ConocoPhillips (NYSE: COP) stock price plunged sharply in the last quarter amid the steady drop in oil prices. The stock price selloff accelerated in the last month after the exploration & production company missed analysts revenue estimate. The revenue and earnings also fell from the previous year quarter.

ConocoPhillips stock price is currently trading close to the lowest level in the past two years. With the market capitalization of $57 billion, the stock has 52 weeks trading range of $50.13 – $79.96.

On the positive side, the future fundamentals of largest E&P Company are improving. This is due to its strong cash generation potential along with the expected growth in oil prices. WTI crude oil price stood around $55 a barrel while Brent oil price is hovering around $60 a barrel. This is substantially higher from the realized oil price of $50 a barrel in the second quarter.

Lower than expected oil inventories are helping in enhancing oil prices. The U.S. crude oil inventories dropped 10 million barrel in the latest quarter according to the Energy Information Administration. In addition, China’s import of U.S. oil rose 45% in July from the previous year period.

Besides improving market dynamics for oil prices, ConocoPhillips appears in a solid cash position to support cash returns and investments in growth opportunities.

This was our seventh consecutive quarter of generating free cash flow while executing our disciplined plans and delivering on our targets,” said Ryan Lance, chairman, and chief executive officer. “

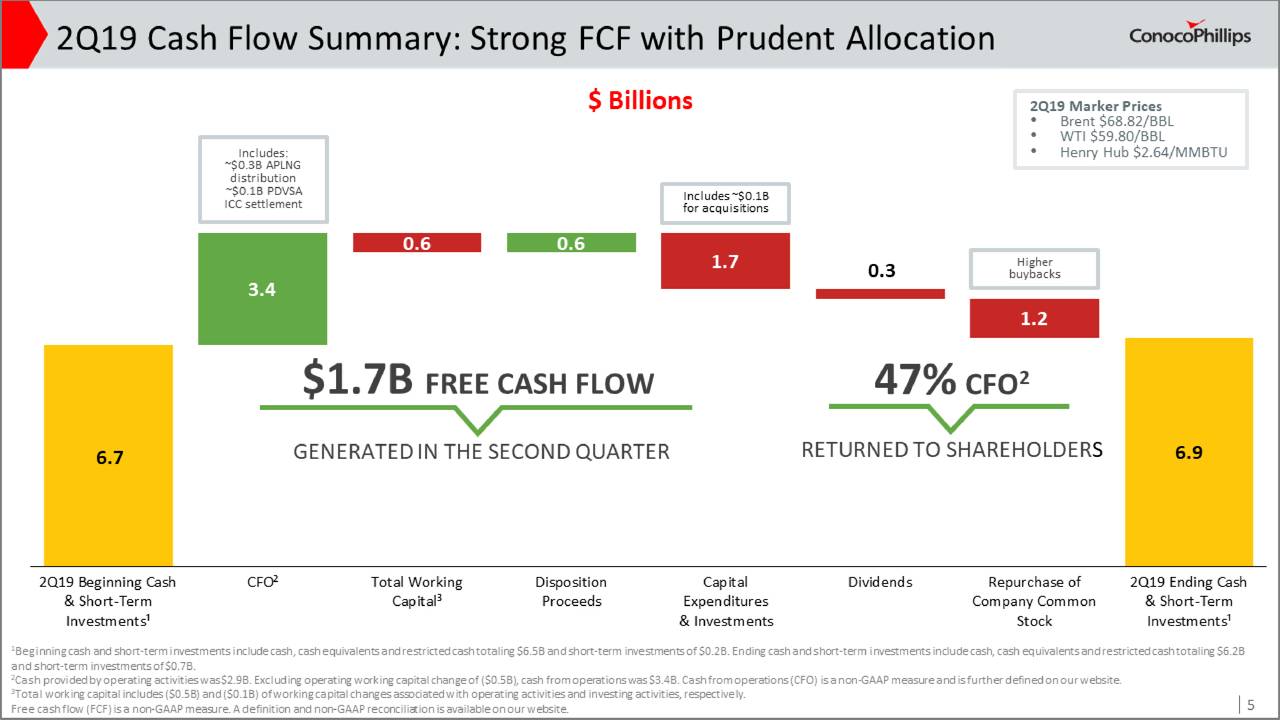

It has generated cash flow from operating activities of $3.4 billion while the capital investments were standing close to $1.7 billion in the second quarter. Consequently, the company was left with $1.7 billion in free cash flows, which was more than enough to cover $0.3 billion of dividend payments.

It has repurchased $1.2 billion of common stock in Q2. Moreover, ConocoPhillips has also increased its share buyback program for this year to $3.5 billion, thanks to stronger than expected cash flow.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account