CVS Health Corporation (NYSE: CVS) stock price is trading well below from 52-weeks high of $82. Although the stock price stabilized slightly in the past couple of months, the shares are down 17% in the past twelve months.

CVS shares are currently trading around $62, up slightly from 52 weeks low of $51. The financial numbers are offering strong support to CVS Health Corporation stock price. In addition, its dividend growth is safe despite sluggish share price performance.

Financial are Supporting CVS Health Corporation Bullish Trend

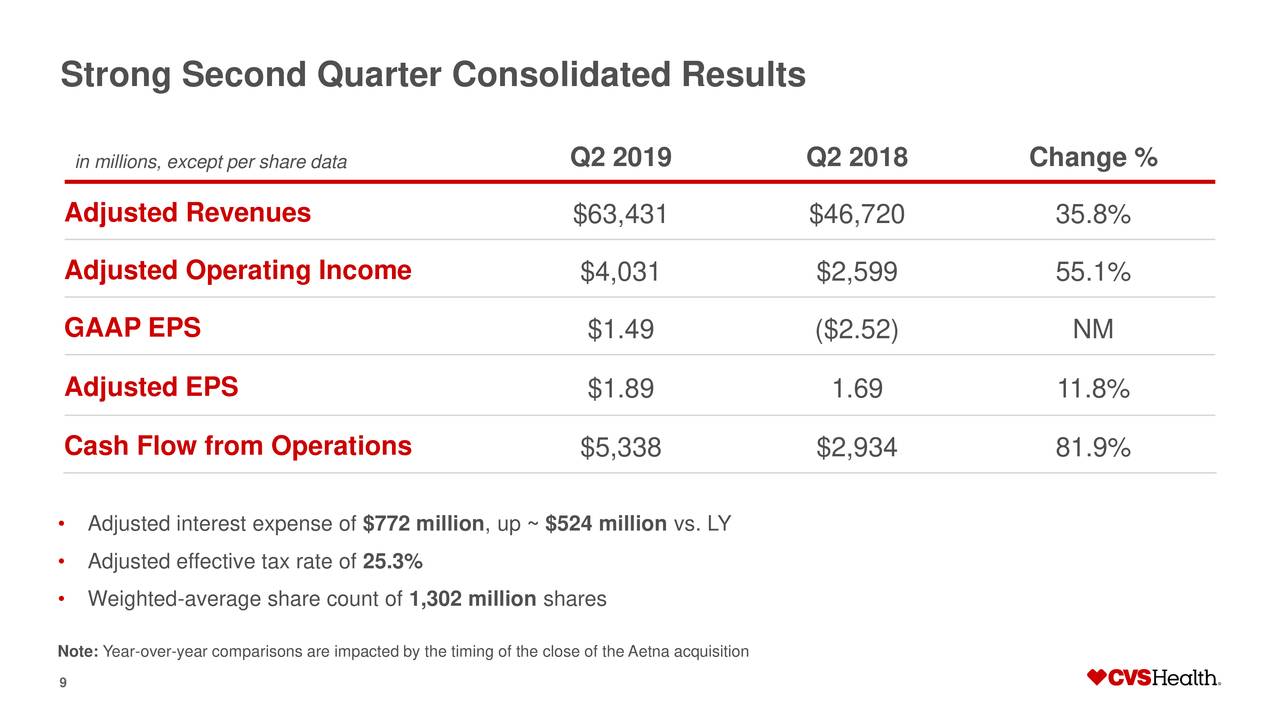

The company generated second-quarter revenue of $63.4 billion. This represents a growth of 35% from the previous year period.

The revenue growth is driven by its recent acquisition of Aetna Inc. Its revenues also received support from increased volume and drug price inflation in both Retail/LTC segments and the Pharmacy Services.

On top, the company has generated a 55% growth in operating income. The robust growth in earnings has enhanced its cash generation potential.

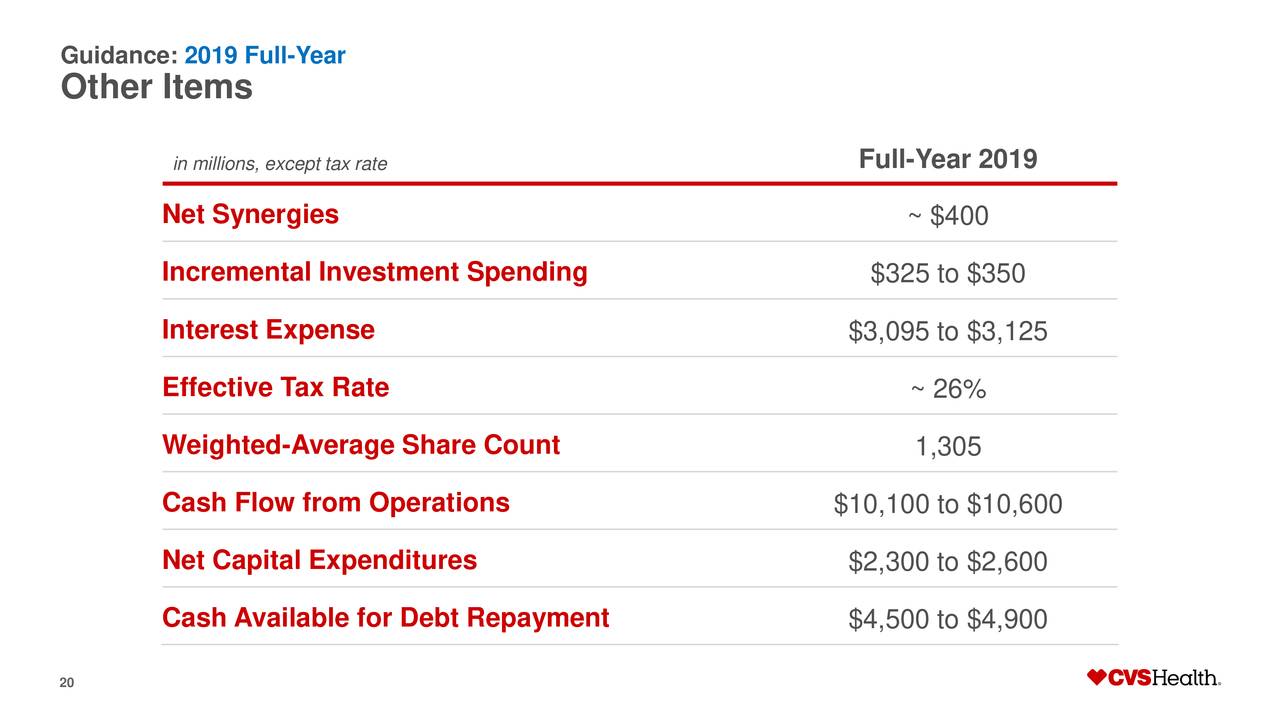

CVS has raised its outlook for the full year following stronger than expected second-quarter results. The company anticipates full-year adjusted operating income in the range of $15.2 billion to $15.4 billion compared to the earlier estimate for $15.0 billion to $15.2 billion

Dividends are Safe

CVS currently offers a quarterly dividend of $0.50 per share, yielding above 3%. Its dividends are completely safe. Indeed, the substantial growth in cash flows offers a room for a dividend increase.

CVS Health Corporation expects to generate $10.6 billion in operating cash flows while the dividend payments are likely to stand around $2.6 billion. Strong cash flow offers a gap for a dividend increase. In addition, the company appears in a position to invest in both organic and non-organic growth opportunities.

Overall, CVS Health Corporation stock price is receiving support from numerous catalysts. The substantial growth in revenues along with strong cash generation potential is among the biggest catalysts. Therefore, analysts are suggesting dividend investors buy CVS Health Corporation stock following the dip.

Click here to learn more about forex brokers and forex trading.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account