Nervous US banks will wait to see if investors will continue to sell off their stocks following new Federal Reserve (pictured) rules that limit buybacks and dividends.

The stress test report, released by the US central bank at the end of last week, highlighted weaker-than-expected capital buffers if banks were to face a severe economic turmoil and proposed these measures to preserve the integrity of the country’s financial system amid the coronavirus economic fallout.

The Fed outlined what it thought it was the most severe economic stress test scenario possible in February, under the Dodd-Frank Act passed by Congress after the 2008 financial crisis. The tests are for the country’s 33 largest banks such as JPMorgan Chase, Wells Fargo and Bank of America.

However, the central bank now believes the earlier scenario may have fallen short, as the pandemic has since increased unemployment calculations beyond expectations, deepening a potential recession.

The Fed board tightened up dividend payments in two ways. Banks cannot pay out more than what was already paid out in the second quarter. They also must limit dividends to a formula tied to recent earnings.

New Fed hurdles hurt a quarter of banks tested

The bank’s Board of Governors also went on to outline three potential scenarios for the economic recovery, with the worst scenario – the W-shaped recovery scenario – resulting in 25% of the banks covered by the test potentially approaching the minimum CET1 capital requirement of 4.5%. The banks reviewed could incur loan losses of $560bn to $700bn under some scenarios, the Fed found. The central bank did not release the names of the banks in this peril.

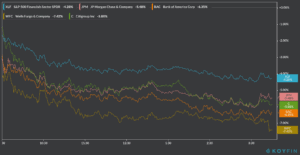

US bank stocks plunged on Friday as a result of the Fed’s measures, with shares of JP Morgan & Chase (JPM), Bank of America (BAC), Citigroup (C), and Wells Fargo (WFC), losing 5.5%, 6.3%, 5.9%, and 7.4%. respectively.

The entire sector was affected by the news, as reflected by the 4.3% loss seen by the S&P 500 Financial Sector SPDR ETF (XLF), which tracks the shares of the majority of the largest banks in the North American country.

This current downturn is the first major test of an overhaul the banking industry went through after the last financial crisis. The industry has emphasized that it has significantly more capital to weather a downturn and has not stopped lending to corporations or retail investors.

Stress tests are carried out by the Fed for the country’s largest banks to determine if they could survive a hypothetical financial crisis without needing a taxpayer bailout or being forced to stop lending.

Eight of the country’s biggest banks, including JPMorgan Chase and Bank of America, had already suspended buybacks earlier this year as the economy slowed down amid the coronavirus.

Among the biggest U.S. banks, JPMorgan Chase and Wells Fargo have paid out the most in dividends to shareholders since 2008, about $80 billion each, according to S&P Global Market Intelligence data. Bank of America paid out about $52bn and Citigroup about $30bn during that period.

The Fed’s report comes only a day after another regulatory agency – the FDIC – decided to reverse the so-called “Volcker rule”, a financial-crisis-era measure that prevented banks from engaging in risky investment activities, freeing nearly $40bn in previously locked-in capital that could potentially weaken banks’ financial structures in the midst of an unprecedented economic turmoil.

Sheila Bair, a former chairman for the FDIC qualified the measure as “ill-advised”, saying that the financial system actually needs more capital in rather than out, especially as the economy is approaching “potentially troubled economic times”.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account