Alibaba (NYSE: BABA) said it will invest $28bn into its cloud infrastructure over the next three years as demand for services like live streaming and video conferencing increases. The Chinese e-commerce giant had generated year over year cloud revenue growth of 62% in the latest quarter while working from home policies amid the coronavirus outbreak has raised the demand for its cloud products in the last two months.

The huge investment of $28bn, which is more than the $23bn the company made in revenue over the latest quarter. Alibaba is a leading cloud provider in the Asia Pacific market, according to data body Gartner.

“By increasing our investment on cloud infrastructure and fundamental technologies, we hope to continue providing world-class, trusted computing resources to help businesses speed up the recovery process, and offer cloud-based intelligent solutions to support their digital transformation in the post-pandemic world,” Jeff Zhang, president of Alibaba Cloud Intelligence and chief technology officer of Alibaba Group, said.

Alibaba holds 46% of the Chinese cloud market share based on research firm Canalys data, well above from Tencent Cloud and Baidu Cloud market share of 18% and 8.8%, respectively. The health emergency has increased the demand for Alibaba’s products like DingTalk, a workplace chat app used by both businesses and schools.

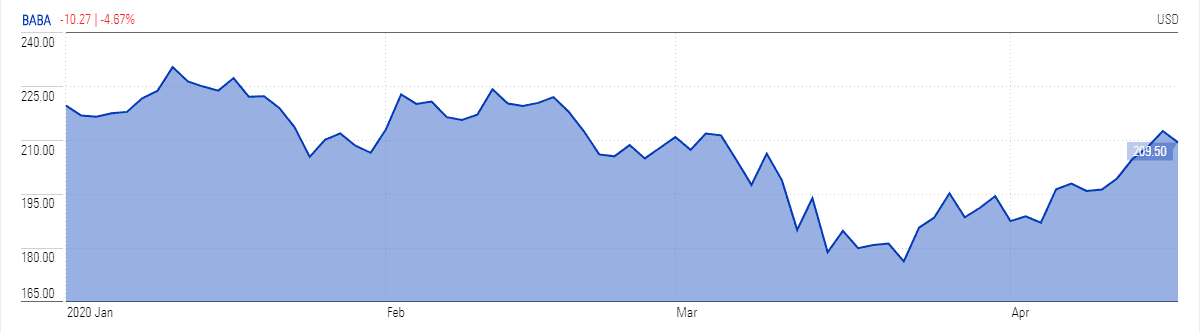

Alibaba stock price has recovered the majority of losses from March low; the stock trades slightly below its 52-weeks high of $231. Whats more bullish indicators are making it one of the favorite stock for day traders.

Broker KeyBanc has provided a price target of $255, implying a significant upside from the current level of $209 a share. Its analyst Hans Chung believes the Chinese e-commerce giant is likely to extend the momentum due to the “strong desire for online sales.

You can checkout out our featured stockbrokers if you are interested in buying shares of Alibaba.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account