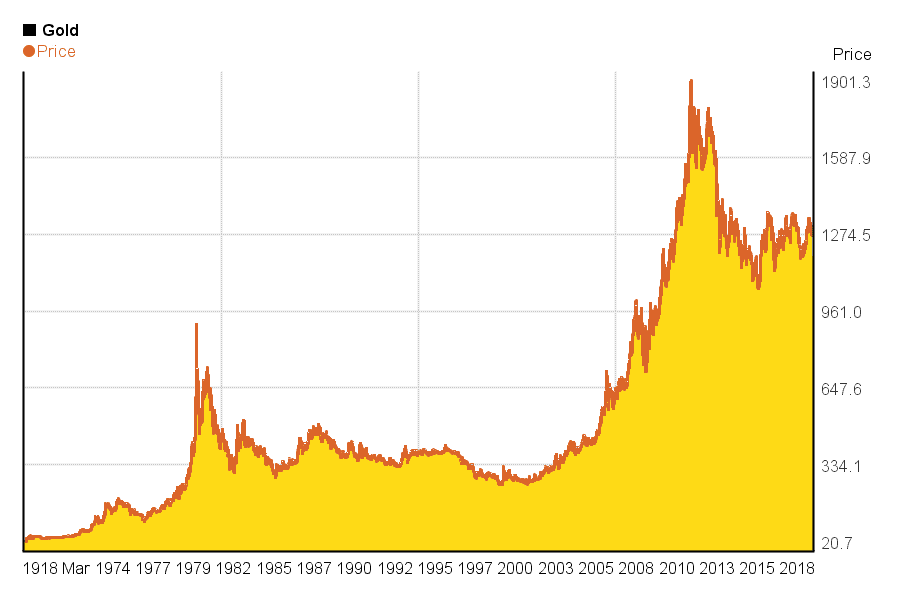

Gold was thought-out to be a universal currency for many years. In 1944, after the Bretton Woods Agreement, dollar substituted gold as an anchor currency. However, gold continued to be used to give a lift to various countries’ local currency. Today, the precious metal is one of the most popular investments both as a form of portfolio diversification and a hedge for different classes of investments.

-

-

How to invest in gold?

Buy physical gold: Invest in gold futures:Buy gold ETFs:Invest in gold mining companies:If you are looking for direct investment in gold, you may consider buying physical gold. This involves buying into gold bullion bars, bullion coins or jewelry. These can be acquired from a gold storefront or jewelry shop down the street or online from reputable online gold trading sites. Like in any other investment, you want to ensure that you are acquiring the gold in its purest form and at a fair price. You will also need a proper safe or depositor’s account with a bank for its storage.

You may also choose to invest in the leveraged gold futures contracts. This investment has to be done through a commodities brokerage house that requires an initial cash deposit necessary to open a margin position. The biggest advantage in gold futures investment is that it allows margin trading implying that you stand to make more than your initial investment should the gold prices shoot. On the flipside, you stand to lose more than your deposit should the price go south. You can, however, take confidence in the fact that Gold prices can never be Zero and this puts a limit to how much you can lose in a single trade.

If you don’t want to own physical gold or being tied to a futures contract but still want to benefit from its price, consider investing in Gold Exchange Traded Funds (ETFs). This refers to highly diversified investments in physical gold and gold-related products. As the name suggests these are bought and easily traded on the stock exchanges.

You may invest directly in the gold mining companies through a direct investment for private companies and buying into the shares of the publicly traded miners. In most instances, the price of the gold company shares will rise and fall in relation to the value of gold. The only exception to this rule is when these companies experience operational challenges specific to the company that often strangles its share price regardless of the performance of gold.

What are the pros and cons of investing in gold?Pros

- Helps protect your long term savings from the effects of inflation

- Presents you with one of the most viable investment diversification options

- It is easier to invest in gold than keep trolling the markets looking for the right shares or stocks

- Unlike fiat currency or company shares, its value can never go down to Zero even in the worst economic downturns like war

- Can be used to hedge against the dollar and most other international currencies

Cons

- Fewer volatilities mean low rates of return

- Keeping physical gold safe may be relatively stressful and expensive

- The high fees in collector’s fees and premiums on prices for physical gold eat into possible profits

Gold as a Form of Investment

Although gold is no longer used as a standard form of currency internationally, it still remains to be a preferred investment choice for many potential investors. Below you will find some of the reasons that make gold a better investment choice in 2019.

- Liquidity

Gold is believed to be one of the most liquid assets as it can be conveniently converted into cash whenever and wherever required. Similar to cash, the liquidity and acceptance of gold is incomparable and you can sell it instantly whenever needed.

- Maintains Its Value

Unlike other investments and assets, gold tends to hold its value over the passage of time. Economists believe that even the gold price is not able to signify its real worth, meaning if the gold price drops, the primitive gold value doesn’t vary a lot. This is mainly because unlike dollar that holds no inherent value, there is a fixed quantity of gold.

- Hedges Inflation

Gold prices generally increase when your local currency loses its worth and inflation takes hold. As gold is valued in dollars, any decrease in the dollars price will trigger raise in the gold prices. Thus, because of its stability, gold can act as a better investment option than its counterparts.

- Portfolio Diversification

Gold is a simple and effortless way to expand your investment portfolio. You can significantly reduce the overall risk of your investments through portfolio diversification. Since, gold generally moves in reverse to the futures market, it’s relatively easier to diversify with gold than other investment options.

- Gold can be used as an Input for Other Products

As gold is used to produce other products like jewelry, there is a significant need that also readjusts the gold prices.

Why Are the Alternates to Gold Investments Failing in 2019?

There are numerous reasons that make gold investment better than other alternatives like stock, forex or bonds.

- Hedge

When we compare gold with other investment options, gold is popular worldwide because of its hedging capability. As we know that each year the cost of goods and services rise due to the increase in inflation. This rise in prices negatively impacts our purchasing power. Since, gold maintains its value, it is said to be the hedge against inflation.

- There are Number of Ways to own it

This is one of the most important aspects. Yes, there are multiple ways to own gold. For instance, you can buy gold coins or bullions. You can even invest in gold securities that enables you to trade that security in which acts similar to owning any tangible asset.

- Maintains its Worth

There can be a decline in gold prices but one thing is certain that it can never be worthless. In fact, it always gets back its real worth after some time.

Where to invest in Gold

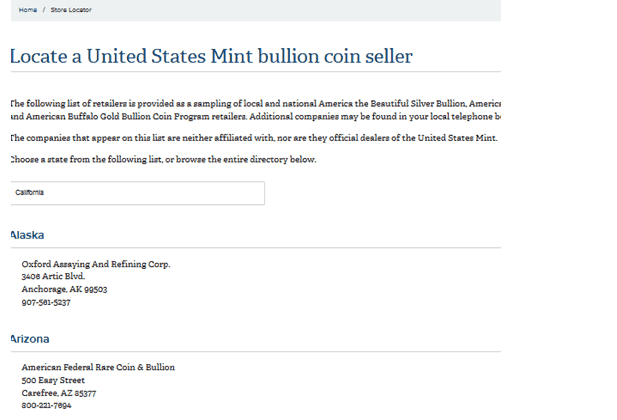

1.United States Mint – Best for physical gold (bullion coins)The United States Mint is a government-owned producer and distributor of physical gold and other precious metals in the form of coins. According to the gold manufacturer, the composition of the gold coins produced and sold here includes the one-tenth, one ounce, the 22 –, and 24 – Karat gold. These coins are specially designed for investors, with most being offered in limited edition mode, to help them diversify their investment portfolios. The U.S Mint doesn’t, however, sell Gold coins directly to investors but passes them through collectors and dealer stores.

How to buy gold bullion coins from U.S Mint

Step 1: Login to USMint website

Head over to the official U.S Mint website and click on the Bullion Dealer Locator link on the Gold Coins page. This will direct you to the retailer’s page where it asks you the state from which you wish to buy the gold coin.

Step 2: Identify a suitable dealer

Upon choosing your state, you are given a list of all U.S Mint Certified Gold Bullion dealers, their contacts and address from whom you can contact and confirm the prices. Of the different coins listed on the U.S Mint website. According to the U.S mint, the price of different coins is evaluated on a weekly basis depending on the past performance of similar coins.

*Note: The price the coins at the dealer’s store will be likely higher than the one displayed on the Mint’s website as they tend to add premiums and collector’s fees.

Pros:

- The intrinsic value of gold, unlike paper money, will never be zero

- Helps shield your reinvestments against inflation

- Acts as a hedge against market crashes

- The rising global demand for gold constantly pushes prices up

Cons:

- Relatively illiquid investment

- High maintenance costs in a safe or bank safe deposit box

- Low returns occasioned by long periods of market stability

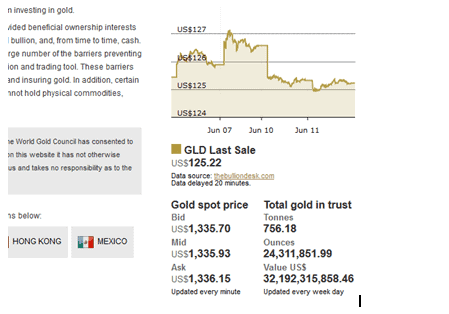

1. SPDR Gold Trust – Best for ETFsStarted over a decade ago and currently valued at over $33 billion, the SPDR Gold Trust comes off as one of the largest Gold ETF you can buy into. It also competes favorably against most other precious metal ETFs and ranks highly on both returns and inexpensive management fees.

These currently stand at 0.4% of the total assets under management. One of the greatest perks of investing in Gold ETFs is the fact that you are trading its price movements. You, therefore, don’t have to worry about the extra costs associated with keeping physical gold safe.

How to buy SPDR gold trust ETF:

Register and fund your account account and start investing

Virtually anyone can buy into this exchange-traded fund. You only need a brokerage account or an individual retirement account to invest in this fund. If you are going to buy into the ETF using a brokerage account, you need to be armed with such details as your proof of address and identity where they require you to send them a copy of your government-issued identification document.

Pros:

- Low management fees of 0.4%

- Your investment is held in electronic form and thus no need to spend more on keeping it safe

- The fact that it is exchange traded makes it highly liquid

Cons:

- More capital intensive compared to such other electronic gold investments as CFDs

Conclusion

When it comes to long-term investment, gold is certainly the best option – and continues to be, this year. If you’re interested in latest monetary news including the inflation status or devaluation of your local currency, you may want to include gold to your investment portfolio.

FAQs

What is the best time to invest in gold in 2019?

The ideal time to invest in gold is when inflation takes hold and demolish the worth of the local currency. The sooner you can identify such plunges, the better you would be able to take advantage of it. Prominent market indicators such as political disturbance and shares market fluctuations may signify the expected devaluation of your national currency.

Noticeably, when national currency is powerful and inflation is in control, there is very little chance for the gold prices to increase.

How much Gold should you buy?

Well obviously, there is no fixed rule as to how much quantity of gold you should buy in order to diversify your investment portfolio. This will depend on your market understanding, your ability to bear losses or your overall financial requirements.

Gold is one of the few investment options that works great even in a bear market. Ideally, you should use the effective portfolio management techniques for allotting gold as for buying other investments.

Why is gold considered an investment safe haven?

Gold is considered an investment safe haven due to its relatively stable nature. Unlike forex trading or the shares and stock investments, gold isn’t easily affected by blips in the national or international economy.

Is gold a viable investment option?

Yes, but only as a long term investment. Most investments like shares and stocks make good short term investments for investors/traders who are able to correctly predict and ride their constant volatilities. The absence of meaningful volatilities for gold investments therefore only make it a viable long term investment.

What factors influence the price of gold?

Ideally, the price of gold is to a large extent influenced by the forces of demand and supply. Traditionally, this demand and supply were purely between the mining company’s supply and demand from physical gold buyers. Today, however, the price takes into account both the demand and supply for both the physical gold and its price action in the exchanges and brokerages.

Can I invest in gold using leverages?

Yes, but only if you are investing in Gold futures or online brokerage traded- gold CFDs. You will, however, note that CFD trading is illegal in the United States and leveraged trades capped at 1:50.

Is gold affected by market volatilities?

Yes, but only to a limited extent. No one investment is immune to market volatilities. There will always be socio-economic and political factors that force significant changes in the price of the precious metal. The volatilities experienced in gold trading are however not as significant as those rocking the shares and stock or forex markets.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

Rating

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Rating

Visit NowInvesting in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

Michael Booker

WARNING:

För att använda sidan måste man vara minst 18 år. Om du behöver hjälp eller rådgivning angående spelproblem, vänligen kontakta Stödlinjen.

Vi kan ibland inkludera affiliatelänkar i vårt innehåll. Genom att klicka på dessa länkar kan vi erhålla en provision – utan extra kostnad för dig.

Det är viktigt att notera att innehållet på denna webbplats inte ska betraktas som spelråd. Spel är en spekulativ verksamhet där ditt kapital är i risk. Vi erbjuder denna webbplats gratis, men vi kan få provision från de företag som vi presenterar här.Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkPrivacy policyScroll Up

If you are looking for direct investment in gold, you may consider buying physical gold. This involves buying into gold bullion bars, bullion coins or jewelry. These can be acquired from a gold storefront or jewelry shop down the street or online from reputable online gold trading sites. Like in any other investment, you want to ensure that you are acquiring the gold in its purest form and at a fair price. You will also need a proper safe or depositor’s account with a bank for its storage.

If you are looking for direct investment in gold, you may consider buying physical gold. This involves buying into gold bullion bars, bullion coins or jewelry. These can be acquired from a gold storefront or jewelry shop down the street or online from reputable online gold trading sites. Like in any other investment, you want to ensure that you are acquiring the gold in its purest form and at a fair price. You will also need a proper safe or depositor’s account with a bank for its storage. You may also choose to invest in the leveraged gold futures contracts. This investment has to be done through a commodities brokerage house that requires an initial cash deposit necessary to open a margin position. The biggest advantage in gold futures investment is that it allows margin trading implying that you stand to make more than your initial investment should the gold prices shoot. On the flipside, you stand to lose more than your deposit should the price go south. You can, however, take confidence in the fact that Gold prices can never be Zero and this puts a limit to how much you can lose in a single trade.

You may also choose to invest in the leveraged gold futures contracts. This investment has to be done through a commodities brokerage house that requires an initial cash deposit necessary to open a margin position. The biggest advantage in gold futures investment is that it allows margin trading implying that you stand to make more than your initial investment should the gold prices shoot. On the flipside, you stand to lose more than your deposit should the price go south. You can, however, take confidence in the fact that Gold prices can never be Zero and this puts a limit to how much you can lose in a single trade. If you don’t want to own physical gold or being tied to a futures contract but still want to benefit from its price, consider investing in Gold Exchange Traded Funds (ETFs). This refers to highly diversified investments in physical gold and gold-related products. As the name suggests these are bought and easily traded on the stock exchanges.

If you don’t want to own physical gold or being tied to a futures contract but still want to benefit from its price, consider investing in Gold Exchange Traded Funds (ETFs). This refers to highly diversified investments in physical gold and gold-related products. As the name suggests these are bought and easily traded on the stock exchanges.

The United States Mint is a government-owned producer and distributor of physical gold and other precious metals in the form of coins. According to the gold manufacturer, the composition of the gold coins produced and sold here includes the one-tenth, one ounce, the 22 –, and 24 – Karat gold. These coins are specially designed for investors, with most being offered in limited edition mode, to help them diversify their investment portfolios. The U.S Mint doesn’t, however, sell Gold coins directly to investors but passes them through collectors and dealer stores.

The United States Mint is a government-owned producer and distributor of physical gold and other precious metals in the form of coins. According to the gold manufacturer, the composition of the gold coins produced and sold here includes the one-tenth, one ounce, the 22 –, and 24 – Karat gold. These coins are specially designed for investors, with most being offered in limited edition mode, to help them diversify their investment portfolios. The U.S Mint doesn’t, however, sell Gold coins directly to investors but passes them through collectors and dealer stores.