Emerging market currencies surged in May as investors looked for alternative assets while waiting for a recovery in mature economies, yet analysts warn that rise is set to end.

In a note released by Barclays on Saturday, the UK-based investment bank warned investors that currencies and sovereign bonds from emerging-market countries were still fairly expensive based on the risks they face, including the economic fallout caused by the coronavirus pandemic.

“Long-term fiscal sustainability will remain a challenge for some, even under optimistic post-Covid-19 assumptions”, said Nikolaos Sgouropoulos, a strategist for the bank.

The analyst emphasized how weak balance sheets and large budget deficits from these countries – including Chile, Mexico, South Korea, and India – could endanger the recovery of their currencies in the short term, as they may be forced to take on more debt to bring their economies back to life.

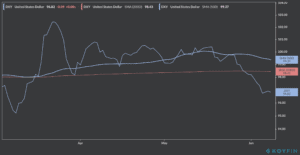

The MSCI Intl Emerging Market Currency Index, which tracks the fluctuation in the value of emerging-market currencies, was up 1.3% last week, while the US Dollar Index (DXY) is trading at 96.82 today, down 0.09% from Friday’s closing price and following a steep 1.4% decline last week.

This latest report from Barclays is in line with a note released by US research firm S&P Global Market Intelligence on Friday, where they highlighted that even though emerging market currencies may recoup some of their losses they are “not likely return to pre-crisis levels over our forecast horizon”.

The S&P report cited concerns from Deutsche Bank about a spike in virus cases in certain emerging economies such as Brazil, which has negative repercussions on its domestic currency.

“We remain very concerned about Brazil where the peak in epidemic curves seems to be between two-to-four weeks away, combined with looming risks of a debt crisis and impeachment”, said George Saravelos, a forex strategist at the German bank.

So far this year, the Mexican Peso and the Colombian Peso are leading the comeback, gaining 7.3% and 5.9% against the US dollar between 30 April and 29 May.

You can engage in forex trading by using one of the brokers featured on our list of best forex brokers.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account