Dollar Tree (DLTR) is set to release its second-quarter earnings report on Thursday and investors are eager to see if the firm can match Walmart or Home Depot after both retailers smashed Wall Street estimates last week.

Dollar Tree’s revenues are expected to surge by 8.2% to $6.21bn during the quarter, up from the $5.74bn the company sold a year ago. Earnings per share for the quarter are expected to land at $0.90, up 18.4% from the $0.76 the company turned a year before.

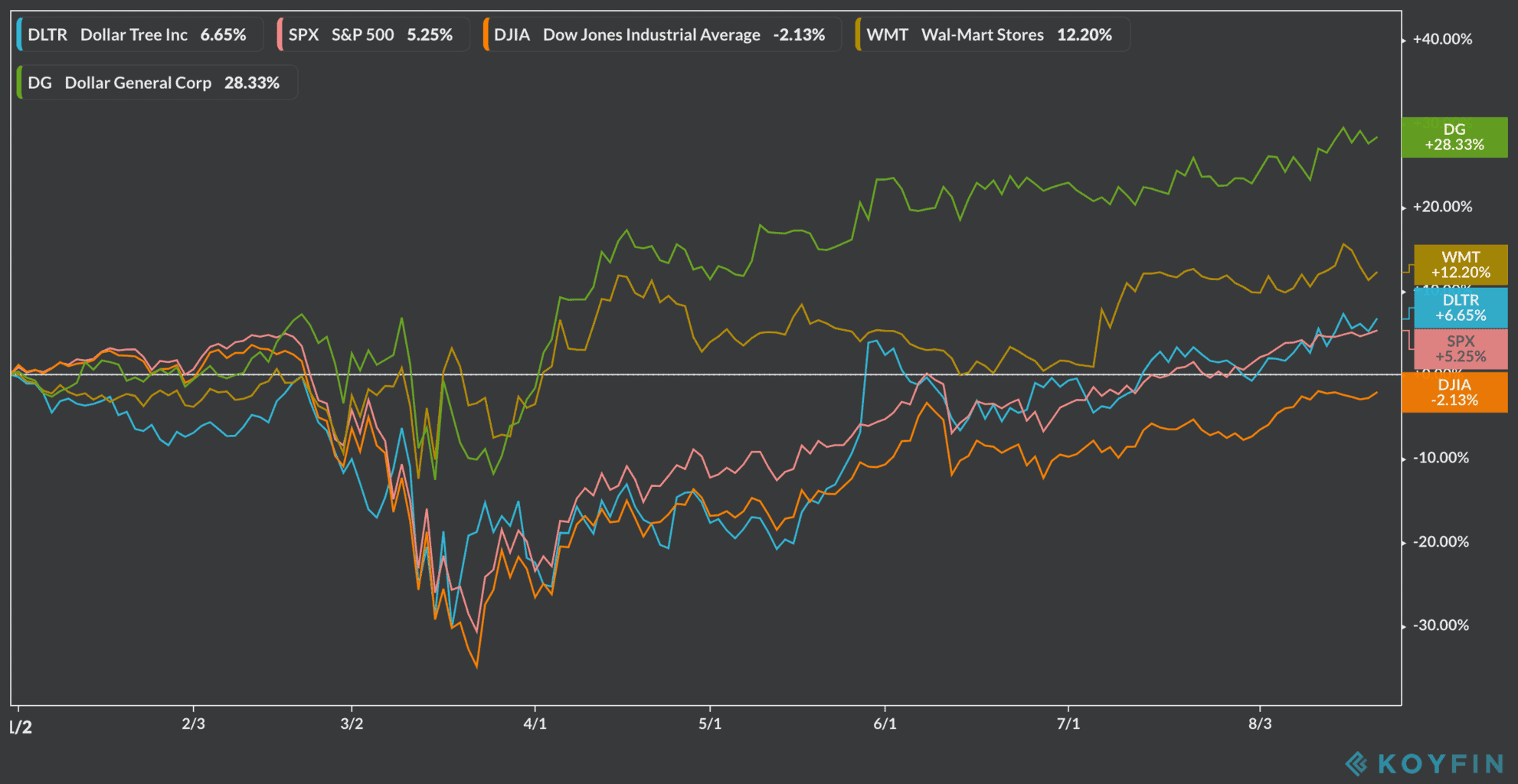

Dollar Tree shares have been lagging its peers, including Dollar General, as the Norfolk-based discount retailer stock has only gained 6.7% compared to 28% its rival’s shares have delivered during 2020.

That said, Dollar Tree’s upcoming earnings could provide a boost for the stock as the firm may have capitalized on pandemic stockpiling, or reveal that its discounted goods appeal amid rising unemployment.

What analysts will look for in Dollar Tree’s earnings

The firm, which operates more than 15,000 stores across 48 states in the US, sells all sorts of products priced at $1 and it is considered a go-to place for savers and low-income households.

The company continues to benefit from its “essential establishment” status at a time when the coronavirus pandemic continues to push certain states in the US to shut down non-essential businesses.

That said, gross profit margins, operating expenses, and management’s guidance will be closely watched by analysts, as the senior management may well had to boost safety standers amid the pandemic, along with providing its front-line workers with extra bonuses to keep them motivated.

How are Dollar Tree shares lining up to these upcoming quarterly results?

Dollar Tree shares reached their post-pandemic peak at $102 per share on 17 August ahead of this week’s earnings report, following the positive results posted by Walmart, Target, and other big-box retailers, which pointed to a surge in sales across the industry.

Dollar Tree stock failed to fully close their late 2019 price gap, at the time, which remains the most important resistance for the share price its potential next destination if this earnings report turns out to be better than the market expects.

The stock’s most recent price action has not resulted in an overbought relative strength index level, which is positive, as good results could push the oscillator to the higher-highs it needs to reach to climb above that gap.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account