Paypal Forex Brokers – Best Forex Brokers Accepting Paypal in 2026

Most forex brokers active in the online space allow you to deposit funds with a debit/credit card or bank account. While this might suit the vast majority of traders, some prefer to fund their account with e-wallets like Paypal. This is because Paypal deposits are instant and free, and they also add an extra layer of security on your sensitive financial details.

In this article, we explain how Paypal deposits and withdrawals work at online forex brokers, as well as what you need to look out for prior to opening an account. Crucially, this centres on key factors like regulation, spreads, fees, customer support, and research tools.

Top Forex Brokers That Accept PayPal

Before we take a more in-depth look at PayPal forex brokers, here’s a quick glance at the best broker that accepts PayPal in 2026.

- Plus500– PayPal forex broker with tight spreads

-

-

Note: The most important factor that you need to look out for when choosing a Paypal forex broker is its regulatory status. If the platform isn’t regulated by a tier-one licensing body like the FCA (UK) ASIC (Australia), CySEC (Cyprus) or MAS (Singapore), you should probably avoid it.

Pros and Cons of Using a Paypal Forex Broker

Pros- Paypal adds an extra layer of security on your sensitive financial information

- Deposits are usually processed instantly

- Rarely do brokers charge fees to deposit and withdraw funds via Paypal

- Paypal withdrawal requests are typically processed faster than debit/credit cards

Cons- You will need to verify your Paypal account before you can deposit funds at a broker

- Deposit and withdrawal limits are usually lower than debit/credit cards or bank transfers

How to Get Started at a Paypal Forex Broker

Are you complete newbie in the world of online trading and looking for some help on how to get started? If so, we welcome you to read our comprehensive step-by-step guide on how to use a Paypal forex broker. We explain the ins and outs of choosing a broker, opening an account, depositing funds, and placing your first ever forex trade!

Note: Regardless of which Paypal forex broker you decide to sign up with, the following guidelines should remain constant. As such, this allows you to choose a forex broker that best meets your needs.Step 1: Open a Paypal Account and Get Verified

If you don’t currently have an account with Paypal, this should be your first port of call. Even if you do have an account, you will need to ensure that it is fully verified before moving on to the next step.

This is because Paypal places additional security measures when its e-wallet is used to trade online, not least because they want to ensure that you are the true owner of the account.

As such, you will need to go through the following steps to get your account ready for action at an online forex site.

- If applicable, open an account by providing some personal information (full name, nationality, home address, date of birth, etc.)

- Verify your email by clicking on the link that Paypal sends you

- Verify your cell phone by entering the PIN that Paypal sends to you via SMS

- Add a bank account to Paypal. You will then need to enter the exact deposit amount that Paypal sends you (in dollars and cents).

- Add a debit card to Paypal. You will also need to verify this by confirming the exact amount that Paypal debits from your card.

It is useful if you add a bank account and debit card that adds transactions to your online or mobile statement instantly. This will allow you to verify your Paypal account in a matter of minutes. Unfortunately, some banks take 1-3 working days to show this information.

Step 2: Find a Suitable Forex Broker That Accepts Paypal

Once your Paypal account has been verified, you are then ready to find a forex broker. There are hundreds, if not thousands of forex brokers now active in the online trading space, so be sure to think about what your priorities are. For example, are you looking for a broker that offer super-low fees, or are you more concerned with trading a specific currency pair like AUD/NZD or GBP/USD?

Plus500 - FCA regulated broker with highly competitive spreads

Plus500 is another popular broker offering competitive spreads and an easy-to-use trading platform. The broker provides its clients with a wide range of more than 2,000 CFD instruments traded with leverages of up to 1:300. Plus500 was founded in 2008 and has gained regulatory approval in several parts of the world.

In the UK, for instance, Plus 500 is authorised and regulated by the FCA. In Australia, it is regulated by the ASIC, and CySEC in Cyprus.

Plus 500 CFD forex broker also support the use of online cash wallets like PayPal in funding trader accounts and facilitating withdrawals.

Our Rating

- The broker offers tight spreads

- Offers an easy-to-use proprietary trading platform

- Charges inactivity fee

- Not available in the US

CFDs are complex financial instruments and 80.5% of retail investor accounts lose money when trading CFDs.If you’re not sure how to research a trading platform yourself, we would suggest scrolling down to our section on ‘How to Choose a Paypal Forex Broker‘. If you don’t have time to perform your own due diligence, why not consider the merits of the Paypal forex broker we have recommended above?

Step 3: Open an Account and Verify Your Identity

At this stage of our step-by-step guide, you should now have a verified Paypal account and have chosen a broker that best meets your needs. As such, you will now need to open an account with the Paypal forex broker in question. The process rarely takes more than a few minutes, and merely requires you to enter some personal information.

This will include your:

- Full Name

- Date of Birth

- Home Address

- Nationality

- Annual Income

- Name and Address of Employer

- Contact Details

Most Paypal forex brokers will also ask you some questions about your prior trading experience. This is to ensure that you understand the risks of trading, especially with respect to leverage. To complete the account registration process, you will now need to verify your identity. You can do this by uploading a clear copy of your passport or driver’s license, followed by a proof of address. This will need to be a recently dated bank statement, utility bill, or tax statement.

Note: Some Paypal forex brokers allow you to deposit funds and trade without first verifying your identity. You will, however, be required to do this before a withdrawal is permitted. As such, we would suggest getting the verification process out of the way so that you can avoid withdrawal delays further down the line.Step 4: Deposit Funds With Paypal

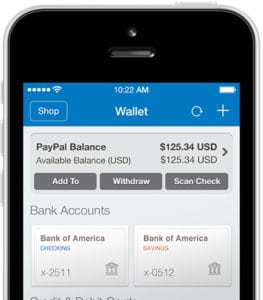

Once you’re all set-up at your chosen Paypal forex broker, you will now need to deposit some funds. Once you find the deposit page, scroll down and look for the e-wallet section. Upon selecting Paypal, you will then need to enter the amount that you wish to deposit. Don’t forget, you’ll need to meet a minimum deposit amount.

- A pop-up box will then appear asking you to enter your Paypal login credentials

- Choose which funding source you want to use (Paypal balance, bank account or debit card) and then check the deposit amount is correct

- We would suggest using your Paypal balance or linked debit card, as this will ensure your deposit is processed instantly

The pop-up box will then close and you will be taken back to the forex broker deposit page. If everything went through smoothly, the funds should have been credited to your forex trading account balance.

Step 5: Place a Forex Trade

Once your Paypal forex broker account is funded, you are now ready to place your first-ever trade. Take note, forex is a lot more complex than stock trading, so it’s important that you understand how buy and sell orders work, as well as stop-loss and take-profit orders. Ultimately, this will ensure you mitigate your losses in the event a trade goes against you.

To place a forex trade, you’ll need to:

- Select which currency pair you wish you trade – for example, GBP/USD or EUR/USD

- Decide whether you think the exchange rate of the pair will go up (buy order) or down (sell order)

- Select your total stake

- Decide whether you want to apply leverage on your trade

- Enter your required entry price, or simply take the current market price

- Enter your stop-loss price, which dictates when your trade should be automatically closed

- Enter your take-profit price, which will allow you to lock-in your profits automatically

By following all of the steps listed above, you should have just placed your first-ever forex trade.

How do Withdrawals Work at Paypal Forex Brokers?

Looking to withdraw your forex trading profits with Paypal? Don’t forget, you will need to verify your identity before the broker will authorize your first cashout request.

Once you have, you simply need to head over to the broker’s banking page, select Paypal, and then enter the amount that you wish to withdraw out.

Once the broker has processed the withdrawal request (which can be anything from 0-3 working days), the funds will arrive back into your Paypal account.

You will then have the option of transferring the funds from Paypal over to your linked bank account. This is usually instant.

What Currency Pairs can I Trade at Paypal Forex Brokers?

Most Paypal forex brokers will give you access to heaps of individual currency pairs. This consists of majors, minors, and exotics, which we explain in more detail below.

Major Forex Pairs

As the name suggests, major forex pairs consist of two major currencies. However, one side of the pair must consist of the US dollar. For example, if you wanted to trade the US dollar (USD) against British pound sterling (GBP), this would be a major forex pair, but if you traded GBP against the Euro (EUR), this wouldn’t be.

The following eight currencies are viewed as major currencies:

- U.S. dollar (USD)

- Canadian dollar (CAD)

- Euro (EUR)

- British pound (GBP)

- Swiss franc (CHF)

- New Zealand dollar (NZD)

- Australian dollar (AUD)

- Japanese yen (JPY)

Using a Paypal forex broker to trade major pairs will allow you to benefit from tight spreads, as trading volumes are high and volatility is low.

Minor Forex Pairs

Otherwise referred to as a cross-currency pair, minors will still consist of two major currencies. However, they won’t contain the US dollar.

Some of the most traded minor forex pairs include:

- EUR/GBP

- GBP/CAD

- CHF/JPY

- NZD/JPY

- EUR/AUD

Minor pairs still benefit from huge trading volumes, although volatility is slightly higher. This means that spreads are usually wider, so minors can be more costly to trade.

Exotic Forex Pairs

Exotic pairs will contain one major currency (like the US dollar or Euro) and a currency from an emerging economy. Think along the lines of Turkey, Kenya, Russia, or Brazil. Exotic pairs can be extremely volatile, and spreads are often very high. As such, you should only trade exotic pairs if you have a higher tolerance for risk.

Notable exotic pairs include:

- CAD/HKD (Hong Kong dollar)

- GBP/ZAR (South African rand)

- JPY/NOK (Norwegian krone)

- AUD/TRY (Turkish lira)

How do I Choose a Paypal Forex Broker?

Now that you know the ins and outs of how Paypal forex brokers work, you now need to start thinking about what platform to sign up with. As we noted earlier, there are hundreds of forex brokers active in the online space, albeit, not all will accept e-wallets like Paypal.

So, once you’ve established whether or nor a broker actually supports Paypal, you then need to look at other metrics like regulation, fees, spreads, research, and technical indicators.

- Regulation

Irrespective of whether or not the forex broker supports Paypal, you should only sign up with the platform if it is regulated. Most platforms will hold at least one regulatory license, although it’s always good when they hold more. It’s important that the license was issued by a tier-one regulatory body, such as the UK’s FCA, CySEC in Cyprus, or ASIC of Australia.

- Spreads

Spreads are super-important in the world of forex trading. For those unaware, this is the difference between the buy and sell price of a certain currency pair. For example, if the buy and sell price of GBP/USD is 1.3100 and 1.3101, then the spread is 1 pip. The ‘tighter’ the spread, the more cost-effective it is for you to trade forex.

- Trading Commission

Most Paypal forex brokers will also charge you a commission to trade. This is usually charged as a percentage of the trade size, and it will increase further if you apply leverage. For example, let’s say that you place a $3,000 buy order on EUR/USD. If the broker charges 0.5% per order, you would pay $15 in fees. You will then need to pay a fee when you exit your trade.

- Number of Forex Pairs

You also need to explore how extensive the forex department is in terms of tradable pairs. For example, while it’s all-but-certain that the platform will host all major pairs, it might be thin on the ground on minors and exotics. The good news is that most brokers allow you to explore its full list of supported currencies prior to signing up.

- Trading Software

In order to buy and sell forex pairs in real-time, your trades will be facilitated by software. The most recognized platforms in this respect are MetaTrader 4 (MT4) and MetaTrader 5 (MT5). With that said, some brokers will instead host their own trading software, so be sure to check this. You’ll also need to check whether the broker offers a fully-fledged mobile app if you have a tendency to buy and sell currencies on the move.

- Leverage

Although we would suggest avoiding leverage if you’re just starting out in the online forex space, there might come a time where you decide to increase your stakes. If you do, you’ll want to ensure that the broker offers leverage on your preferred pairs. The limits will depend on where you are based, as well as what the broker feels comfortable offering you.

- Customer Support

You are best advised to stick with Paypal forex brokers that offer multiple customer support channels. This should include live chat, telephone, and email support. It’s also handy if the broker offers customer support 24 hours per day.

Conclusion

In conclusion, using Paypal to deposit and withdraw funds at a forex broker site offers a number of benefits. For example, not only are deposits usually instant and free, but you won’t be required to enter your debit/credit card details into the broker’s site. With that said, the number of brokers supporting Paypal is still a bit thin on the ground.

Even if you do locate a Paypal forex broker, you still need to look at other factors before signing up. As we have covered extensively in our article, this should include the broker’s regulatory standing, spreads and fees, the number pairs supported, withdrawal times, and customer support.

FAQs

Is it safe to use Paypal at a forex broker?

Using Paypal, as opposed to a traditional debit or credit card, is actually safer. This is because you are not required to enter financially sensitive card details directly into the website of the broker. Instead, you merely need to login to your Paypal account and the e-wallet provider will process the transaction on your behalf.

How do I withdraw funds from a forex broker via Paypal?

Once you make a withdrawal request, the broker will transfer the funds into your Paypal account within 0-3 working days. You can then withdraw the funds from your Paypal account back into your bank account.

Are Paypal forex brokers regulated?

Most, but not all, Paypal forex brokers are regulated. This will include license issuers such as the FCA, CySEC, ASIC, and MAS. If the Paypal forex broker in question isn’t regulated, avoid it at all costs.

How do I fund my Paypal account?

You will need to link a bank account and/or debit card to your Paypal account. Once you verify the funding source, you won’t need to enter your card/bank details again when paying for a transaction, as Paypal does this on your behalf..

What is the minimum deposit amount at Paypal forex brokers?

There is no one-size-fits-all answer to this question, as it depends on the forex broker. Most require a minimum deposit of at least $100, although others will ask for more.

What is the most traded forex pair?

The most traded forex pair is now EUR/USD. The pair carries the nickname ‘Fibre’.

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

Looking to withdraw your forex trading profits with Paypal? Don’t forget, you will need to verify your identity before the broker will authorize your first cashout request.

Looking to withdraw your forex trading profits with Paypal? Don’t forget, you will need to verify your identity before the broker will authorize your first cashout request.