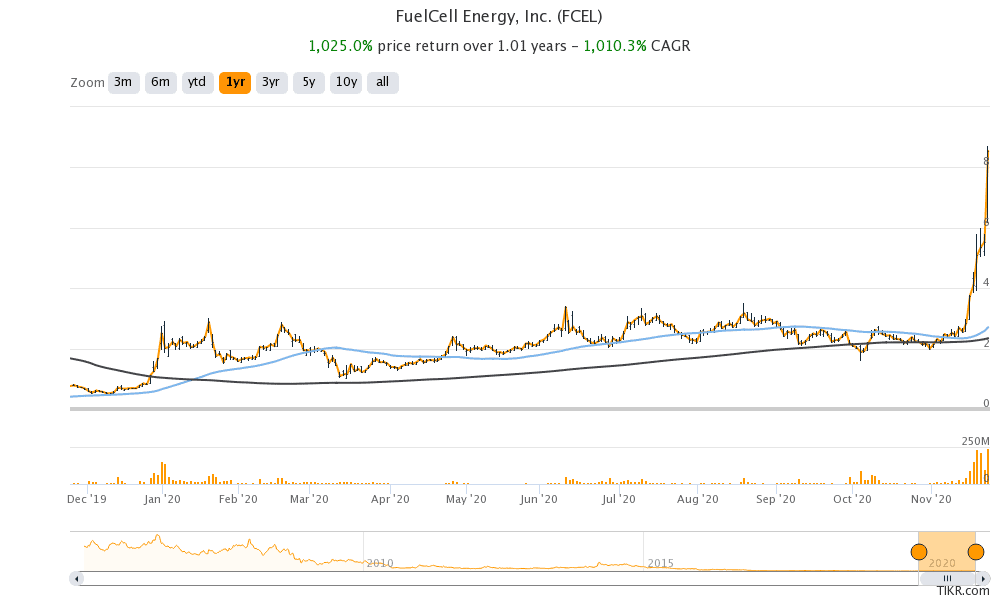

Renewable energy stocks have been on a fire this year. Yesterday, FuelCell Energy (FCEL) stock soared over 54% and opened higher today also.

To be sure, the rise is not limited to FuelCell Energy only. Tesla soared 6.5% yesterday to a new record high. Tesla stock is up sharply this month after the news that it would be included in the S&P 500.

Renewable energy stocks

NIO, also known as the “Tesla of China” also jumped over 12% yesterday and hit a new record high. The company now has a market capitalization of $75 billion. In contrast, General Motors and Ford have a market capitalization of $64 billion and $35 billion respectively.

Li Auto and XPeng Auto, that listed on the US markets this year only, also gained 14.5% and 33% respectively yesterday. DPW Holdings’ stock also more than tripled yesterday after one of its subsidiaries announced plans to install electric vehicle charging points at national fast foods restaurants. DPW Holdings was among the biggest gainers yesterday and surpassed even the massive gains in FuelCell Energy stock.

FuelCell Energy stock

Investors would recall that in September, SPI Energy, a renewable energy company not many had heard of, soared over 4,400% intraday after announcing a subsidiary to produce electric vehicles. The euphoria that we are witnessing towards the electric vehicles and renewable energy is reminiscent of the dot com boom days.

While there is little denying that the future of the automotive industry is would be renewable and alternative fuel, the sharp rise in stocks like FuelCell smells of a bubble.

What does FuelCell Energy do?

FuelCell Energy manufactures and operates Fuel Cell power plants and operates over 50 fuel cell power plants across the world. In October, it was awarded $8 million for designing and manufacturing an electrolysis platform to produce hydrogen by the US Department of Energy.

Last month, it completed a share issuance to raise capital. The stock has gained over 325% so far in November. JPMorgan Chase analyst Paul Coster, who had an overweight rating on the stock, recently downgraded it after the sharp rally.

Why is FuelCell Energy stock going up?

To be sure, there was no specific news yesterday related to FuelCell Energy or far that matter about any other major electric vehicle or green energy stock. The rally is part of the broader uptrend that we’ve seen in green energy stocks after Joe Biden’s election.

Trump has been a climate change denier and even pulled the US out of the Paris Climate Deal. President-elect Joe Biden has not only vowed to join the Paris Climate Deal but also talked about spending trillions of dollars on renewable energy.

Green energy stocks like FuelCell Energy are rallying in anticipation of a more favorable policy environment under a Biden administration. The Trump administration was generally more favorable towards old-economy industries like steel, coal, and oil and gas.

Fuel cell technology

Here it is worth noting that while automotive companies like Toyota Motors and Hyundai are investing in hydrogen fuel cell technology, many are not convinced about the technology’s future. Tesla’s CEO Elon Musk has lashed out against fuel cell technology multiple times.

All said the future of the automotive industry would depend on which technology—electric vehicles or fuel cells—can come up with a cost-efficient and more reliable technology.

Should you buy FuelCell Energy stock now?

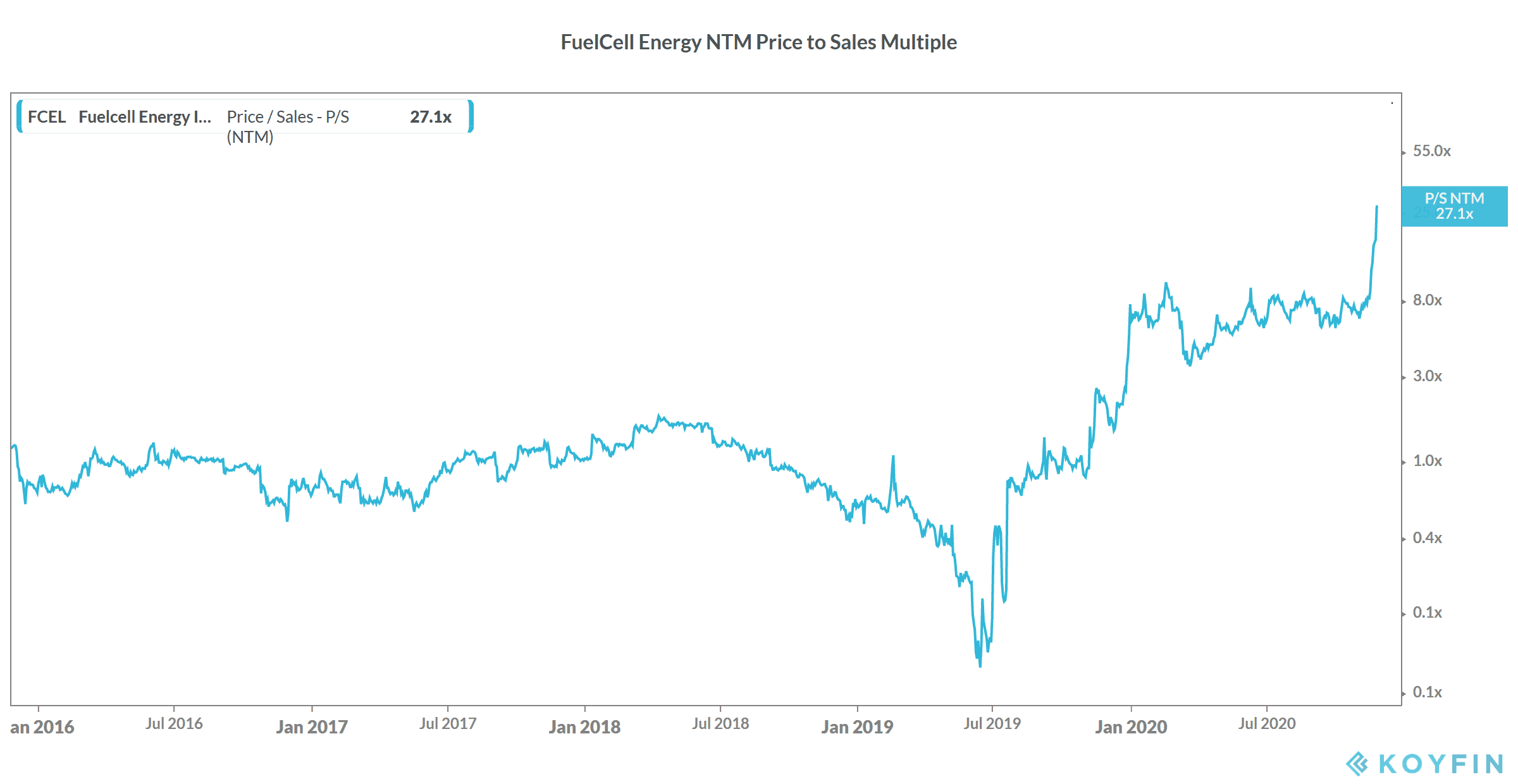

There is a euphoria towards green energy stocks like FuelCell Energy that has taken valuations to astronomical levels. However, if Biden goes ahead with his plans of boosting renewable energy generation in the US, companies like FuelCell could benefit.

FuelCell Energy stock trades at an NTM (next-12 months) price to sales multiple of 27.1x which is not cheap by any standards. However, the stocks in the green economy have seen a massive rerating this year led by Tesla, whose market capitalization now exceeds the combined market capitalization of Toyota Motors, Volkswagen, Ford, and General Motors.

How to buy FuelCell Energy stock?

After the sharp rise in Tesla’s stock price, its CEO Elon Musk is now the second richest person globally surpassing the net worth of Microsoft’s founder Bill Gates.

You can trade in FuelCell stock through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

An alternative approach to investing in green energy stocks like FuelCell Energy could be to invest in ETFs that invest in clean energy companies like FuelCell Energy.

Through a clean energy ETF, you can diversify your risks across many companies instead of just investing in a few companies. While this may mean that you might miss out on “home runs” you would also not end up owning the worst performing stocks in your portfolio.

By investing in an ETF, one gets returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account