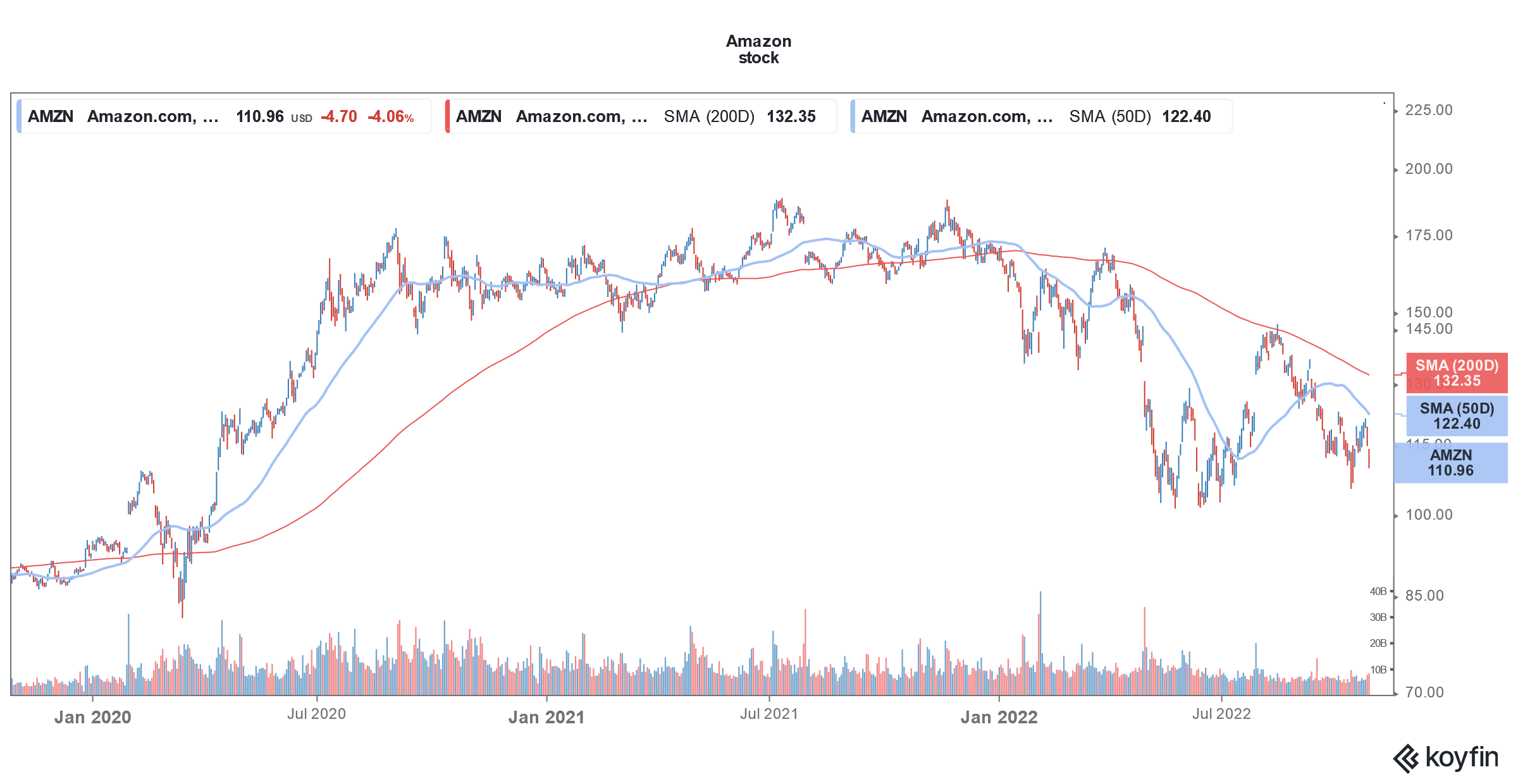

Amazon stock (NYSE: AMZN) is trading sharply lower in premarkets today and looks set to hit a new 52-week low in today’s price action. The company disappointed markets with its Q3 2022 earnings, joining the ranks of other Big Tech companies which spooked markets with their earnings and outlook.

Amazon posted revenues of $127.10 billion in the quarter, a YoY rise of 15%. In constant currency terms, the company’s revenues rose 19% in the quarter. The company returned to double-digit revenue growth after two consecutive quarters of single-digit growth. The revenues nonetheless fell short of the $127.46 billion that analysts were expecting.

Amazon missed revenue estimates in the third quarter

Looking at the business segments, North America sales increased 20% YoY to $27.7 billion. Amazon’s international e-commerce sales however fell 5% to $27.7 billion. In constant currency terms, the segment’s revenues increased by 12%.

Notably, the contribution from third-party sellers has risen on the platform. In Q3 2022, they accounted for 58% of the paid unit sold, which is the highest-ever percentage.

AWS posted revenues of $20.5 billion which was 27% higher than the corresponding quarter last year. AWS sales fell short of the $21.1 billion that analysts were expecting. Notably, Microsoft also provided lower-than-expected guidance for its cloud business during the recent earnings call. While Microsoft beat on both the topline and bottomline, the stock crashed after the earnings release on weak guidance.

Amazon reported a fall in operating income

Amazon posted an operating income of $2.5 billion in the third quarter of 2022, which was nearly half of what it did in the corresponding quarter last year. As has been the case for the last couple of quarters, the income came from AWS and both the North America and International e-commerce operations posted an operating loss in the quarter.

In Q3 2022, Amazon’s North America operations posted an operating loss of $0.4 billion as compared to an operating profit of $0.9 billion in Q3 2021. The International segment posted an operating loss of $2.5 billion. In the third quarter of 2021, the segment posted an operating loss of $0.9 billion.

AWS’s operating profits were below estimates

AWS posted an operating profit of $5.4 billion versus an operating profit of $4.9 billion in Q3 2021. The metric however fell short of estimates. The company said that AWS is now running at an annualized revenue run rate of $82 billion.

AWS has been a cash cow for Amazon especially as e-commerce growth has come down. Redburn believes that AWS would be worth $3 trillion in the future and that Amazon would spin it eventually.

Andy Jassy talked about the challenges

Like fellow tech companies, Amazon’s CEO Andy Jassy also talked about macro challenges. He said, “There is obviously a lot happening in the macroeconomic environment, and we’ll balance our investments to be more streamlined without compromising our key long-term, strategic bets.”

Notably, the company held a Prime Day earlier this month. While several researchers have said that consumer response was quite tepid during the event, Amazon said that consumer reaction to the sale was “great.”

Amazon spooked markets with its guidance

Amazon spooked markets with its guidance. The company expects sales between $140-$148 billion in the fourth quarter of 2022, which implies a YoY growth between 2-8%. The guidance fell short of what analysts were expecting.

Brian Olsavsky, Amazon’s CFO said during the earnings call, “As the third quarter progressed, we saw moderating sales growth across many of our businesses, as well as increased foreign-currency headwinds … and we expect these impacts to persist throughout the fourth quarter.”

Holiday spending

Amazon is also circumspect about holiday spending. Olsavsky said, “we’re realistic that there’s various factors weighing on people’s wallets, and we’re not quite sure how strong holiday spending will be versus last year. And we’re ready for a variety of outcomes.”

While the company did not provide revenue guidance for AWS, Olsavsky implied that the growth rate is coming down. He said that AWS’s revenue growth in the back end of the quarter was in the mid-20s, which is below the 28% growth that the business generated in the full quarter.

Amazon posted negative free cash flows

Amazon posted negative free cash flows in the quarter. The company posted negative free cash flows in 2021 also and looks on track for another year for negative free cash flows. In response to an analyst question on the cash flows, Olsavsky attributed it to multiple factors.

Firstly, he said that the company’s earnings have fallen. Secondly, he added that Amazon’s inventory has increased which is a drain on cash flows. Notably, retail companies are now saddled with excess inventory as supply chains have improved.

Previously also, Amazon has said that it has built excess capacity which is a drain on productivity. During the earnings call, Olsavsky said, “While we’re making strides in productivity and network optimization, we still have work to do there. So we have to get our cost structure back to pre-pandemic levels in a lot of areas of the company and mostly in operations.”

Gene Munster on Amazon earnings

Gene Munster of Loup Ventures believes markets are overreacting to Amazon earnings. He said that in a normal environment, the stock would have fallen by 5-10%. He however admitted to the deceleration in AWS revenues.

Munster said that he made the mistake of believing that there’s safety in large-cap tech companies. He however said that he “is still a believer in Amazon.” According to Munster, Amazon has a moat in the logistics business which is difficult to replicate. He advised having a long-term view of the stock and said that despite the crash the stock looks expensive.

We’ll get the views of more analysts shortly. Notably, after the Q2 2022 earnings release, analysts across the board raised Amazon’s target prices on better-than-expected guidance. Now, with AMZN providing dismal guidance, it would be interesting to see how brokerages react to the earnings.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account