Bitcoin (BTC) is the largest cryptocurrency in the market after being operative for over ten years. Many enthusiasts and analysts consider that Bitcoin is a distinctive asset because of one of its main features: digital scarcity.

Digital scarcity means that the total supply of Bitcoin is capped. There will never be more than 21 million BTC in existence.

This happens thanks to a mechanism called Proof-of-Work (PoW) in which miners, individuals, and companies that confirm transactions and secure the network, get rewarded for their work.

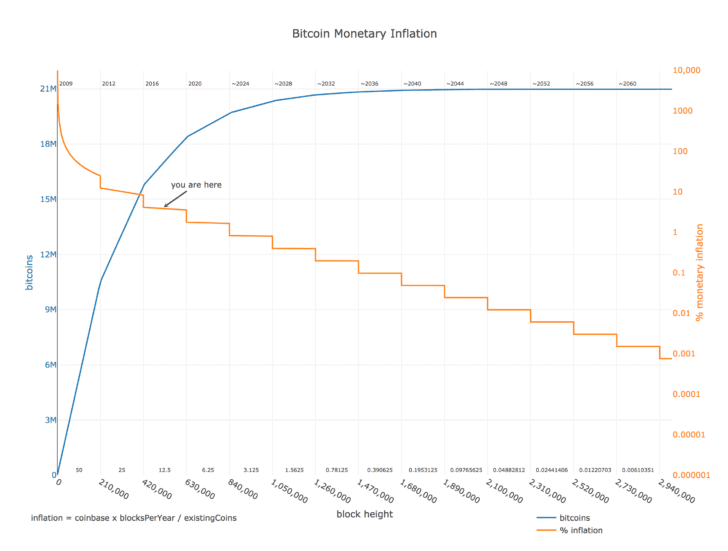

Every four years, the Bitcoin network experiences a halving event, in which the reward that miners receive gets cut in half. This is why Bitcoin is considered an asset with a falling inflation rate over time.

In this article, we will explain how the halving event takes place, how miners get rewarded, how a reduction in the new supply of BTC affects Bitcoin’s price and many other things.

Fact #1: Bitcoin Miners Reward Gets Reduced by 50% Every Four Years

Bitcoin’s halving event takes place every single time 210,000 blocks are mined. The Bitcoin network creates 1 block every 10 minutes. Each day, around 144 blocks are generated. This is equal to 1,800 BTC per day. Each of these blocks includes transactions made by users in the network.

Every time a person makes a purchase or sends a BTC transaction, it gets registered on the blockchain. In order for the whole network to confirm that the transaction is valid, it requires miners to process difficult calculations that end up validating whether the funds transferred are genuine or not.

Miners get rewarded with Bitcoins every single time they find a block. Nowadays, as the mining market is much more competitive than what it was before, miners need specialized hardware machines to operate. These machines are called Application-Specific Integrated Circuits (ASICs). In the past, it was possible to mine Bitcoin using CPUs and GPUs.

At the same time, as the network became much more competitive, miners have to work together if they want to find blocks. Solo mining is a practice that became obsolete due to the exponential growth of the Bitcoin network and the cryptocurrency market.

The rewards Bitcoin miners receive gets reduced by 50% every 210,000 blocks (approximately every four fears). This is in order to avoid Bitcoin’s depreciation in the long run.

In comparison, fiat currencies can be printed without any limit by a centralized authority. Countries such as Venezuela, Argentina or Zimbabwe have experienced high inflation rates and even hyperinflation.

Fact #2: Bitcoin Has Fixed Supply

Satoshi Nakamoto, the anonymous creator of Bitcoin decided to implement a monetary policy for Bitcoin to increase in value rather than losing it. Having a clear Bitcoin issuance reduction scheme minimizes uncertainty about what will happen with the most popular digital asset and how this can affect prices.

About it, Satoshi Nakamoto explained:

“My choice for the number of coins and distribution schedule was an educated guess. It was a difficult choice because once the network is going it’s locked in and we’re stuck with it. I wanted to pick something that would make prices similar to existing currencies, but without knowing the future, that’s very hard.”

He went on saying that if Bitcoin is used in a small niche, it will be worth less per unit than existing currencies. If instead, Bitcoin becomes a currency used for a small fraction of world commerce, then 21 million coins would be worth much more per unit. Nowadays, each Bitcoin is being traded around $8,000.

Network fees are going to play an important role in miners’ profitability in the future when just a few Bitcoin will be given to miners for their job. With a larger number of users, the Bitcoin network could eventually rely on transaction fees rather than on fixed BTC rewards per block.

That would require a solution to the scalability issues faced by Bitcoin and a larger number of transactions to take place on the network. Although today Bitcoin fees represent a small portion of the total amount of reward received by miners, it is expected to play an important role in the health of the network in the future.

Fact #3: 2020 Halving Event To Reduce Bitcoin Rewards To 6.25 BTC Per Block

Although many consider that Bitcoin is a deflationary cryptocurrency, it is not. Bitcoin has an inflationary supply that is reduced every four years, as we explained before.

At the time of writing this article, each block provides miners with a reward of 12.5 Bitcoin, equal to $100,000 per block (considering a Bitcoin price of $8,000).

As the new issuance of Bitcoin is reduced every four years, a larger demand for the digital currency is expected to have a positive impact on the price of the digital asset.

Each halving event reduces the new issuance per block by 50%. That means that the inflation rate per year is also reduced.

Nowadays, Bitcoin has an inflation rate of 3.72% per year. After the upcoming halving event on May 2020, the inflation rate will fall to 1.8%.

Every four years, after a halving event, inflation will fall and reach a value close to 0% before the last Bitcoin is mined in 2140. Furthermore, Bitcoins get lost every single year.

This happens because many holders pass away without leaving information about their holdings or because they send Bitcoin to a wallet they do not have access to. Eventually, there will be less than 21 million Bitcoin in circulation.

In 2020, Bitcoin miners will receive 6.25 BTC per block. In 2024, they will receive 3.125 BTC per block, in 2028 1.5625 BTC and in 2032 0.78125 BTC. All these rewards should include the fees paid by users when they process a transaction. As mentioned before, fees will play a more important role as the network expands and halving events take place.

Fact #4: Bitcoin Price Boost After Halving

Bitcoin is very volatile compared to other traditional financial assets. This is something that we must take into account before analyzing how Bitcoin behaves and how its price changes on a daily basis.

It is worth mentioning that although Bitcoin’s new issuance reduction is bullish in the long term, it can have a small short-term negative impact on the price. Indeed, the positive effects on Bitcoin’s price tend not to be immediate.

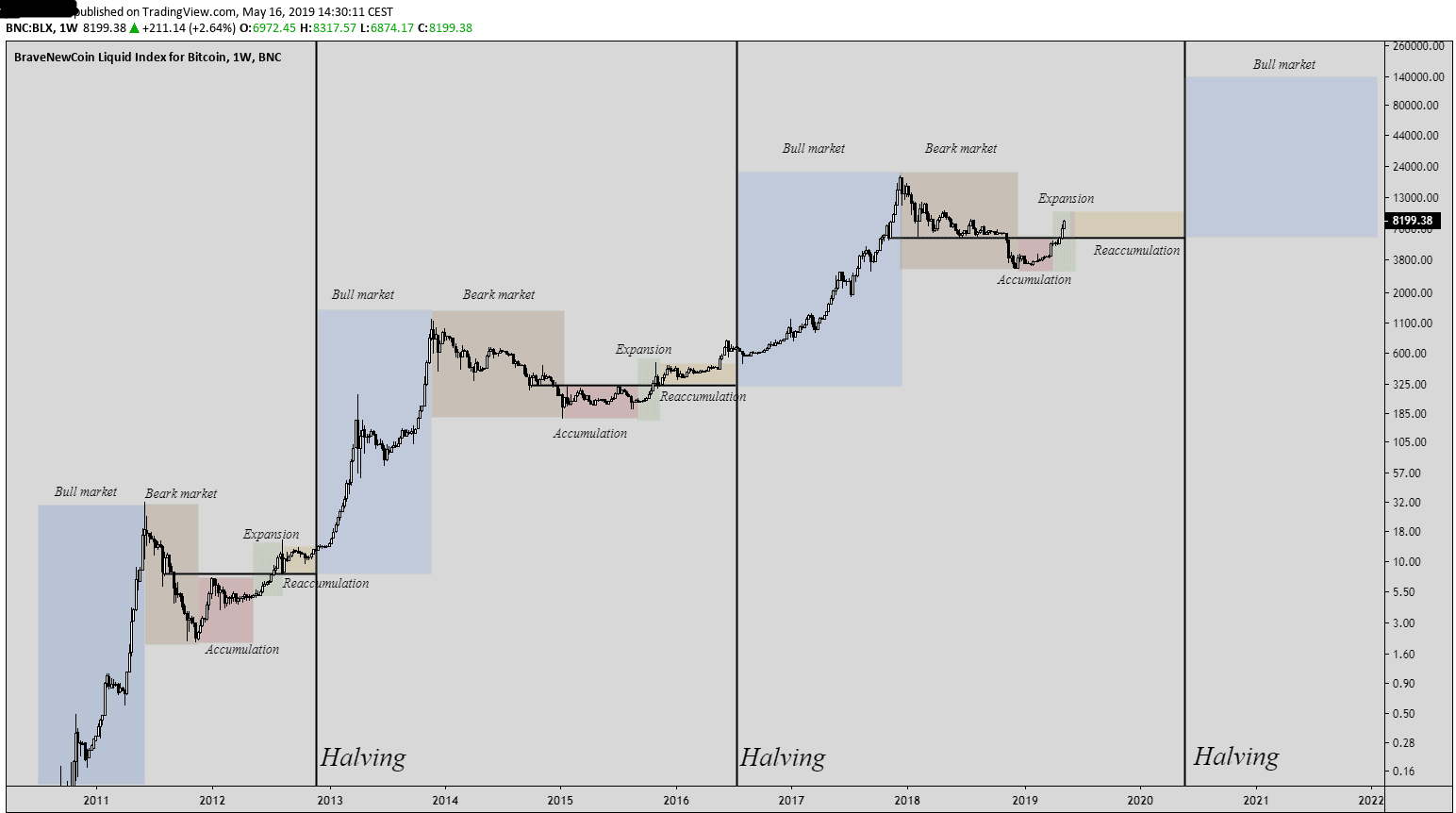

Although the price of Bitcoin starts a bull run a few months before the halving event takes place, immediately after the halving, Bitcoin price falls. In the last two halvings, Bitcoin’s price behaved in a similar way. Nonetheless, the bull market continues and accelerates after the halving.

Everything starts with a period of accumulation after a bear market. This period of accumulation took place between December and March 2019.

This is followed by an expansion in the price of the most popular digital asset. In 2019, this period took place between March and June. The price of Bitcoin surged from under $5000 to over $13,750 in some exchanges.

The expansion phase is then followed by a “reaccumulation” period, as the Redditor hey_its_meeee explains. The period of reaccumulation is the step before the bull market. During these months before the halving event, Bitcoin tends to be traded sideways before surging after the mining reward reduction.

The next days after the halving, Bitcoin tends to lose part of its value before entering a bull market that sees Bitcoin’s price more than doubling. The bull market tends to be as long as an entire year, or even more between 2016 and the end of 2017 when Bitcoin surged to $20,000.

As Satoshi Nakamoto explained, with a larger demand for the digital currency, a cryptocurrency with a fixed supply and a falling inflationary issuance would eventually help its price to surge.

At the moment, Bitcoin inflation per day in US dollars is $14.69 million. That means that miners have to sell a large part of this earnings in order to remain operative. They have to pay for a fast internet connection, for a place where to operate, some workers and the energy they consume.

Nowadays, the price of energy is a key factor in terms of what miners are able to earn. The cheaper the electricity the lower amount of BTC they have to sell to pay for their operations.

The Bitcoin they sell to the market have an effect on the price of the most popular cryptocurrency. There is a structural selling pressure of around 70% of Bitcoin’s daily inflation, which must be absorbed by the current demand for Bitcoin.

At the same time, when profitability decreases due to a drop in the price of Bitcoin or because of higher energy costs, the selling pressure tends to increase as well.

Thus, PoW creates an inherent selling pressure for Bitcoin that demand must be able to handle in order for Bitcoin price to grow. However, the lower amount of BTC issued after a halving should also have a positive effect on Bitcoin’s price reducing the amount of BTC miners have to sell.

Other things must be taken into account at the time of analyzing the effect on the price of Bitcoin. Difficulty and ASIC hardware improvements are also key factors to understand whether a miner is profitable or not.

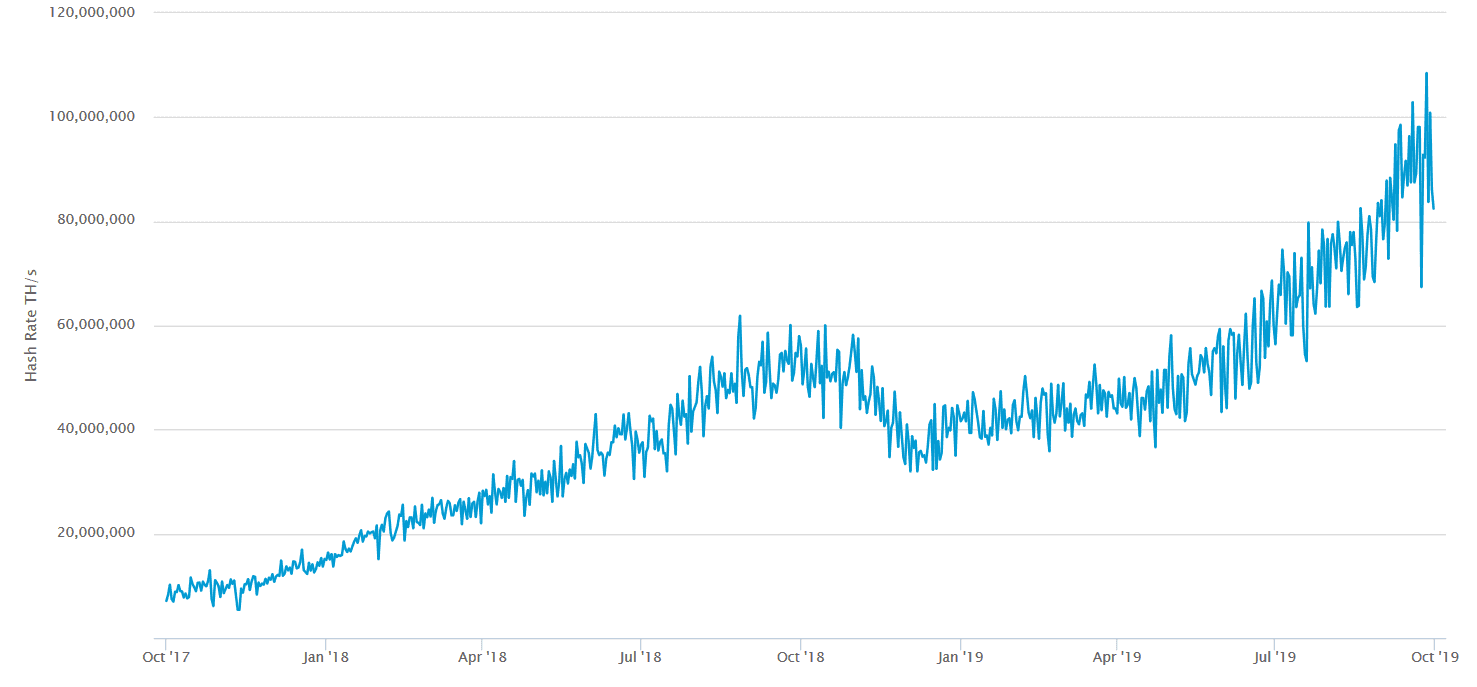

Fact #5: Halving Has An Effect On Hash Rate

Bitcoin halving events have also short-term effects on the hash rate of the network. The higher the hash rate, the more secure the Bitcoin network is. The same happens and applies to other PoW currencies such as Litecoin (LTC).

After the first halving event in 2012, the Bitcoin hash rate fell by over 34% in just a few days. This was due to the fact that miners were receiving half of the reward (at that time 50 BTC got reduced to 25 BTC) and because the price of Bitcoin didn’t immediately increase after the halving.

However, Bitcoin’s hash rate reached 29 TH/s on February 17, 2013, just a few months after the halving event.

The second halving didn’t have a noticeable effect on Bitcoin’s hash rate. Indeed, as the price of the cryptocurrency was growing, the new issuance reduction didn’t have a harmful effect on miners, that were able to handle the situation very well.

It is not possible to predict what can happen during the next Bitcoin halving event. If the price of the most popular cryptocurrency doesn’t grow immediately after the halving, with growing difficulty, it is possible for it to fall.

However, if the network difficulty remains stable and Bitcoin’s price moves to the upward, we could expect a price increase. If the price increase is more than the one expected, new miners will enter the network and eventually have a positive impact on Bitcoin’s hash rate.

Litecoin’s halving event in early August 2019 had a negative effect on its hash rate. The sixth-largest cryptocurrency experienced a decline in its hash rate of over 38% in just three months.

This happened because Litecoin underwent a price decline from $140 in June to $52 a few hours ago in some exchanges. The larger the drop in price, the less profitable the miners are with a supply reduction of 50%.

With a price increase on Litecoin after the halving, its hash rate would have dropped less or remained stable close to the levels before the halving event in August.

Currently, Bitcoin’s hash rate is close to 100 million TH/s per second. During the last years, the security of the network has been substantially increasing. With a larger hash rate, it is more difficult for the network to be affected by a 51% attack.

A 51% attack is a malicious practice conducted by a miner or a group of miners that want to control more than 50% of the network’s mining hash rate. If attackers are able to control more than 50% of the computing power of the network, they would eventually have the possibility to reverse transactions and double-spend coins.

This would result in material losses for many individuals that transacted through this blockchain network. Moreover, it would also have a negative impact on the network’s image.

Thus, understanding the effects a halving event could have on Bitcoin would allow analysts to understand whether the network will be more secure or less secure in the future. As we explained, the hash rate will also be closely linked to the price of the virtual currency and how profitable miners remain.

Conclusion

Bitcoin experiences halving events every 210,000 blocks – or four years. These halving events reduce the rewards that miners receive every time they find a block with their ASIC miners.

Halving events tend to be very positive for the price of Bitcoin in the long term. This happens because there is a lower selling pressure from miners derived to the expenditures they have to make to remain operative.

At the same time, the maximum amount sold by miners is also reduced by 50%. If a miner would like to sell all the BTC mined, they would be able to sell half of what they were selling before the halving event.

With a growing demand for Bitcoin, its price is also expected to move higher in a short period. As we explained in this article, after each halving event, Bitcoin starts a bull market that lasts for around an entire year and that more than doubles Bitcoin’s price.

The effect in Bitcoin’s hash rate may be negative the first days after the halving, considering some speculators sell their BTC, affecting the price in a negative way and pushing some miners away from the network.

Looking for a legit crypto exchange for trading bitcoins? Find the Best Bitcoin Exchanges with low fees here.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account