Chinese technology giant Xiaomi Corp. is reportedly seeking a $1 billion loan two years after securing a loan of the same size from a group of 18 banks for a global expansion.

Five-year Bullet Club Loan

Bloomberg reported on Wednesday that the Beijing-based company is back to the loan market with a $1 billion refinancing facility.

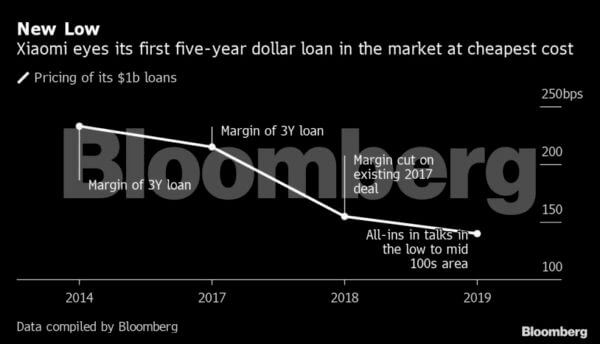

The company is reportedly in early discussions with lenders for a five-year bullet club loan at an all-in rate of low to mid 100 basis points area over Libor. Based on Bloomberg’s compiled data, this is the tech giant’s cheapest loan in the market with its longest tenor.

The loan is expected to be borrowed through Xiaomi Best Time International Ltd. and guaranteed by Xiaomi Corp.

Xiaomi’s Previous Loans

In 2017, Xiaomi was also in the loan market with a three-year $1 billion facility. It managed to secure a deal with a group of banks, which includes Deutsche Bank (GER:DBK.DE) and Morgan Stanley (NYSE:MS).

That business loan was secured at an all-in pricing of 250 to 260 basis points via margin of 215 basis points over Libor. In August last year, Xiaomi sought lenders’ consent to slash the margin of the loan by 60 basis points to 155 basis points over Libor.

In 2014, the company also secured a three-year $1 billion syndicated loan.

Floundering Stock

Xiaomi currently experiences a decline in earnings amid slowing Chinese economy exacerbated by the trade war between China and the United States.

The shares of the company listed in Hong Kong were also hit by losses amid anti-government mass demonstrations that started in June. The shares have likewise lost nearly a third of their value and are at half of the IPO price as a consequence of increased competition and slowing growth.

The company has been overhauling its cash management strategy to boost its struggling stock. Earlier this month, Xiaomi unveiled plans to spend up to $1.5 billion to buy back its own stocks, a move that saw the value of its shares climbing nearly 7 percent. Market analyst Dan Baker commented on the buyback:

“I think it should give investors more confidence to buy the stock because it shows how confident management is in the sustainable cash generating capabilities of the company,”

Xiaomi’s innovative products may also benefit the company. It recently revealed the Mi Mix Alpha, a smartphone with a surround screen that wraps around the entire device. It also unveiled the Mi 9 Pro 5G, the world’s first phone with 30W fast wireless charging capability.

Get more information :

Further information on raising finance through loans or payday loans can be found here.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account