The Bitcoin rally is resuming this morning as the cryptocurrency is trading 2.8% higher at $18,175 per coin aided by a weaker dollar and some late-buying activity as more investors jump on board while BTC advances to its all-time highs.

These levels haven’t been seen since January 2018, when the cryptocurrency’s value started to nosedive right after reaching its all-time highs of $19,187 per coin.

Back then, the downward momentum accelerated strongly in the months that followed and the situation ended up plunging Bitcoin (BTC) to $3,195 per coin by the end of the year.

However, traders believe the scenario is quite different this time as the current rally has been driven by fundamental variables. BTC supports advocate that cryptocurrencies are now perceived as a potential hedge against the fiat debasement carried on by central banks amid the pandemic.

Furthermore, Bitcoin’s latest rally has been gaining credibility as sophisticated investors jump on the bandwagon including figures like billionaire investor Stanley Druckenmiller and Mexican third-richest man Ricardo Salinas Pliego, who recently stated that he invested 10% of his liquid portfolio on the cryptocurrency.

Celebrities have also contributed to the latest hype, much quieter than that of 2017, including former Game of Thrones star Maisie Williams who polled his fans on Twitter about whether she should long Bitcoin or not. Roughly half of her followers responded “no” to the poll but she confirmed that she bought some anyway.

Other drivers that have made Bitcoin’s price move higher include Paypal’s – the US payment processing giant – decision to let users buy cryptocurrencies, in a move that has been qualified as a step forward in solidifying the reputation of unregulated digital currencies.

Is Bitcoin heading to all-time highs?

At this point, Bitcoin is only 5% away from its late 2017 all-time highs of $19,187 per coin, which is not that much considering how volatile the price of the cryptocurrency is.

The price per coin could easily go up that much in a single day based on its historical performance and there seems to be enough interest to back that move.

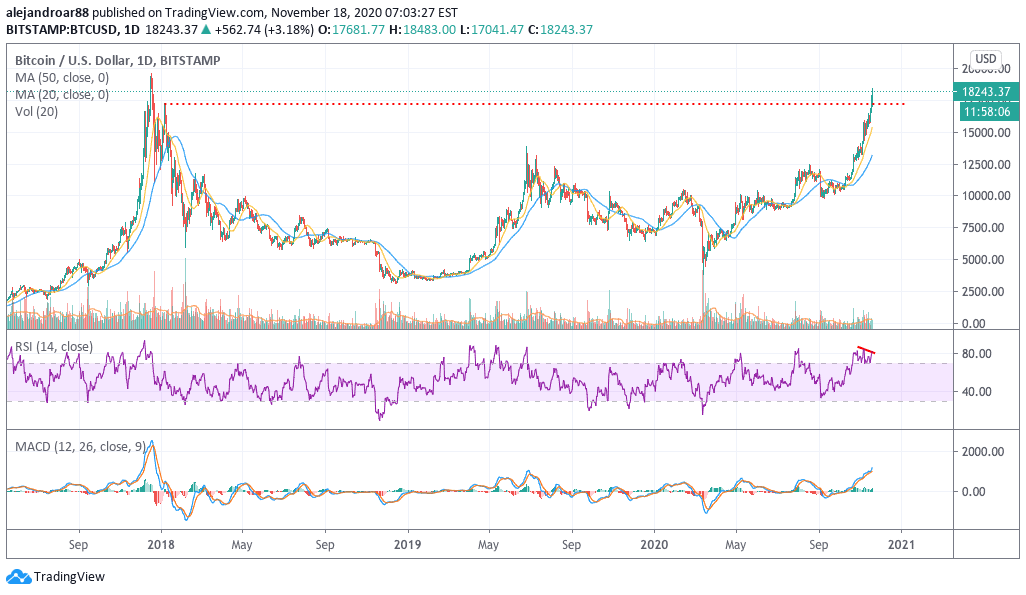

That said, a bearish divergence has already popped up in the RSI, which means that a short-term pullback could come next either before or after that push towards ATH.

Interestingly, there was a huge sell-off just earlier today, as indicated by the intraday charts, that plunged the price of BTC to as low as $17,000 but buyers showed up to save the day and ended up trimming those losses to keep the bull run alive.

This bearish move probably triggered multiple stop-loss orders that aimed to take profits after such a strong rally and it could be positive for bulls as late buyers stepped in at a much more comfortable price point that offered a lot more upside if they are expecting BTC to move to all-time highs in short notice.

That said, the bearish divergence in the RSI remains an important factor to keep in mind, but given the increased interest and media coverage that Bitcoin is getting now, there seems to be enough support to push the price above those all-time highs soon.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account