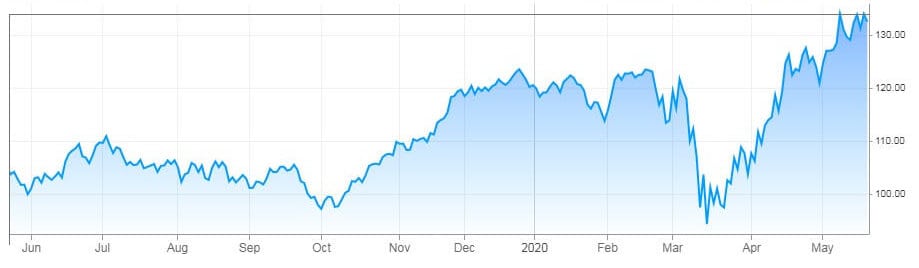

iShares Nasdaq Biotechnology exchange-traded fund (ETF) (IBB), which tracks the group of 211 stocks, has soared sharply since mid-Mach hitting an all-time high of $136.20 on Monday before reversing some gains in the past few sessions. It is trading at $132.57 on Friday morning.

The robust upside momentum in the last two months is driven by the sentiment that biotech ETFs could benefit from increased spending on drugs and higher investor interest.

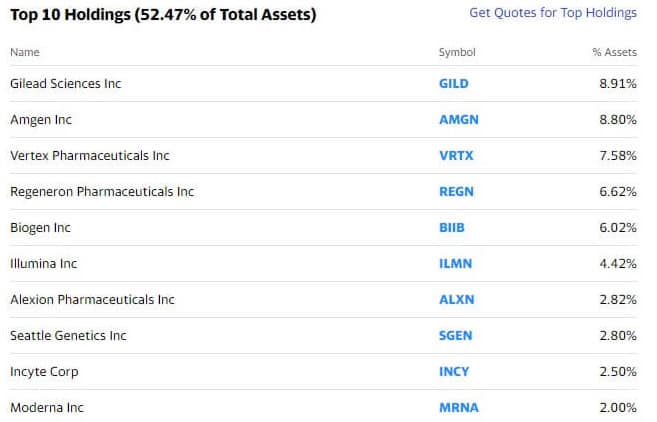

However, traders warned that buying at current levels should tread carefully because some of the big names that account for the biggest chunk of IBB portfolio are breaking down.

Gilead Sciences (NYSE: GILD) is among the big names that have lost almost 12% of the stock trading value from its 52-weeks high of $85 that it had hit at the end of April.

Amgen (NYSE: AMGN) is the other big stock that is struggling over the past few weeks.

The top four holdings of iShares Nasdaq Biotechnology ETF accounts for 30% of total value and the top ten holdings represent 52.47% value of ETF.

“If Gilead and Amgen start to break down, it could be a problem for the group,” Miller Tabak chief market strategist Matt Maley (pictured) told CNBC’c Trading Nation on Wednesday.

“Now, nobody wants to short any of these names because if you get a nice discovery on [a] Covid-19 vaccine, the group’s going to go do very nicely. But I just think people don’t want to be aggressive after the big move we’ve had, given that these two stocks are starting to show some cracks,” he added.

It’s time to be selective in placing investments, according to Mark Tepper, the president and chief executive officer of Strategic Wealth Partners.

“This is not a situation where I’d be looking to just blindly buy the group and hop into the IBB ETF,” he said. “Price matters.”

If you plan to invest in ETFs, you can checkout our featured ETFs brokers here.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account