Last week, Ford (NYSE: F) released its Q2 2023 earnings. One of the key takeaways from the report was that the automotive giant is going slow on its electric vehicle (EV) expansion plan and simultaneously focusing on hybrids.

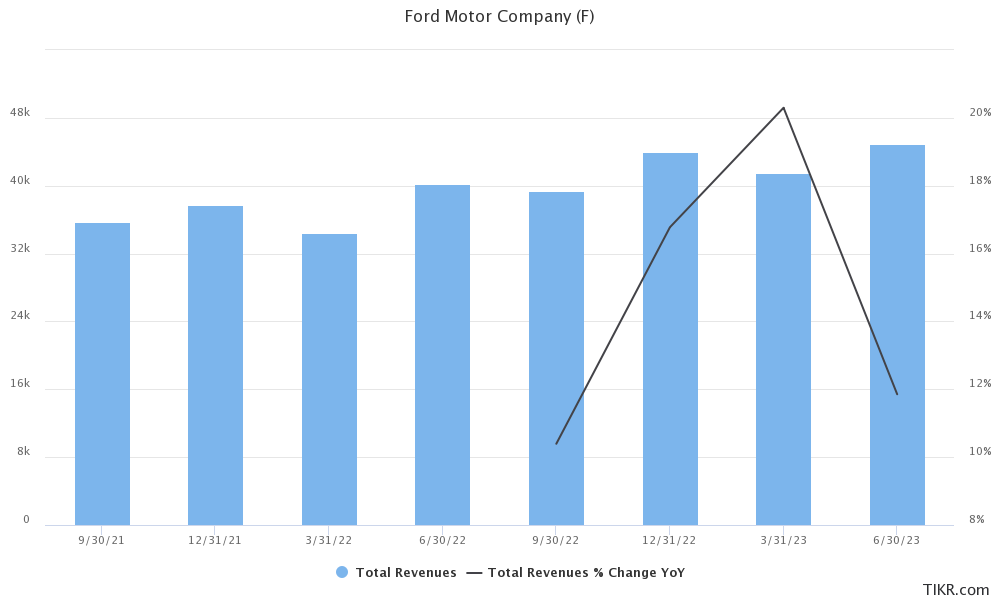

To begin with, Ford reported a solid set of numbers in the second quarter and its revenues came in at $42.43 billion which was well ahead of the $40.38 billion that analysts expected. Its adjusted EPS of 72 cents also surpassed analysts’ estimate of 55 cents. It also raised its full-year pre-tax profit guidance to $11 billion-$12 billion from the previous guidance of $9 billion-$11 billion.

Ford stock fell after the Q2 earnings release

It also raised its adjusted free cash flow guidance from $6 billion to $6.5 billion to $7 billion. Fellow legacy automaker General Motors also posted better-than-expected earnings and raised its full-year guidance. However, still, both stocks fell after the earnings release. Incidentally, there was a broad-based rally in pure-play EV stocks last week and Chinese EV stocks like NIO (NYSE: NIO) and Xpeng Motors (NYSE: XPEV).

Key takeaways from F’s Q2 earnings

Ford’s Model e which is the EV business lost $1.08 billion in the second quarter which was preceded by a loss of $722 million in the previous quarter. The company now expects the business to lose $4.5 billion this year which is wider than the $3 billion pre-tax loss that it previously forecast.

Ford also scaled back its ambitious EV pivot and said that it now expects to reach an EV production capacity of 600,000 units by the end of 2024 versus the previous guidance of hitting that goal by the end of this year only.

Previously, F had said that its EV production capacity would rise to 2 million units by 2026. However, during the Q2 earnings call it said, “we maintain flexibility on where we reach when we reach two million total EV global capacity because we are balancing growth, profitability, and returns.”

EV price war

Alluding to the EV price war, Ford said, “Contribution margin and EBIT margin were both negative with pricing and volume pressures intensified, and that’s impacting all OEMs. Given the rapid and dynamic gain on the pricing environment, we no longer expect to see contribution margin breakeven for our Gen 1 products this year.”

The company however still expects the Model e to reach a pre-tax profit margin of 8% by 2026.

The EV price war has worsened and Ford even lowered the price of its F-150 Lightning by as much as $10,000. However, during the earnings call the company said that despite the price cut, the model’s prices are above what they were at the time of the launch.

It said, “While EV adoption is still growing, the paradigm has shifted. EV price premiums over internal combustion vehicles fell more than $3,000 in the second quarter and nearly $5,000 in first half. We expect the EV market to remain volatile until the winners and losers shake out.”

Ford to focus on hybrids

Meanwhile, Ford is also focusing on hybrids taking a leaf out of Toyota’s playbook. It said that hybrids account for around 10% of F-150 sales while the corresponding figure for Mavericks is a whopping 56%.

During the earnings call, Ford CEO Jim Farley said, “What the customer really likes is when we take a hybrid system that’s more efficient for certain duty cycles and then we add new capabilities because of the batteries.”

He added, “We have been surprised, frankly, at the popularity of hybrid systems for F-150.” He said that Ford would offer more hybrid vehicles in the future.

Ford is still bullish on its EV pivot

Despite the short-term challenges, Ford is bullish on its EV business and Farley said, “EV customers are brand loyal and we’re winning lots of them with our high-volume, first-generation products; we’re making smart investments in capabilities and capacity around the world; and, while others are trying to catch up, we have clean-sheet, next-generation products in advanced development that will blow people away.”

During the earnings call, Ford said that many of its EV customers including for the F-150 Lightning are new to Ford.

Ford partnered with Tesla for Superchargers

In May, Tesla (NYSE: TSLA) and Ford announced a partnership under which Tesla would open up over 12,000 Superchargers across the US and Canada for Ford drivers beginning early next year.

The partnership acted as a template for other companies and over the next two months, companies like General Motors, Rivian (NYSE: RIVN), and Polestar (NYSE: PSNY) also announced similar partnerships with Tesla.

Morgan Stanley reiterated F stock as overweight

After the earnings release, Morgan Stanley reiterated F stock as overweight and said, “Solid 2Q beat and upped FY guide driven by strong margin and cash flows from Blue and Pro.”

Notably, despite higher-than-expected EV losses, Ford was able to not only post better-than-expected earnings for the second quarter but also raise its full-year guidance. However, the company’s EV pivot hasn’t been as smooth as expected.

That said, Ford is much more transparent than other legacy automakers as it provides the breakdown of its EV losses – unlike other legacy automakers whose profitable internal combustion engine operations mask their EV losses.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account