Julian Emanuel (pictured), chief equity and derivatives strategist for global consulting firm BTIG, is warning investors about a potential 15% to 20% correction in US stocks as the market continues to move up while the economy goes down.

“It’s probably time for the market to reassess the uncertainties to the economy”, he said during an interview on CNBC’s Trading Nation, pointing to a wide range of concerns that have emerged since the coronavirus pandemic including rising tensions between the US and China and the upcoming presidential election.

Emanuel said the correction could happen during summer season, adding that small-cap stocks are the more sensitive sector in the stock market. The strategist said he came into 2020 as one of Wall Street’s biggest bulls, but now sees a stock market out of alignment with the economy as risks rise.

He said: “We just think up 50% [from the low] obviously given the risks, particularly the fact that the government is delaying the next round of stimulus which we think is necessary”.

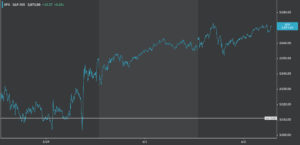

Meanwhile, the S&P 500 (SPY) recorded its third consecutive gain yesterday, pushing the index up from 3,029 on Thursday to 3,080 this Tuesday, accumulating a 1.7% gain during this three-day period.

However, Emanuel is optimistic about the long-term performance of the US stock market, as he anticipates new all-time highs at some point in 2021.

“Our view is that you get into the fall and you get into early next year, likely there’s enough time for the economy to find its footing, for there to be medical advances and we can envision new all-time highs at some point in 2021, unquestionable”, the analyst said on Monday.

BTIG is an independent consulting firm that provides trading services, investment banking, and research to more than 3,000 institutional clients around the world through a network of 600 employees and 18 offices located in different continents.

Julian Emanuel is a former chief strategist for Swiss bank UBS and he is now the managing director and chief equity and derivatives strategist for BTIG.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account