Chevron (NYSE: CVX) stock price performance remained strong despite the significant drop in oil prices during the last quarter. Its closest competitor, ConocoPhillips, has lost 19% of value year to date. On the other hand, Chevron stock price rose 4% since the start of this year.

Its stock is currently trading slightly below from 52-weeks high of $127 a share. Fortunately, Chevron stock price is undervalued when compared to the industry average. The stock also looks underappreciated based on financial numbers, operational performance, and cash returns.

Chevron stock price is trading well below the industry average valuations. Its price to sales ratio 1.46 and price to earnings ratio of 15 is down from the industry average of 2.12 and 20.26 times, respectively. Its price to book ratio of 1.42 is well below from the industry average 3.06.

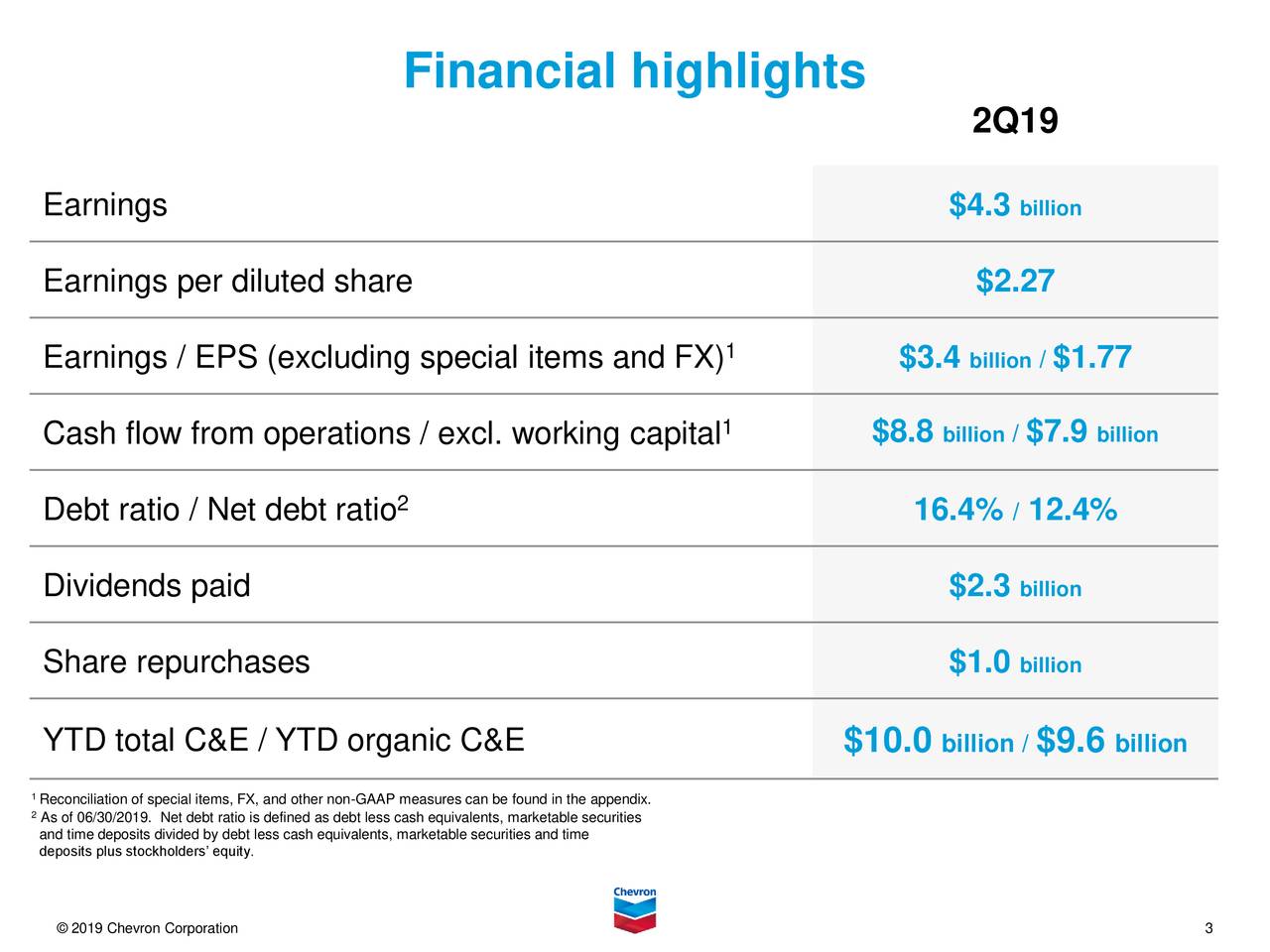

On the flip side, its financial numbers are adding to investors sentiments. The company has generated earnings of $4.3 billion in the latest quarter. Its second-quarter total production of 3.08M boe/day increased by 9.1% Y/Y. The growth in production is supported by the growth of 8.1% in net liquids production and a 10.7% increase in natural gas output. Its production from Permian Basin grew 50% to 421K bbl/day.

“Our strong financial and operational results reflect consistent execution, allowing us to pay our dividend, fund our attractive capital program, further strengthen our balance sheet and return surplus cash to our shareholders,’ said Michael Wirth, Chevron’s chairman of the board and chief executive officer.

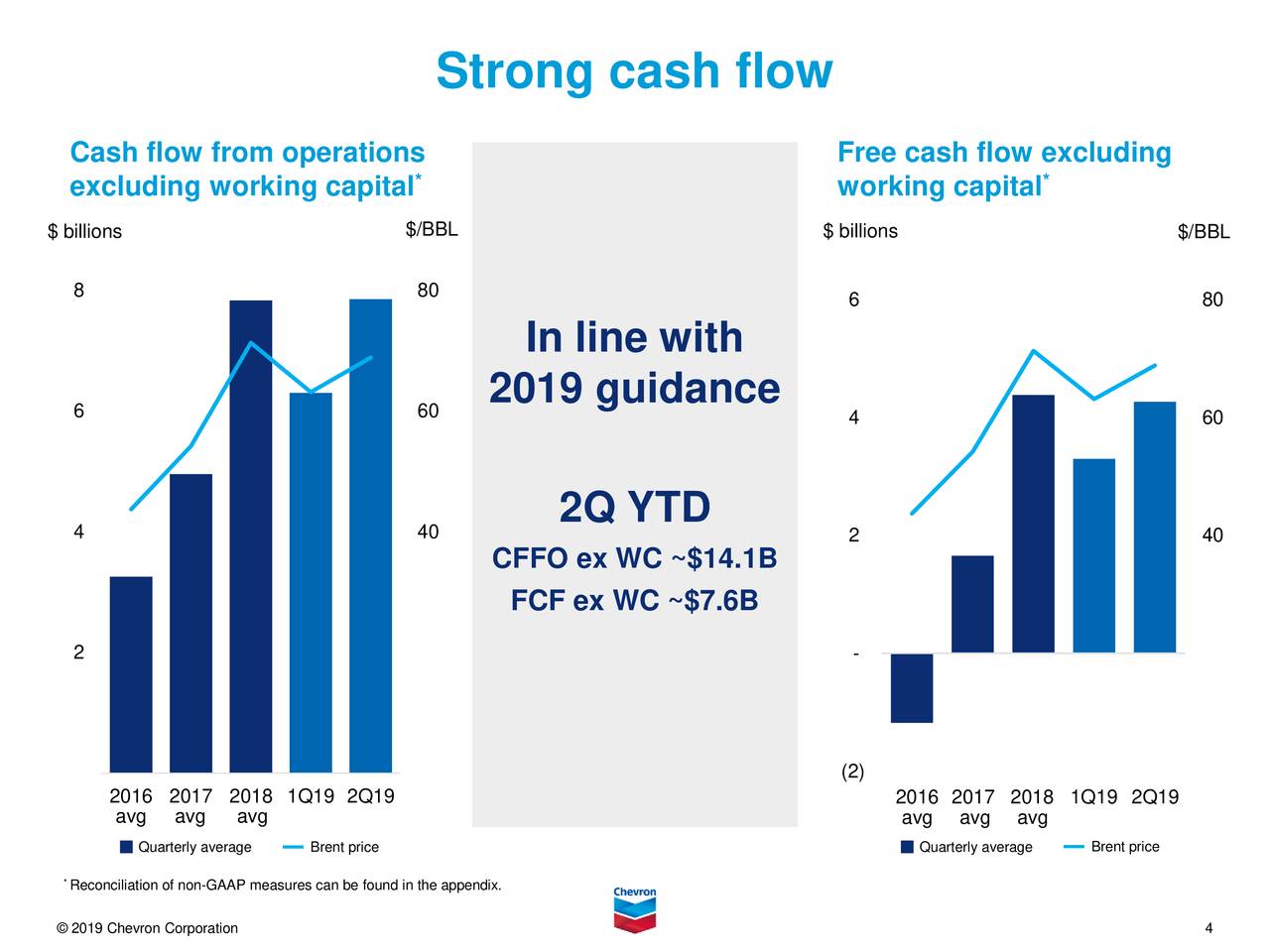

Chevron has generated operating cash flow of $8.8 billion in the second quarter while it’s capital expenditure was standing around $3.5 billion. Thus, the company was left with $5.1 in free cash flow compared to dividend payments of $2.3 billion.

The huge gap in free cash flows and dividend payments allowed the company to repurchase $1 billion of common stock in the second quarter. The company expects to buyback $1.25 billion of stock in the third quarter this year. Overall, several catalysts are supporting Chevron stock price upside momentum.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account