The eurozone economy is already in its deepest recession on record and economists anticipate the meeting of the European Central Bank (ECB) on Thursday will take further measures to support the 19-nation bloc.

Most analysts polled by Bloomberg expect the ECB, led by president Christine Lagarde (pictured), to leave interest rates intact at the current minus 0.5%. Also, most analysts expect the bank to commit to do more to support the bloc’s economy during this pandemic.

Thursday’s meeting follows what have been a few difficult months despite the ECB pledging to buy more than €1.1trn in assets this year to back eurozone governments who are spending hundreds of billions to support businesses and worker’s pay packets.

The ECB is likely to extend its debt purchases to include junk bonds and provide a backstop for corporate financing.

The central bank could extend the collateral allowance to all higher-rated junk debt and make outright purchases of debt from newly downgraded “fallen angels”, ING analysts said.

Other options include buying exchange-traded funds, bank bonds, offering even more favourable terms on cheap multi-year bank loans and increasing the multiplier on the ECB’s tiered rate. This exempts banks from taking an effective penalty due to negative interest rates for their excess reserves at the ECB.

“Therefore, we expect the ECB to reiterate its commitment to stand ready to increase and extend the purchase programme and stand ready to act should more be needed,” analysts at Danske Bank said.

The latest Reuters poll, taken April 14-22, showed the bloc’s economy contracting by 3.1% in the first quarter and 9.6% in the current quarter. Forecasts for the quarter-on-quarter downturn have not changed much over the past few weeks, but if realised, this quarter would mark the sharpest decline on record.

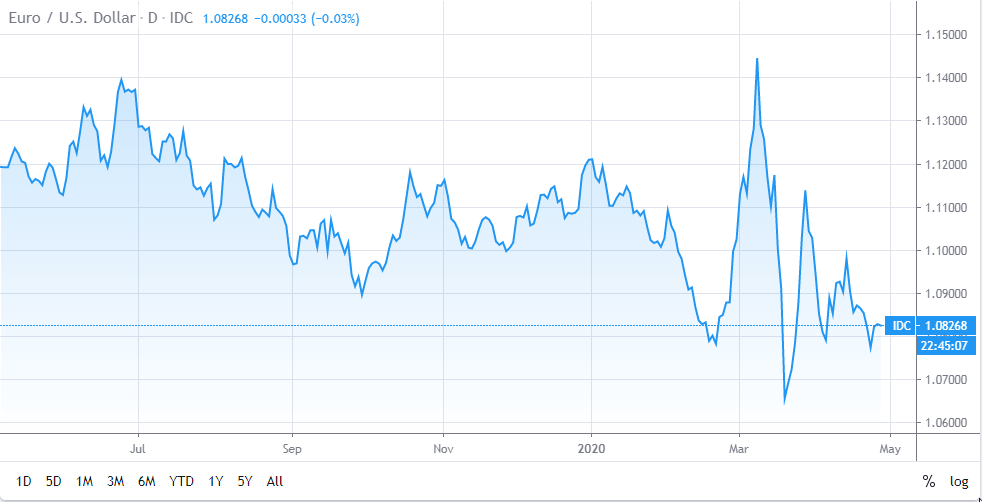

In times of economic uncertainty, traders can take advantage of market volatility and profit off trading commodities or trading Forex instruments.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account