Big tech firms are lined up to report earnings this week and Facebook is among them, posting its first-quarter results on Wednesday. Analysts expect revenue growth to ease at the Menlo Park-based social media giant, as firms cut their marketing budgets due to the recent economic slowdown triggered by the coronavirus outbreak.

Even though lockdown measures have contributed to an increase the company’s user base and the usage of its popular platform, including Instagram and Whatsapp, analysts expect a drop in revenues as Facebook completely relies on advertising for revenue.

Bryan White, an equity analyst from Monness Crespi Hardt, has cut his revenue forecast for Facebook’s first-quarter revenues to $16.9bn, down from $18.47bn he first anticipated.

White’s estimates are possibly in the lower end of Wall Street forecasts, as analysts surveyed by Visible Alpha estimate Facebook’s revenues will come in at $17.5bn, while others pooled by Zacks are forecast sales of $17.2bn.

Shebly Seyrafi from FBN Securities recently dropped his earnings per share estimate for the quarter from to $1.79 from her earlier view of $2.04, citing the fact that Facebook, led by co-founder and chief executive Mark Zuckerberg (pictured), generates half of its revenues from the US, Canada, and Europe, all of which have seen a significant deceleration in their economic activity as a result of the virus.

This forecast seems to be in line with the consensus earnings per share of 11 analysts pooled by Zacks, who have set Facebook’s earnings per share for the quarter at $1.72.

This would result in a 104% jump compared to $0.85 the company reported a year ago, even though that quarter was affected by a one-time $3bn charge the company took on potential legal expenses derived from the Federal Trade Commission probe it faced. After adjusting that non-recurring charge, actual growth would be around 2%.

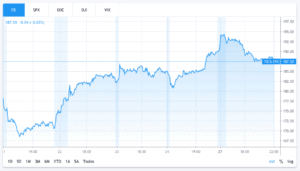

Facebook shares have been rallying ahead of the company’s quarterly report and accumulate a 9.8% gain since April 21, even though the stock is still losing 8.7% so far this year as a result of the sell-off triggered by the health emergency on 20 February.

You can browse our selection of featured stock brokers to buy Facebook shares, or you can also trade ETFs that track tech companies including Facebook, Apple, and Google to benefit from the positive performance of the industry as a whole.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account