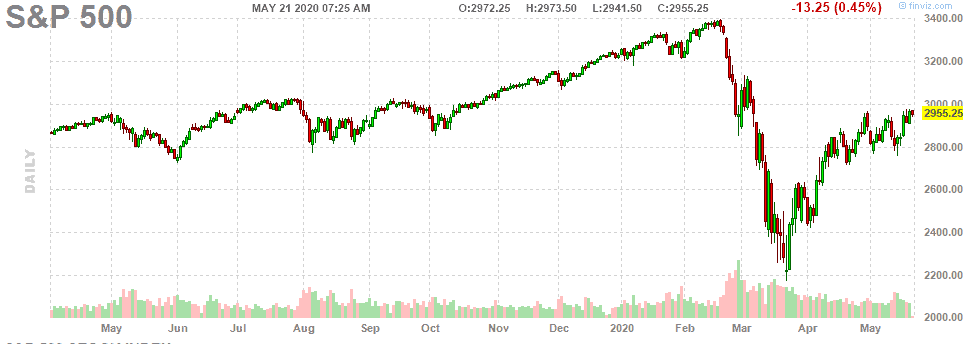

Historic stock market volatility, social distancing rules, and commission-free trading all contributed to a 100% year over year increase in dealing volumes for electronic brokers during the first quarter, with many e-brokers reporting record new accounts along with a 35-50% increase in mobile logins.

Piper Sandler analyst Rich Repetto who tracks e-broker trends, says record March quarter trading activity extended into April, with no signs of letting up.

Repetto claims that electronic broker’s shift to $0 commissions is one of the biggest factors behind the strong trading activity. “You can trade 20 shares one time, 50 shares the next time, to maybe get a better price on a different trade, and you don’t care because it’s free,” Repetto told CNBC on Wednesday.

The adjustments in portfolios from individual investors due to massive market swings have also added to an enormous year over year spike in online trading activity for TD Ameritrade (up 144%), E-TRADE (up 129%), Charles Schwab (up 98%) and Interactive Brokers (up 72%).

The number of logins for Fidelity Investments grew 56% year over year in March alone, while Robinhood’s trading volume tripled in March from the year-ago period.

Interestingly, Ally Invest director Frank Lietke noted that a buy ratio stood at 71% in March, a month when S&P 500 tumbled to bottom out at around 2200 points on 23 March.

TD AmeriTrade chief market strategist JJ Kinahan saw investors interest spiking in two distinct groups.

First, investors, who were chasing dividends, had invested in dividend-paying companies like Exxon (NYSE: XOM), Chevron (NYSE: CVX), and Bank of America (NYSE: BAC). The second group of investors picked most beaten-down stocks like Carnival (NYSE: CCL) and airline companies.

If you plan to invest in stocks online, you can checkout our featured electronic stock brokers here.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account