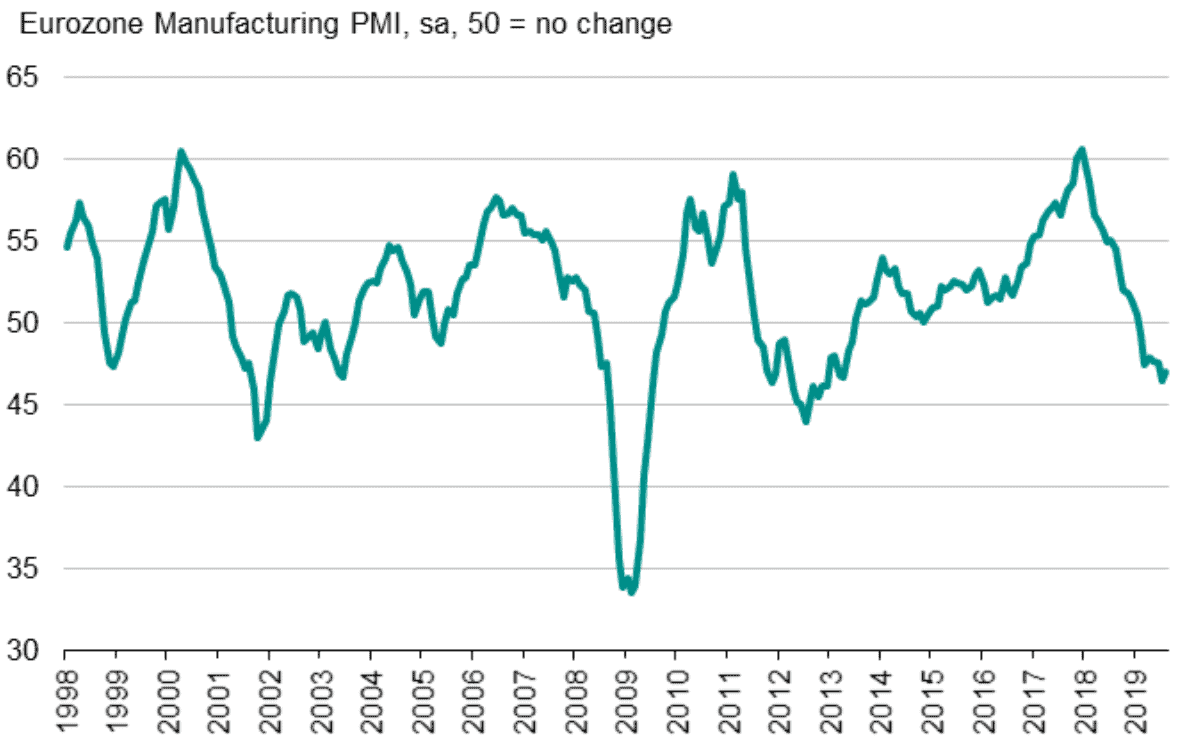

The Manufacturing PMI of the Eurozone registered 47.0 in August as production and new orders continue to fall. At the same time, confidence hit the lowest point since November 2012, suggesting the industrial sector could keep falling during the coming months. The information was released by IHS Markit on September 2nd.

Manufacturing PMI Remains Negative

The final Eurozone Manufacturing PMI for August remains in negative territory (under 50.0) for the seventh consecutive month. Production and new orders were to of the most important factors that led to the current decline in the PMI. At the same time, employment has also fallen for the fourth consecutive month.

The Manufacturing PMI is a composite indicator of manufacturing performance in specific countries or economic regions. In order to get this result, the index takes into account new orders, industrial output, employment situation, delivery times for suppliers and stock.

The current August result for the Eurozone shows an improvement compared to July’s six-nad-a-half year low. In July, the Manufacturing PMI of the Eurozone was 46.5. However, this is the second-lowest result since April 2013, which indicates that industrial manufacturers are registering a noticeable deterioration in operating conditions.

Despite the improvement in this month Manufacturing PMI for the Eurozone, the index remains close to multi-year lows, including in Germany, Austria and Ireland with 43.5, 47.9 and 48.6 respectively. Greece, Netherlands and France registered improvements compared to the last few months. They registered a Manufacturing PMI result of 54.9, 52.6 and 51.1, respectively.

It is worth mentioning that there are different issues that are expected to affect these results, including trade wars – specifically the one between the United States and China – and financial uncertainty around the world. Furthermore, Germany is also experiencing lower demand for cars and also business machinery. Meanwhile, the positive results in France were still modest.

Commenting on the final Manufacturing PMI data, Chris Williamson, Chief Business Economist at IHS Markit, commented:

“The deteriorating manufacturing conditions mean the goods-producing sector is likely to act as an increased drag on eurozone economic growth in the third quarter. At current levels, the survey is consistent with goods production declining at a quarterly rate of 1%.”

With Germany and core European countries registering a weakening economy, the Manufacturing PMI results of Eastern European Countries (the Czech Republic and Poland) are already being affected. These two countries registered very weak results, 44.9 the Czech Republic and 48.8 Poland.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account